The Mobile Tsunami Reframes Windows As One Of Three OS Players

Windows 8 is a make or break product launch for Microsoft. Windows will endure a slow start as traditional PC users delay upgrades, while those eager for Windows tablets jump in. After a slow start in 2013, Windows 8 will take hold in 2014, keeping Microsoft relevant and the master of the PC market, but simply a contender in tablets, and a distant third in smartphones.

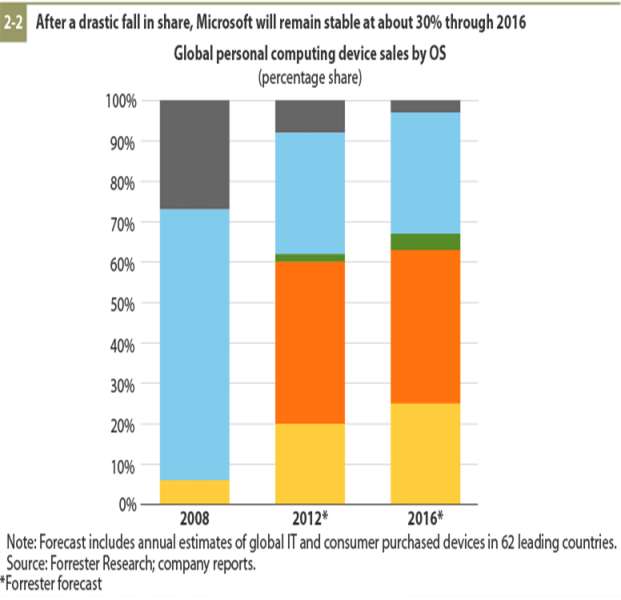

Microsoft has long dominated PC units, with something more than 95% sales. The incremental gains of Apple’s Mac products over the last five years haven’t really changed that reality. But the tremendous growth of smartphones, and then tablets, has. If you combine all the unit sales of personal devices, Microsoft’s share of units has shrunk drastically to about 30% in 2012.

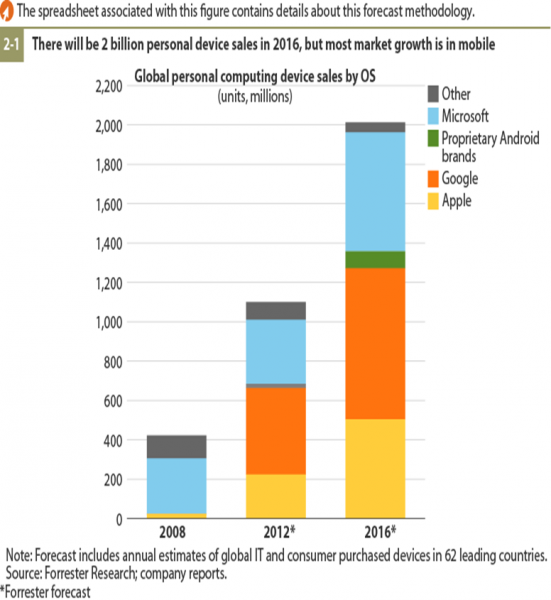

It’s hard to absorb the reality of the shift without a picture, so in the report “Windows: The Next Five Years,” we estimated and forecast the unit sales of PCs, smartphones, and tablets from 2008 to 2016 to create a visual. As you can see below in the chart of unit sales, Microsoft has and will continue to grow unit sales of Windows and Windows Phone. But the mobile market grew very fast in the last five years, while Microsoft had tiny share in smartphones and no share in tablets.

If you look at the results by share of all personal devices, below, you can see how big a shift happened over the last five years as smartphone units exploded and the iPad took hold.

Windows 8 will simply stop the shrinking, maintaining Microsoft’s share at about 30% through 2016. By 2016, we believe that Microsoft will have about 27% of tablet unit sales, but only about 14% of smartphone sales (and some of us are very skeptical they’ll even get to 14%).

The result is the CIOs and individuals face a market over the next five years where Microsoft still dominates PCs, Apple’s iPad leads the tablet category, and Google’s Android leads in smartphone sales.

For more details, clients can listen to the webinar from Oct 19: "Microsoft Windows Evolves From Dominance To Contender" and download the slides. Clients can work with us to look at the detailed forecast across 62 countries.

What do you think of this mixed market? How will companies and individuals react to the lack of one dominant player? How will personal cloud services shape these markets – by supporting heterogeneity or causing people to bet on one vendor for all three categories of personal devices? Let us know in your comments below.