Nokia Siemens Networks Announces Radical Strategy Review

Nokia Seimens Networks’ top management has finally pulled the emergency brakes, after months of unsuccessful attempts to find a buyer. Going forward, NSN will focus on mobile network infrastructure and the services market. All other areas are non-core and subject to disposal. We estimate that about two-thirds of NSN’s current portfolio will remain in this new focus area. NSN will retain an attractive product and services portfolio and innovative solutions, as for instance its Liquid Net offering. However, some elements, like convergence offerings, will be difficult to pursue credibly in the future.

In our view, the new focus NSN is taking is right:

- NSN is focusing on growth segments of the infrastructure market. NSN aims to provide the most efficient mobile networks (including network outsourcing and sharing) to extract maximum value for telcos’ operations by developing intelligent network solutions and boost customer experience management.

- NSN will generate large savings from operating expenses and production overheads. NSN targets savings of €1 billion annually by the end of 2013. NSN tries to achieve this goal be focusing on organizational streamlining, real estate, information technology, product and service procurement costs, G&A, and supplier consolidation. Despite good revenue growth in recent quarters, NSN’s revenues per employee remain well below that of Ericsson’s in 2010 and even lags Huawei’s. NSN’s plans to reduce its global workforce by 17,000, or 23%, will go some way to address this imbalance.

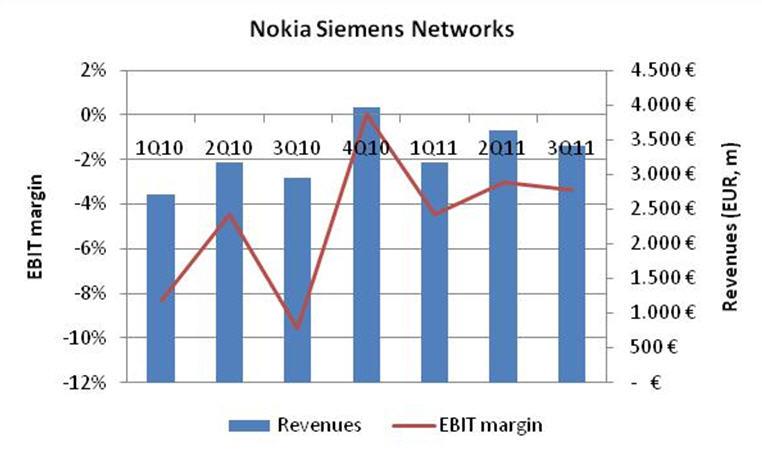

These changes are radical. But radical action is required to save the patient: Since its inception more than four years ago, NSN can only report a handful of quarters with positive operating profits. Of course, long-term negative cash flow means death to any business. NSN was only kept afloat by cash injections by its parent companies. Just this summer, Nokia and Siemens each injected €500 million. Still, competitive pressure from the likes of Huawei, ZTE, and Ericsson is too much for NSN’s cost basis.

Source: company reports (non-IFRS)

Despite the clearer strategic focus and cost savings, we see several challenges that need addressing:

- The picture of NSN as a break-up story must be avoided. Should this opinion spread, many telcos might circumnavigate NSN as a provider due to long-term service uncertainties. NSN must counter this image to prevent a self-fulfilling chain reaction from unfolding as Nokia and Siemens look keen to set NSN “free.” NSN must demonstrate to customers that the new NSN remains one commercial entity and a reliable partner and innovative provider.

- NSN’s go-to-market setup looks weak. Selling in a services and customer experience environment will be much tougher in the future, involving the CMO, CIO, and head of sales in addition to the CTO. NSN must strengthen its sales skills and channel approach.

- NSN looks ill-prepared for the growth of IT services in the infrastructure space. By pushing into the intelligent network and customer experience management space, NSN is moving into borderline territory of mighty IT services players such as IBM and HP. In its current shape, NSN looks ill-prepared for battle or partnership discussions.

The announcement does not come unexpected — not even to most of NSN’s employees. After many quarters of uncertainty, NSN’s strategic repositioning is sending out a clear message that management is ready to tackle some key challenges and is prepared to change the direction of the company. Yet, as we outlined, the next challenges are already visible.