Sizing The Cloud

Today, Forrester has published its report “Sizing The Cloud”. This report applies Forrester’s sizing methodology for emerging markets to the cloud computing market for the first time. This methodology allows us not only to apply our growth assumptions to the current numbers for cloud markets, but also to take into account when those markets will hit saturation and see commoditization, affecting the price of a cloud service over time. The result? The first serious attempt to size the cloud computing market for the next 10 years.

Cloud computing definitions are still a challenge. Virtualization technologies, management tools, and service provider industrialization have evolved continuously and at an amazing speed over the past five years. Each year, it gets harder to make clear-cut distinctions, based on technology, between what is a cloud and what is simply a virtualized data center or a traditional hosting provider. Therefore, Forrester decided to focus instead on the major disruption in the IT industry that cloud computing is bringing about — disruption based not on technology but on the business model under which IT operates. For our sizing forecast, we used Forrester’s cloud computing taxonomy, which defines 12 different market segments and business models. The self-service consumption of highly standardized services via a pay-per-use payment model basically implies a pure opex business model; business users have no capex investments in the cloud. However, if corporate CIO organizations perform this “capex to opex” transformation themselves, we can talk with a clear conscience about a private cloud. If a company expects an external provider to transform the capex investment into pay-per-use opex, we’re talking about a public cloud or a virtual private cloud. The latter is most attractive to users who want to know where their data is and have greater privacy requirements than a highly shared public cloud allows.

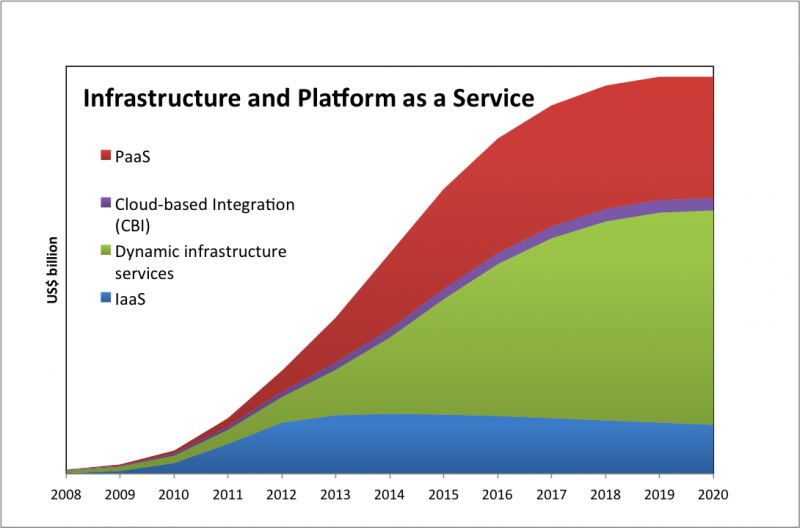

Here are some highlights from the report for four of the twelve cloud computing segments we sized:

- Infrastructure-as-a-service (IaaS) will shift from public clouds to virtual private clouds. The industry is adapting the original Amazon EC2 business model of highly standardized IaaS at an amazing speed. While adoption remains high, the size of the market will shrink, caused by Moore’s law of commoditizing prices; this also applies to some degree to virtual hardware. Dynamic infrastructure services, which are the virtual private cloud counterpart of IaaS in the public cloud, are combining pure infrastructure with high-level services and close integration into existing on-premises landscapes. This segment is just about to see real growth and will outperform IaaS in the public cloud in the long run.

- Platform-as-a-service (PaaS) will become a middleware platform alternative. Preintegrated and, in many cases, simplified platforms for the development of general-purpose business applications will become a serious alternative for developing custom applications; ISVs will also find them a highly attractive option for delivering software-as-a-service (SaaS) applications. Next month, Forrester will publish a Forrester Wave™ evaluation of PaaS providers to give an overview of this new market.

Forrester clients can read the full report, “Sizing The Cloud”. Thanks to the many Forrester analysts working with me on the report, including Holger Kisker, Pascal Matzke, Andy Bartels, James Staten, Frank Gillett, and Ken Vollmer.

Let me know if this helps you to predict your business opportunity in the Cloud.

Stefan