Avoid The Visual Clutter And Go For In-Stream Audio Advertising

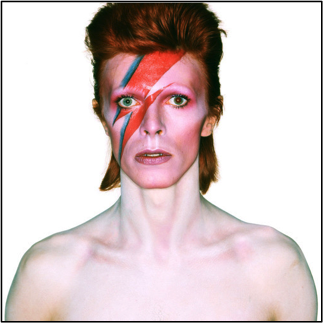

In 2002, the zeitgeist orchestrator David Bowie opined, “Music itself is going to become like running water or electricity.” A few years later, in 2005, the futurists Gerd Leonhard and Dave Kusek proposed “music as water” in their industry-shaking book, The Future of Music (A Manifesto for the Digital Music Revolution).

In 2002, the zeitgeist orchestrator David Bowie opined, “Music itself is going to become like running water or electricity.” A few years later, in 2005, the futurists Gerd Leonhard and Dave Kusek proposed “music as water” in their industry-shaking book, The Future of Music (A Manifesto for the Digital Music Revolution).

The metaphor was simple — music would flow on demand, like a utility, to people's home hi-fis and portable music players. Subscription access to "all" music was the approach that ultimately ended up with no more ownership of physical or even digital copies; CDs, mp3s, and the other ground-bound trinkets would no longer be necessary. Even in my own behavior, I see this change — where once I’d spend time ripping my CDs and loading up my 160GB iPod, now I simply curate music, like my Boxing playlist, in the cloud via Spotify.

Eleven years later, Bowie’s prediction is coming true and streaming is progressing at speed. In metropolitan Argentina 1 in 3 consumers are listening to streaming music – evenly split between mobile and computers (desktop, laptop, tablet). In France 15% of those we surveyed streamed on a computer but a whopping 27% used mobile. In fact this trend to streaming via mobile is likely to be one that will continue worldwide and today in metropolitan regions of Hong Kong and Mexico, as well as South Korea mobile has already considerably overtaken computers as the preferred listening method.

The lion’s share of labels and, increasingly, the musicians they represent understand that digital plays by different rules. While merchandise and events are becoming increasingly important sources of revenue, digital trinkets are not. The transition to "music as water" is well underway, but not without bumps and grumbles from some of the players in the ecosystem who are not necessarily on the same page playlist.

- The major labels. Their main concern was that streaming services would cannibalize their downloads business, but Apple, with the imminent launch of its music streaming service iTunes Radio, has finally managed to overcome major label (and its own) fears in that regard. In fact, anecdotal evidence shows that streaming’s main impact so far has been to decrease the amount of music pirated and downloaded for free, with only a minor impact on digital sales.

- The indie labels. A new midyear report by Nielsen Soundscan shows that indie labels have gathered 34.4% of American music sales in 2013, larger than any single major. In the streaming space, according to International Federation of the Phonographic Industry (IFPI), the Indies are buoyant, too, and Albert Slendebroek, general manager of Dutch indie dance label Armada Music, says, “We’re monetising activity in territories where we used to have no returns, and that is thanks to services such as Deezer and Spotify that operate on a global basis and open in new countries all the time.“

- Artists. No artist is happy with the rates paid by streaming, where the industry average for a play is around 0.4 pence. While smaller artists accept this and console themselves with greater reach, more-established artists have started to take issue with the poor royalty rates. Recently, Thom Yorke, the lead singer of Radiohead, pulled his solo project material from the site Spotify, and David Lowrey, the singer and songwriter from Camper Van Beethoven and Cracker, went so far as to post his royalty statement online showing that he got less payment from Pandora for one million plays online than the cost of a band t-shirt (not quite the full story, but illustrative none the less).

- The consumers. Consumers love streaming music, and their uptake of services is exploding due to mobile usage. In the US, a study by Parks Associates for TargetSpot revealed that the male/female split is relatively even, with half married, 42% with children, 64% owning their homes, and 22% with a household income of $100,000 or more. High-net-worth consumers are listening, too, which means that marketers don’t need to pay high premiums for ad placement in the New York Times to get in front of these individuals when audio channels remain a great democratizer for access.

- The broadcasters and distributors. The digital audio broadcasters have well and truly joined the traditional over-the-air (OTA) players with around 500 licensed digital music services operating in more than 100 countries. With three big players joining in 2013 in the form of Google, Twitter, and most importantly, Apple, with its ad-supported iTunes Radio service, the addressable consumer base is mushrooming. Internet and terrestrial radio have different models for royalty payments, where "digital only" stations, in the US, have to pay higher rates. Pandora recently bought a terrestrial station as a get-around to pay reduced rates, much to the annoyance of rights management organizations and artists.

And, of course, what is of interest to marketers is the way they can play a part in the world of streaming audio. The additional stakeholders to add to the ecosystem are:

- Advertising technology vendors for in-stream audio. This technology, like video before it, used to be stuck in a ghetto somewhere between the responsibility of traditional broadcasters and the new digital team. Over the past few years, it has matured to the point where it is part of standard campaign efforts, available through exchanges and even integrated into RTB platforms.

- Advertisers/brands. Advertisers and marketers are largely stuck on preconceptions of OTA and haven’t understood the unique opportunity for marketing within streaming services. It is data-rich and, unlike visual advertising, doesn’t fight for consumers' attention, with a single stream active at one time.

My new report, In-Stream Audio Advertising shows why this new avenue for marketers is rich in data, provides positive ROI, and is a marketing outlet that is largely underinvested in. Finally, for those looking to get advertising traction on the difficult medium of mobile, in-stream audio is a particularly good method, with subscription models baking in opt-in advertising as part of the deal.

My view is that downloading is a transitional stage for the music and audio industry and that consumers' personal libraries of mp3s will dwindle as CDs, tapes, and vinyl did before them.

What do you think? Are you using in-stream audio advertising in your marketing? Do you plan to use it? Is the business model shot to hell?

Anthony

And one more thing . . . for those looking for a high-energy workout playlist, please find mine below. For those of you on freemium and not being retargetted, the ads you hear most certainly won’t be for pillows, baby formula, and tranquil country walks!