Smart Banks Tap Into Customers’ Mobile Moments

Mobile banking continues to gather momentum worldwide and is also developing rapidly in China. Nearly half of metro Chinese consumers pay bills at least monthly on a mobile phone. While consumers are rapidly embracing mobile moments, most banks have yet to follow them. My recent published Brief: Smart Banks Tap Into Customers’ Mobile Moments tells B2C marketing professionals working at banks how to better address customers in their most relevant mobile moments throughout the customer journey.

Forrester sees the following key trends in China:

- Banks are embracing mobile channels to serve mobile-mind-shifted customers. Top retail banks, including China Construction Bank and China Merchants Bank, have already adopted a mobile-first strategy.

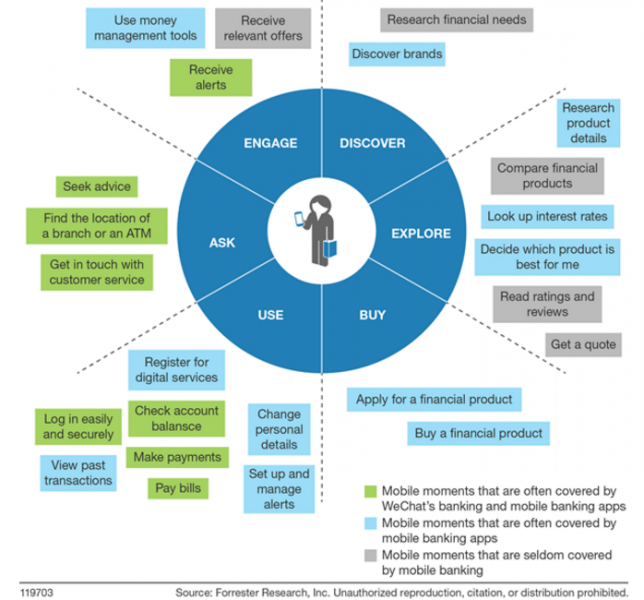

- Bank customers’ mobile moments occur throughout the customer journey . . . Leading digital banking teams are addressing customer needs in mobile moments throughout the customer life cycle across a range of mobile platforms, including WeChat.

- . . . but most banks don’t always serve customers in all moments. Most banks’ mobile presence primarily focuses on the buy, use, and ask stages and less on the discover, explore, and engage stages (see figure).

To learn how smart banks differentiate by focusing on mobile moments, read the full report. My follow-up report on how airlines tap into customers’ mobile moments will appear in Q2. Stay tuned!

To learn how smart banks differentiate by focusing on mobile moments, read the full report. My follow-up report on how airlines tap into customers’ mobile moments will appear in Q2. Stay tuned!