Two Apple Devices Weigh Less than Two Windows 8 Devices. Will Employees Live With Just One?

As Apple sweeps up the dust from their latest launch event, Microsoft is preparing for the most extensive operating system launch ever, expecting to reach 2.1 billion people with its Windows 8 marketing launch over the next several months. It's as good a time as any to reflect on the state of the Windows tablet landscape and draw some conclusions about what it means for Infrastructure and Operations Professionals.

For the past year I have been passionately explaining to PC vendors the criticality of building a handful of products up to a standard instead of down to a price in a commodity market. If you can't differentiate in ways that people will pay a premium for, the only competitive levers left are quality, price and service…and you can't afford to make any mistakes. In this case, the people in question are those willing to spend their own money (without reimbursement) on tablets and laptops for work. Forrester data shows that it's a $10B market today and a $19B market by 2016. "IT Consumers" may be the only PC growth segment left.

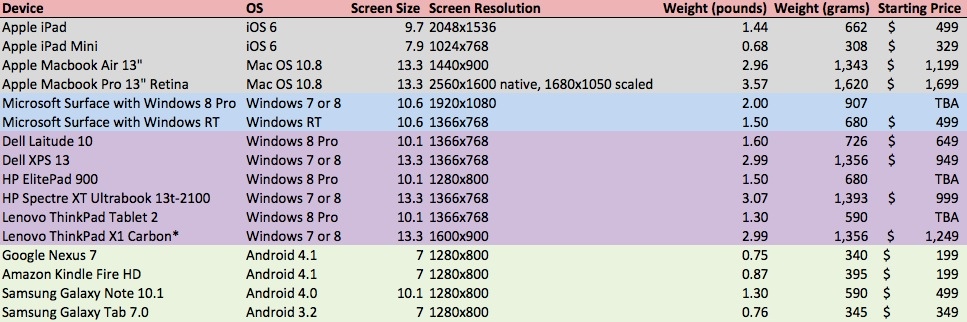

Apple continues to prove this market's viability and they're placing a bet that tablets will remain tablets on their merits, and will continue to be an addition to the computer bag alongside the laptop, and they're building both up to a standard instead of down to a price. Microsoft is betting that what people want is a tablet and a PC all in one, and that apps which behave both as touch and desktop apps on the same device are the future. The Surface represents Microsoft's attempt to make the best possible case, and ensure the device is built to its own standards. Even though the latest Forrsights Employee data show that employee preference for Windows 8 on work tablets is already 20% vs. 26% for iOS, the one-device strategy is an incredibly risky bet. Let's look at some of the numbers from what's on the market:

- Windows 8 is a big OS – bigger than dedicated tablet operating systems. The code base is bigger, the resource requirements are bigger (most Slate tablets require a fan, for instance), and so maintaining high performance requires more hardware and bigger batteries. This presents a packaging problem and adds risk to assumptions around user acceptance.

- Windows 8 will have similar lifecycle and management costs on a tablet to a Windows 7 PC. Windows 8 will be managed like any other PC, which means that patching, applying security policy, deploying software, provisioning, etc. are all labor intensive, repetitive processes. Many of these activities are either not necessary or possible on iPads, so Forrester believe the lifecycle management cost of iPads will be less.

- The availability of Windows 8 touch apps trails apps for iOS by a wide margin. Yes, conventional Windows apps will run on a Windows 8 tablet, but that means a keyboard and mouse for optimal use. For Windows 8's touch interface to have value, the apps they want have to be available. My colleague Ted Schadler highlights the gap as it exists today and Frank Gillett proposes what the future will hold.

- The Microsoft OEM ecosystem is just now shipping its first generation of touch-first tablets. By contrast, Apple is on its 4th generation tablet, so they have had much more time to align the supply chain, corner the market on key components and patent design elements in the process.