Where Do UK Consumers Stand On The Financial Well-Being Spectrum?

Even before the onset of the COVID-19 pandemic, UK consumers were already juggling multiple financial challenges, and many felt worried about their financial situation. The pandemic has impacted consumers’ finances further, with many lacking financial resilience and confidence in their financial future.

Financial well-being isn’t just about having a certain bank account balance or amount of investments. It’s about whether people feel confident they can both manage their day-to-day finances and plan for the future. For some people, financial security is about whether they can pay their bills on time or put money aside for an unexpected medical bill. For others, financial peace of mind is knowing they will have enough money to live comfortably until the end of their life.

As financial services firms increase their focus on improving customers’ financial well-being, they are looking to better understand their customers’ financial needs, develop products and services that can have a positive impact on their financial health, and help them achieve their financial goals. Forrester’s Financial Well-Being Segmentation helps firms better assess their customers’ level of financial resilience and attitude toward their financial situation.

Forrester’s Financial Well-Being Segmentation

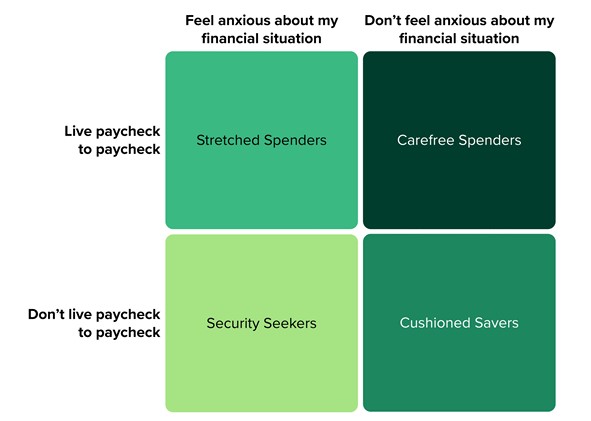

UK Consumers Fall Into Four Distinct Financial Well-Being Segments

To help financial services firms understand where UK consumers stand on the financial well-being spectrum, we surveyed 2,519 online adults in 2020 and found that:

- 31% of UK consumers are Cushioned Savers. Cushioned Savers don’t live paycheck to paycheck and do not feel anxious about their financial situation. This segment faces few financial hardships. Even so, they still have financial challenges such as building savings, affording a house, or coping with losses in their investments, stock market, and/or retirement funds. The majority of UK’s Cushioned Savers perceive their current financial situation as comfortable (56%) or describe themselves as stable (47%) when it comes to their finances.

- 30% of UK consumers are Security Seekers. Security Seekers don’t live paycheck to paycheck, yet they do feel anxious about their financial situation. Their top financial challenges are building savings, affording a house, and experiencing a recent reduction of income in their household. When asked about how they feel about their finances, 37% say they feel uncertain, while 28% say they feel anxious.

- 20% of UK consumers are Carefree Spenders. Carefree Spenders live paycheck to paycheck yet do not feel anxious about their financial situation. The three top financial challenges holding them back are affording a house, building savings, and paying for basic daily expenses. Still, nearly a quarter (24%) of those Carefree Spenders say they perceive their current financial situation as stable, and another 20% describe their financial situation as comfortable.

- 18% of UK consumers are Stretched Spenders. Stretched Spenders live paycheck to paycheck and feel anxious about their financial situation. Their top financial challenges are paying for basic daily expenses, affording debt or loan payments, and affording a house. Fifty-eight percent of them say they feel overwhelmed by debt. When asked how they feel about their financial situation, they most often say they feel anxious and stressed.

The UK has a higher proportion of Cushioned Savers and Security Seekers than other countries we looked at as part of this study. While some UK consumers — particularly those with low incomes — have seen a reduction in their earnings due to COVID-19, many British households have built up their savings since the beginning of the pandemic. This is largely due to a fall in discretionary spending during lockdowns. In the face of the pandemic and a recession, many UK consumers have also become more prudent and have started saving regularly to build emergency funds. However, even for those who are not living hand to mouth, planning for the future or knowing how to invest is particularly tricky given the economic backdrop. COVID-19 has derailed even the best-laid retirement plans. Beyond help with planning and saving for retirement, customers also need advice on how to decode different investment products and create an investment strategy.

For an overview of the state of financial well-being in the UK, have a look at our latest infographic.

Firms can map their own customers to these four segments and gain insight into their financial attitudes, behaviors, and interest in or use of specific personal financial management tools, services, or advice. By understanding which segments their customers fall into, financial services firms are better equipped to tailor their financial experiences. Connect via an inquiry to learn more.