Understanding The New Guidelines For Foreign Direct Investment (FDI) In eCommerce In India

The Indian government issued new guidelines for FDI in eCommerce on March 29, 2016 to provide clear definitions for the sector and to remove ambiguities in the law that companies have been using to get foreign investment. Here are some of the key changes and my thoughts on their impact:

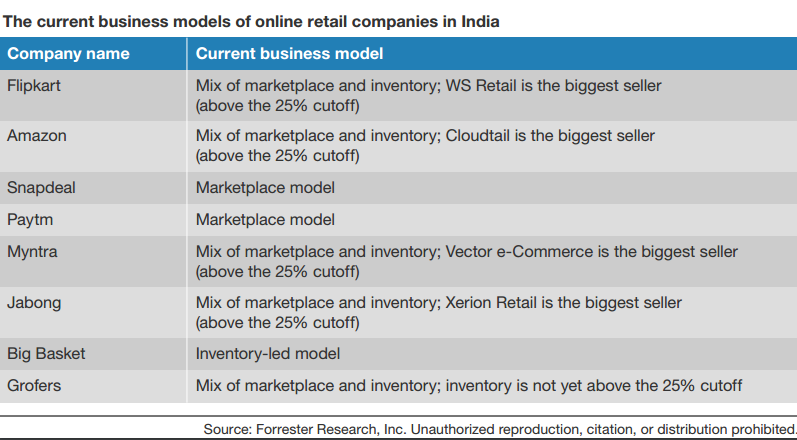

- The government has defined an eCommerce entity, a marketplace model, and an inventory-led model. For the first time, the government has given clear definitions to remove the ambiguity in this sector. It also makes clearer the government’s position on the business models that online retailers are adopting. Online retailers are increasingly adopting an inventory-led model, as it gives them more control over supply and speeds the route to profitability. By not allowing FDI in the inventory-led model, the government has made it more complicated for online retailers looking to become profitable in the near term to support their valuations, go for an IPO, or raise funds.

- 100% FDI is allowed in the marketplace model. Allowing 100% FDI in the marketplace model largely maintains the status quo, as most online retail companies like Amazon, Flipkart, and Snapdeal are funded through the marketplace loophole; these companies position themselves as technology facilitators for the buyer and seller. The new guidelines will help boost investment in marketplaces, as not every investor has felt confident about investing via a loophole. This is good news for the leading marketplaces that are looking for more funds to grow their business; they can now approach a new set of investors who were waiting for this clarification from the government.

- The 25% sales rule will affect major eCommerce firms.According to the new guidelines,eCommerce firms won’t be permitted to have more than 25% of their marketplace sales come from one vendor or their group companies. This will affect companies like Amazon, Big Basket, Flipkart, and Myntra. Flipkart’s largest seller, WS Retail, far exceeds this 25% barrier, while Cloudtail ― a joint venture between N R Narayana Murthy's Catamaran Ventures and Amazon ― is Amazon’s biggest seller. Both will have to downsize the sales from these sellers and change their business structures to meet the new guidelines. Vertical players like Big Basket (which runs an inventory-led online grocery company), Myntra (which gets the majority of its sales from Vector e-Commerce), and Jabong (which gets the majority of its sales from Xerion Retail) will also need to restructure their business.

- New curbs on discounting may have an impact. The new guidelines also state that marketplaces can’t directly or indirectly influence the price of goods and services, so they can’t provide additional discounts on products. The government’s aim is to remove the price difference between online and offline retail. However, the impact of this change will depend on how seriously the government enforces this, as online retailers can always find ways to give discounts to acquire customers.

- The liability for post-sale issues, delivery, and customer satisfaction moves to the seller. According to the new guidelines, warranties/guarantees of goods and services sold, post-sale issues, delivery of goods, and customer satisfaction will be the responsibility of the seller. This means that in the event of a product defect, the marketplace is not legally responsible. This is not good news for customers in a market where customer experience is still not the key priority of sellers, as not all sellers are in a position to provide consistent products and services. And small sellers may find it difficult to handle post-sale issues.

In my view, the new guidelines simply maintain much of the status quo in terms of FDI but create new problems for existing players in the market, as they will have to change their existing business to meet these guidelines. However, the impact of these guidelines will depend on how strictly the government enforces them.