The Data Digest: Trust Is The Digital Wallet’s Most Valuable Asset

By Anjali Lai

As the sun sets on the summer season, I made one last getaway to a local island to enjoy the final moments of warm weather. While this small, remote island offers a chance to disconnect, it doesn't forsake the conveniences we are accustomed to in the process. Despite my lack of cash to hand, making a purchase from the small businesses at a rustic farmer’s market couldn’t have been easier — thanks to the vendors’ alternative mobile payment option.

Leveraging new devices for complex tasks that involve sensitive information or personal data demands consumer trust. The mobile payment adoption curve has been gradual for several reasons, one of which is the lack of trust, but recent news hints at the impressive connections that become possible once consumers put their trust in a service. PayPal recently announced several updates to its mobile phone application that make the app as relevant, complex, and functional as a mobile wallet. By winning the trust of a vast consumer base, PayPal is able to introduce more advanced features with the knowledge that consumers will seamlessly engage with the new offerings.

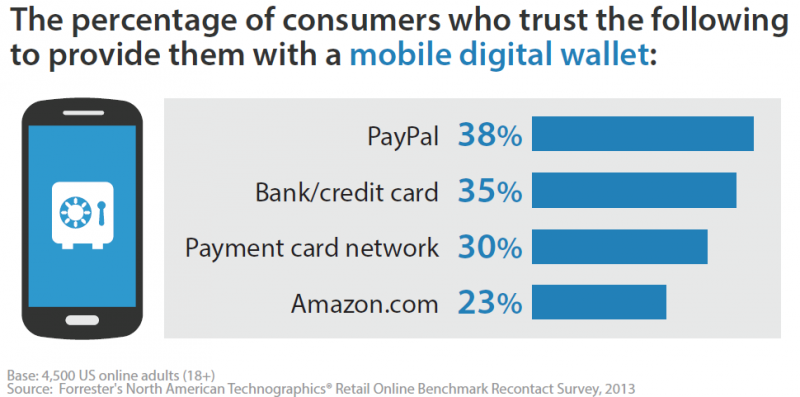

In fact, Forrester’s Consumer Technographics® data shows that US online adults trust PayPal more than any other financial institution to act as a mobile wallet platform:

The island vendors’ trust in PayPal allows them to integrate mobile payment exchanges into a society where technology is usually discouraged — and allows PayPal to innovate for a loyal, receptive, far-reaching audience. As my colleague Denée Carrington mentions in her recent report, “The convergence of mobile and tablet technology, digital wallet platforms, and value-added service innovation has created an environment where transformative commerce experiences can be brought to life.” PayPal serves as an example for companies tackling the mobile wallet challenge, “but the market is wide open for the competitor who can create a sense of necessity with its accepting merchants.”