US Tech Market Getting Stronger: US Q2 2013 GDP Report And Data Revisions Show Weak But Improving US Economy, And Better Tech

The US Bureau of Economic Analysis released its preliminary report on second quarter 2013 US GDP, along with both major revisions to US economic data over the past 50 years, and minor revisions to the data on US business investment in information technology goods and services. Here are my key takeaways from the report, and its implications for the US tech market.

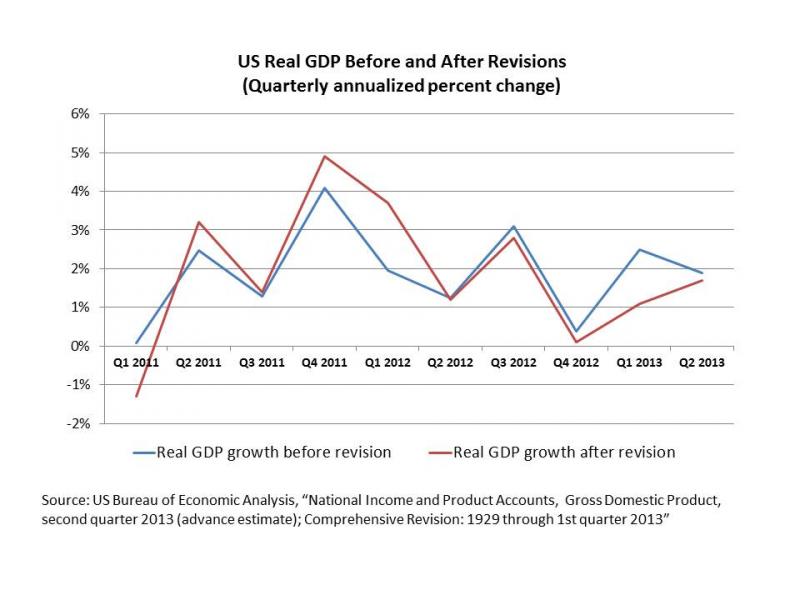

- US real GDP growth in Q2 2013 came in better than expected. The 1.7% growth at an annual rate from Q1 2013 was in line with our projection of 1.9%, but better than what many economists had been forecasting. Growth rates in Q4 2012 and Q1 2013 were revised down to 0.1% and 1.1%, respectively, from the earlier 0.4% and 2.5%. These revisions indicate that the end of the payroll tax reductions, the higher tax rates for high-income people, and the Federal budget cuts from sequester did take a toll on economic growth, with government consumption declining in Q4 2012, Q1 2013, and Q2 2013, and business investment in factories and offices falling in Q1 2013. But consumer spending has been solid, with growth of 1.8% in Q2 2013, 2.3% in Q1 2013, and 1.7% in Q2 2013. Business investment in equipment, which softened to just 1.6% growth in Q1 2013, improved to 6.8% growth in Q2 2013. And housing continues to be a growth engine for the US economy, with double digit growth rates in residential investment in the past four quarters, and improving home prices boosting consumer confidence and spending.

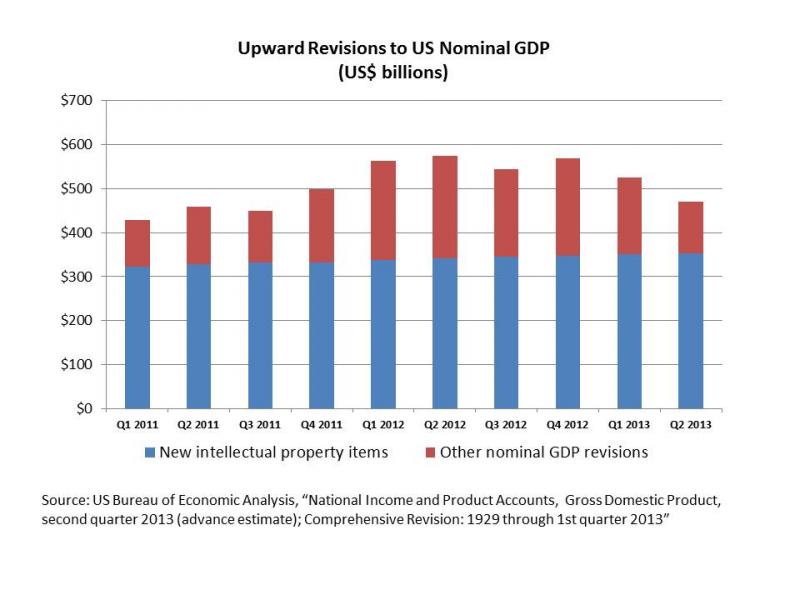

- Adding economic values for intellectual property increases US GDP by $300-$400 billion. A major change in the US national accounts in this release is the addition of investment values for intellectual property such as research and development, and entertainment, literary, and artistic creations. (BEA also moved software into its new category for intellectual property products, though it has always had values for software in its calculations of GDP.) The addition to the GDP accounts of these investments increased US nominal GDP by $300 to $400 billion, and other revisions (such as higher inflation) added $100 to $200 billion per quarter. While the addition of intellectual property values to the GDP accounts does not directly effect the tech market, it does mean tech investment that contributes to these values (for example, through analytical and collaboration software that supports the research and development process, or high-power PCs and servers to create movies with rich computer-generated images) will now adding to recorded GDP.

