Why The Future Of Insurance Will Be Mobile And What Will It Mean For Insurance Business Models

Anybody out there who doesn't have a mobile device, raise your hand…just what I thought.

The explosion of mobile phones and apps in the everyday lives of consumers–and agents–is powering big changes in the business of insurance. Heightened customer expectations are getting formed by the changing mobile landscape; new generations of customers; new competitors, and the ferocious pace of mobile tech-enabled innovation that is radically reshaping how customers become informed, purchase, and get service.

In our new report, the first of Forrester's Mobile Insurance Playbook, we examine how mobile forces are driving customer expectations and how customer demands are going to influence new insurance business models.

Consider that:

- Consumers are living La Vida Mobile. Mobile is a pervasive element in the daily lives of insurance customers. With more mobile devices available within easy reach, US consumers are tapping into this ready convenience to research, buy, and service their financial needs, including insurance. And how about those Millennial insurance customers? More than one in four told us that they use mobile as their main personal financial channel.

- Agents are becoming proficient mobile tool users. The tablet form factor looks almost purpose-built for the needs of agents. From their hi-def displays to fast boot-up and super portability, agents are ardent tablet-ers, and half the agents in an informal survey at the end of last year cited mobile as one of their leading business initiatives.

These forces, along with others, are pressuring insurance digital teams to leverage mobile’s power to deliver the right information at the right time and in the right customer experience. And the role that mobile is playing is putting mobile on the agenda of insurance boards. How can digital insurance teams make sure that those mobile investments pay off by delivering a business impact? By making mobile apps:

- Simple. Mobile apps are getting easier to use. In 2012, it's just plain nonsense to think that users should be hunched over tiny mobile keyboards typing in data. Smart insurers are turning to capabilities like photo image capture as in Progressive's quoting, claiming, and bill pay "take a picture" options; voice control like in American Family's DreamVault home contents inventory app; and the "bump" feature that Geico's Connect app offers that enables drivers other than the named insured(s) on the policy, to download and share their digital ID cards.

- Ubiquitous.Mobile apps means that insurers can be by their customers' sides whenever needed or wanted. Along with expected bill pay and FNOL functions, smart digital insurers are building apps that fill other needs for consumers. Esurance's mobile app has "feed a craving" functionality that lets users find anything from coffee to cupcakes. It points out my favorite cupcake joint, Eat Cake–my reward for a hard day of analyst toil–but I am overly familiar with their location, so I really don't need Esurance's help finding it, but it will help me if I need a cupcake fix when I'm on the road.

- Personal. Mobile apps capture my information to create a personal experiences. While researching this report, I got introduced to a lot of cool mobile apps that used my personal information to do good–like pointing out my excellent cornering and how I interpret posted speed limits–in a new way. Two that caught my attention (and you'll hear more about this in upcoming blog) are BRIGHTdriver and DriveScribe, with each taking a different angle on the experience: BRIGHTdriver's game approach versus DriveScribe's shriller utility approach.

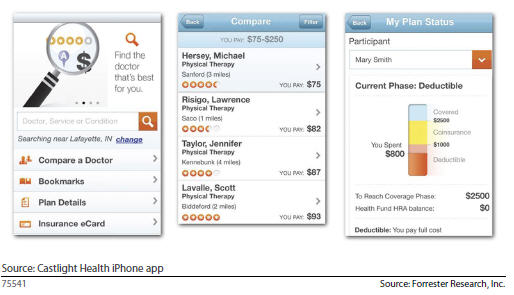

- Empowering.Mobile apps also have to put needed information into the hands of consumers, and that can be anything from finding an agent as evidenced in Texas Farm Bureau's excellent agent locator to CastLight Health's health care cost transparency mobile app (and unfortunately, it has to be offered through an employer) that let's consumers see how their medical providers were rated by other consumers as well as their price for the procedure (See screen shot below). Both mean that consumers can find the right provider at the right price for them.

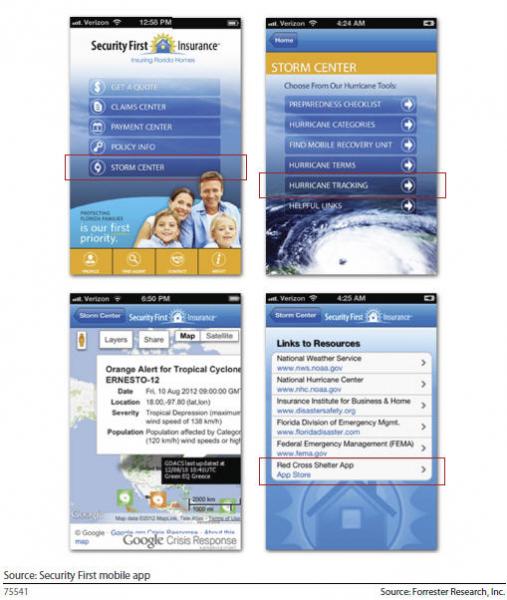

- Reassuring. Mobile apps act as safety nets for users, letting them summon everything from tow trucks to vehicle recalls. Security First, a Florida home insurer, grabbed our attention with their Storm Center functionality, offering a variety of hurricane tools from check lists, open Red Cross shelters, and the location of their Mobile Recovery units (See screeen shot below). Aviva UK Health offers a mobile My Stress Kit app that could help me better manage my stress so I don't speed and eat too many cupcakes.

Through these SUPER capabilities, mobile has changed the way that customers envision an insurance company: We can now hold it in the palm of our hand and our entire relationship with an insurance company — from quotation through to claim — could take place through this single device. That means that mobile will be the catalyst for insurance transformations that will ripple beyond just how customer interactions are changing. The impact of mobile will be felt across the insurance industry and ecosystem. Products, payments, distribution, underwriting, operations, and even what constitutes intellectual property will look very different, from the "lights-out" insurer (meaning a different focus for agents) to the new lease on life that mobile will offer for usage-based insurance.

So how do you think the business of insurance will be influenced by mobile through the end of the end of the decade? Tell us and tell us what you think of our take on the future.