Customer Obsession Differentiated Uber’s Hailing Services In China

Uber faces fierce competition in China from local taxi hailing service providers Didi and Kuaidi Taxi, which both launched Uber-style e-hailing services in 2014. Both providers use a costly subsidy model to entice taxi users to switch to e-hailing services. Kuaidi Taxi, which recently received $700 million in Series D funding to buy more self-owned e-hailing vehicles, has hired more drivers and continues to provide subsidies. Uber has a smaller user base than either Didi or Kuaidi and limited funds that it can leverage — so to win customers in China, Uber must engage customers differently. Uber can leverage its global organization’s existing customer analytics strategy and tools to better understand their (potential) customers and engage with them throughout the customer life cycle.

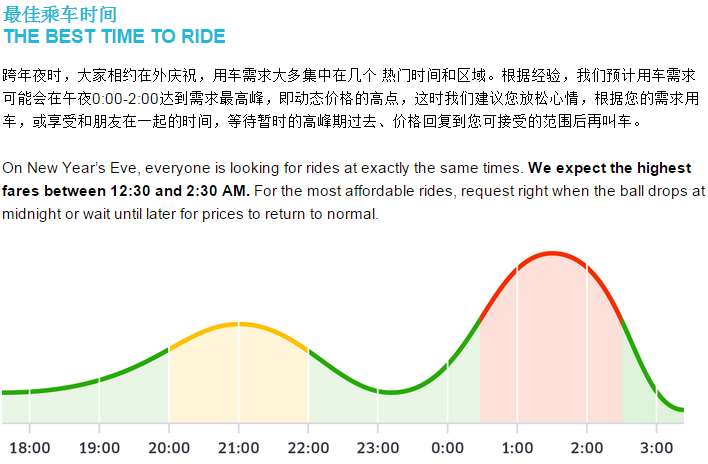

On New Year’s Eve 2014/2015, it was predicted that taxi service would be unobtainable as people concentrated on the New Year countdown. Uber analyzed historical customer data and was able to provide more appealing e-hailing options than Didi’s and Kuaidi’s cash coupons. Uber contacts customers in advance and asks them to confirm any rate increases due to its dynamic pricing model; this helps to set the correct expectations with customers about fares:

This happens all too often with Chinese companies: They start a digital business but don’t really study customers’ online or offline behavior. To improve the customer experience and give them what they want in their moments of need will be critical if Chinese enterprises want to win, serve, and retain customers in the age of the customer. Chinese e-hailing service providers, rather than offering costly cash subsidies, must provide personalized services based on customer preferences, predict prices more accurately to set appropriate expectations with customers, and offer continuous customer satisfaction assessment and improvement.

Similar examples are taking place in many other industries in China, such as lifestyle, entertainment, and eCommerce, for which the market is still in its early stages. While most market players are focusing on customer acquisition, I believe that only those players that really understand customer behavior and apply customer insights to their marketing strategies will win in the end.