Navigating How To Win With US Banking Customers

Recently, Forrester released a report entitled “What Drives Retention and Sales In US Banking?” that tackles this question from the consumer point of view. Using regression analysis, we uncover how these drivers vary for acquisition, retention, and cross-selling in US retail banking.

What did we find? For one thing, consumers value trustworthiness from a bank above all else for both sales and retention. This comes as no surprise to us; with so many financial institutions to choose from, consumers want to do business with a bank that they trust. This finding also supports the key theme that Harley Manning and Kerry Bodine focus on in their recent book, Outside In: Treating your customers well and providing them with a positive customer experience pays off.

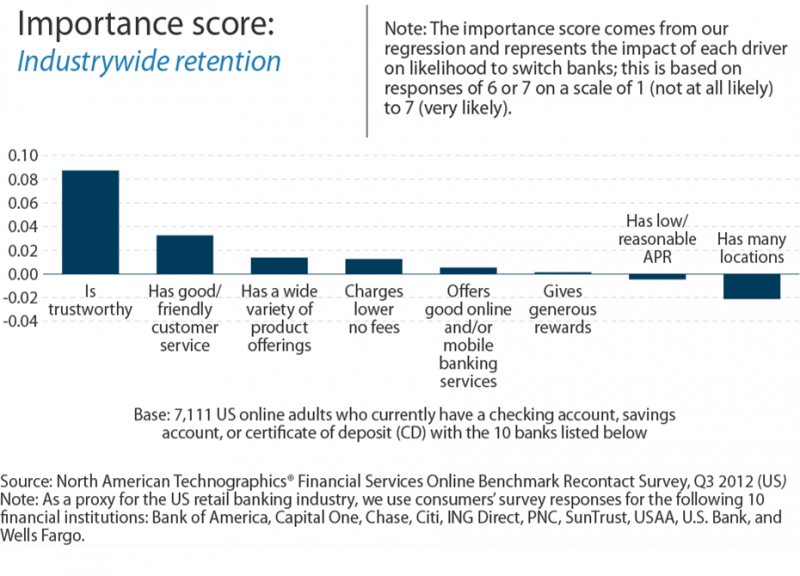

The graphic below shows the drivers of retention for the US retail banking customers: The perception of trustworthiness is off the charts as a driver of retention, and offering good customer service is the second-most influential driver. What our analysis shows to not impact retention — and even shows a negative relationship with retention — is having low APR and many locations.

How did the various US retail banks score for these drivers? Read the report to find out.