Should You Buy More Infrastructure Or Subscribe To A Cloud Service For Videoconferencing?

Videoconferencing infrastructure connects videoconferencing endpoints — the conference-room-based systems, desktop clients, and mobile apps people use to join meetings. By prioritizing solutions that make the technology available to all employees with a simplified guest access model for partners and customers, organizations can make the case that video enhances collaboration and improves business outcomes.

Our Wave evaluation of videoconferencing infrastructure and cloud services vendors includes the 10 most significant OEMs: Acano, AGT, Avaya, Blue Jeans Network, Cisco Systems, Lifesize, Pexip, Polycom, Videxio, and Vidyo. The vast majority of systems integrators, telcos, and conferencing specialists with video offerings actually resell, white-label, or stand up their own services based on these evaluated vendors' products.

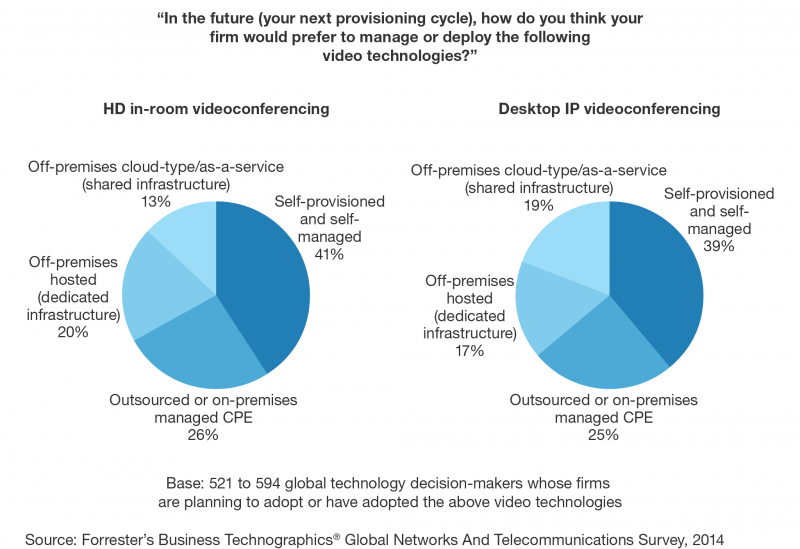

A key tenet of the evaluation was to include BOTH vendors that sell infrastructure and vendors that focus only on the cloud. It’s important to compare both camps because large enterprises want to know which vendors can help them extend or replace their existing investments in infrastructure on premises. A key finding from our research is that there are indeed many large enterprises logging 1 million minutes or more of videoconferencing from cloud services per month, and some replacing their large deployments of infrastructure with cloud services entirely. Alternatively, some are setting up their own "private cloud" environments with virtualized infrastructure.

I encourage you to read the report to answer which vendor(s):

- Can help you extend interoperability to Microsoft Lync or Google Hangouts

- Had the best video quality in our demos and briefings

- Can help you scale up capacity with virtualized infrastructure

- Complement your existing infrastructure by scaling up capacity with virtual meeting rooms

- Are helping enterprises transition to the cloud with complete solutions spanning call control and directory services