Asia Is A Beacon For Luxury Commerce Innovations

COVID-19 has upended luxury brands’ customer engagement strategies, forcing them to launch digital transformation initiatives. With a robust digital economy and more empowered luxury consumers, Asia in general — and China in particular — has become a beacon for luxury commerce innovations globally. My latest report, Luxury Commerce Innovations In Asia, shows how leading luxury brands are piloting emerging technologies and embracing new business models to engage customers and drive growth.

Facing COVID-19, luxury brands are rushing to implement a digital fix by:

- Upgrading virtual shopping experiences. In May 2020, Bulgari launched its first e-commerce boutique, which features 3D product images and augmented reality, in Singapore — before doing so in its home country of Italy. The boutique allows consumers to test Bulgari bags true to size in a real-world environment. Other luxury brands and retailers such as Changi took a different approach: luxury shopping concierge services assisted by WhatsApp chat and video calls. Luxury brands in Japan took a similar approach via LINE.

- Jumping on the livestreaming bandwagon. Livestreaming commerce has been gathering steam in China and quickly expanding across Asia. It has also become shoppers’ favorite way to engage with luxury brands in China. Early adopters got positive results from livestreaming commerce: Louis Vuitton debuted livestreaming on Little Red Book and generated 152,000 page views, and Burberry garnered more than 1.4 million views for its livestreaming session with a fashion influencer on Tmall and sold out of most featured products.

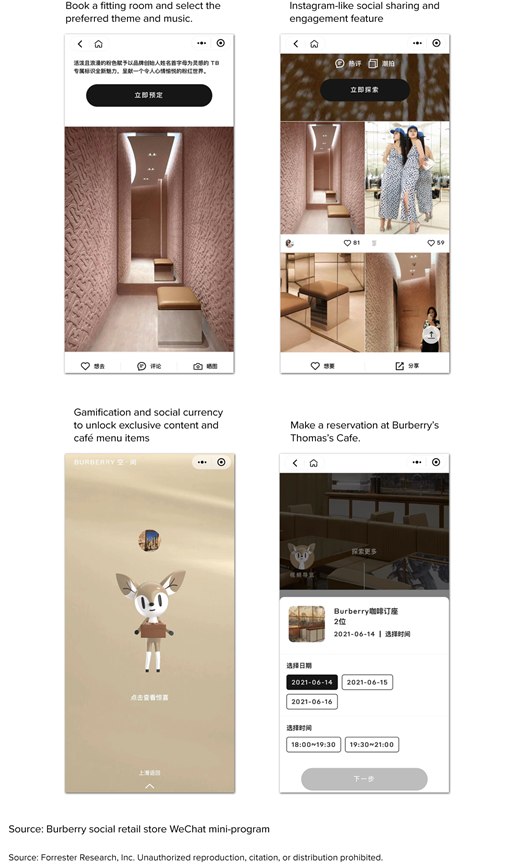

- Testing new social retail models. In addition to influencer marketing and social commerce, luxury brands are exploring new social retail models. One example is Burberry’s new social retail store in Shenzhen powered by Tencent technology. The offline retail space has a deep connection to a custom WeChat mini-program, allowing the new model to blend the physical and social worlds in an immersive digital retail experience. Key features include gamification, social engagement and social currency, fitting room booking and customization, and offline café reservations (see figure below).

- Developing contactless physical shopping experiences. Pre-pandemic, luxury skincare brand SK-II developed the self-service Future X Smart Store model, catering to young Japanese consumers who don’t want to interact with store associates. In the wake of COVID-19, the brand upgraded the experience by introducing contactless skin analysis machine Mini Magic Scan and expanded the contactless physical shopping experience to several Future X Smart Stores in Tokyo, Shanghai, and Singapore and in department stores, pop-ups, and travel retail in Hainan.

Investing in digital and e-commerce is merely table stakes, however. It’s now crucial to embrace deeper innovation to gain competitive advantage. To sustain their business, differentiate their brand, and engage customers more deeply in a post-COVID world, leading luxury brands are undertaking deeper business transformation initiatives across people, process, and technology.

To learn more about luxury brands’ deeper business transformation initiatives in Asia and how to prioritize foundations in the journey of luxury commerce innovations, Forrester client can read the full report or schedule an inquiry.