Customer-Obsessed Firms Must Balance Value FOR And Value OF Customers

JP Morgan collected more than $1.5 billion in overdraft fees in 2020. This came during a time when many households were struggling to keep their bank balances positive due to COVID-19. Take Ally Bank as a contrast: The firm waived overdraft fees during the pandemic. And now, Ally has decided to scrap overdraft fees entirely.

While JP Morgan focuses on extracting value of customers, Ally considers the value it delivers for its customers.

Ally found that its fees disproportionately harmed low-income households living paycheck to paycheck, Black, and Hispanic families. Ally also wanted to reduce stress for customers and simplify its offering. By scrapping overdraft fees, Ally creates more value for customers along four dimensions:

- Economic value: by eliminating fees

- Functional value: via its simplified offering

- Experiential value: through fewer unpleasant interactions when dealing with fee notifications

- Symbolic value: a sense of being included for directly affected customers; a higher sense of meaning for other customers who value including others

While Ally gives up some value it could have extracted from its customers, it’s not an unsustainable hit because overdraft fees make up only 1% of Ally’s revenue.

What Can Leaders Of (Aspiring) Customer-Obsessed Firms Learn From This?

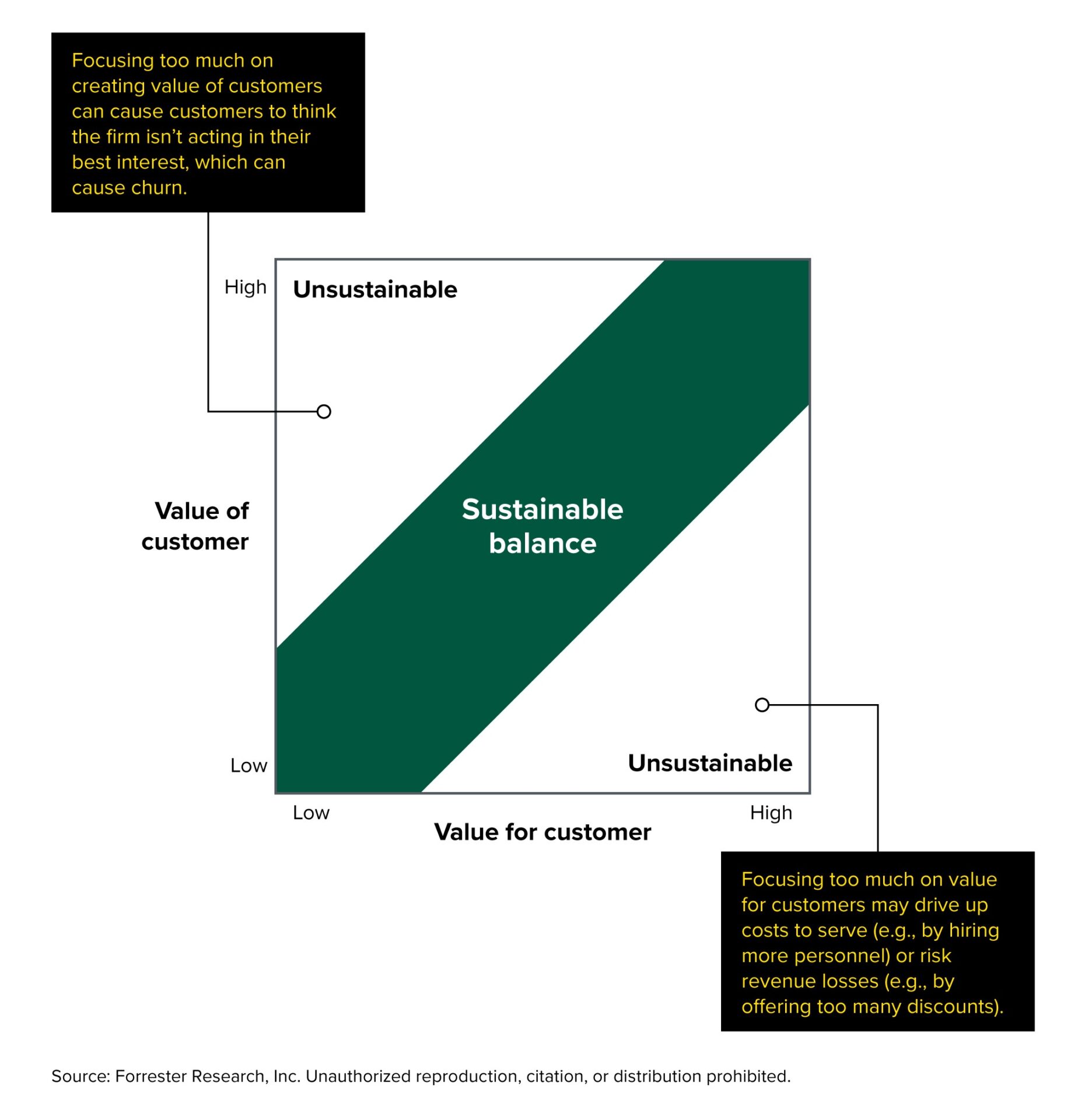

If you are one of those leaders, you won’t need a “magic” metric to drive customer obsession. Instead, leaders need a system of complementary metrics that helps balance value of customers for the business and value of the business for customers in the long run.

Read our follow-up blog that shows the three steps for creating a complementary system of metrics to balance value for and of customers, along with a new value metrics framework.

For all the details, check out the new report “Successful Symmetry: Use Metrics To Balance Value For The Customer And Business.”