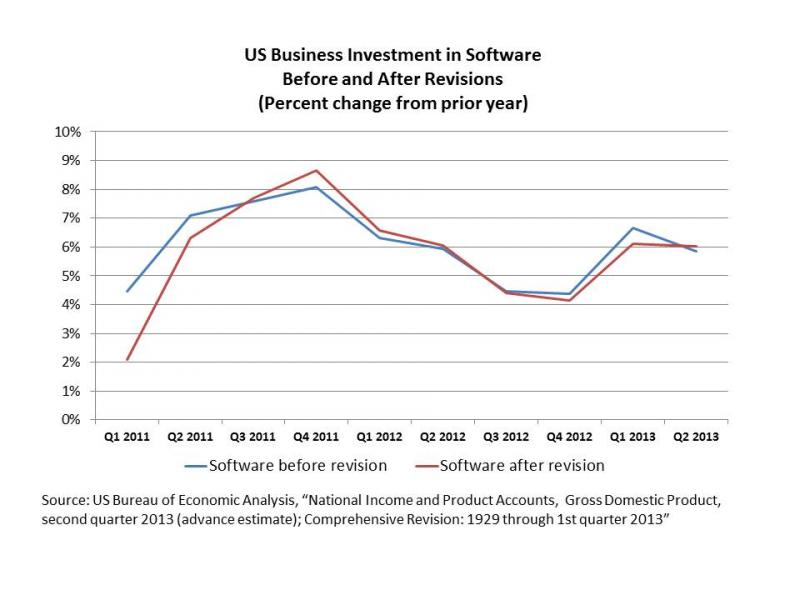

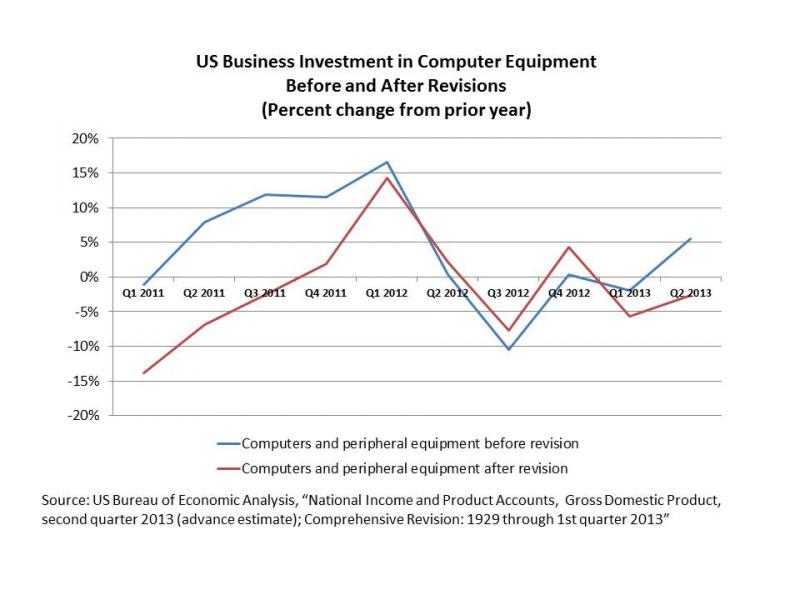

- US tech investment was generally revised downward, but with not much impact on software growth rates. The BEA data on business investment in computer equipment was reduced in most quarters by small amounts (less than $1 billion at annualized rates), but in both Q1 2013 and in the 2011 time period was reduced by $2 billion to $4 billion. Business investment in software was lowered more substantially, by $11 billion to $14 billion per quarter. We won't know until BEA releases more details whether those reductions were in what is called "own account" software (software created by a firm for its own use) as opposed to "packaged" or "custom" software, which is provided by software vendors, but my bet is that it is the former. But the net effect of these changes was to keep software growth almost the same as before revisions, but to reduce the growth in computer equipment, especially so far in 2013 as well as throughout 2011.

- Business investment in software is expanding by 6%, though investment in computer hardware is shrinking. Looking at the Q1 and Q2 2013 data in the charts above, software investment is on a solid growth path. This matters, both because software is the largest part of the US tech market (apart from telecomm services), and because it directly impacts spending on IT consulting and systems integration services. Growth in these two categories will offset the declines in computer equipment investment. We won't know what is happening to communications equipment until BEA publishes the underlying data tables, which break out those investments from investments in medical equipment, copiers, office and accounting equipment, and nonmedical instruments. Still, since the "other" category of information technology investment was revised up by $20 to $25 billion per quarter, it is possible that communications equipment may be another source of strength in the US tech market.