SAP’s Maintenance Price Hike Should Concern Sourcing Professionals And Their CIOs

On Monday, SAP communicated that it will increase the price of standard support on new contracts by 5% from July 15, 2013, from 18% to 19%. SAP’s announcement claims that the increase is necessary: “In order to ensure the same high level of quality support in the future.” That justification is disingenuous, in my opinion. SAP already makes a very healthy profit on maintenance. (SAP does not report its margin on maintenance revenue. For 2012, it reported 81% gross profit on software licenses and maintenance combined.) Moreover, third-party support providers (3SP’s) like RiminiStreet can provide better support at half the price or less.

SAP’s other justification is equally unconvincing. It states that within the standard support package “there is ongoing expansion of value, for example a continuous flow of innovation through Enhancement Packs.” SAP reinvests 14% of its revenue in R&D, but I estimate that 90% of that goes on developing new products such as Hana that you have to pay again for if you want them. (SAP disputes this estimate but did not provide an alternative figure.) That would mean that Enhancement Pack development represents around 1% of revenue, insufficient to justify charging double what 3SP’s charge, let alone a 5% price increase.

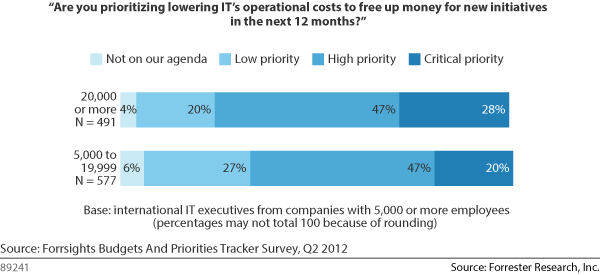

But let’s look beyond the questionable marketing and examine the real business rationale. Presumably SAP believes that the price elasticity of demand is sufficiently low for this to be net revenue positive. In other words, SAP hopes that customers are so dependent on its products that they will accept this increase. However, this comes at a time when CIOs are desperate to cut maintenance and operating costs in order to free up budget for vital new initiatives (see below, from my Strategic Software Sourcing Playbook overview Get Better Software Deals By Aligning Your Sourcing Strategy And Commercial Approach).

SAP does not need to milk its install base to increase its profits, because it is already in a strong position. Innovations such as Hana, SAP360 and Rapid Deployment Solutions are just what customers want, while its main competitor, Oracle’s applications business, is struggling (as some of my colleagues explain in Oracle's Dilemma: Applications Unlimited Versus Oracle Fusion Applications).

I’ve blogged before about the two cultures within SAP, the one committed to improving its customers’ businesses and the other focused on quarterly revenue targets. This price increase seems to come from the latter, and I believe it’s a mistake, because it may:

· Prompt a few more companies to realize that they are already over-dependent on SAP. Many of our clients are considering expanding their SAP footprint, both to simplify their current environments and to support new projects in areas such as mobility and analytics. This could be a risky strategy, because they have to trust SAP not to take advantage of them as they become even more dependent on its products and services. This price increase should cause those clients to reconsider whether SAP is worthy of that trust. Even if they’re not directly affected by this change (e.g., because they’re on Enterprise Support) they may start to wonder, if SAP thinks it is acceptable to increase maintenance charges now, without any real attempt at a business justification, what will it do when it is even more powerful than it already is?

· Boost the 3SP market. If SAP is wrong about the price elasticity of demand for its support services, then this increase, together with the annual so-called “cost of living” increases, will accelerate defections to 3SP’s. It may lose more revenue that way than it gains from the remainder accepting the higher charges. In the best case scenario (for customers), rapid growth in the 3SP market could attract major SAP service providers such as HP and IBM to enter it, forcing SAP to compete by unbundling its Support and Enhancement Pack products.

Bottom line: In trying to simplify their systems, IT departments have standardized so much that they are dependent on a few dominant technology providers. It may be a sound strategy, but it means that they can’t rely on traditional procurement approaches to control maintenance costs. Enterprises need a new approach to restore the commercial balance with technology leaders like SAP, one that Forrester calls Strategic Software Sourcing. In particular, you need to secure long-term protection against price increases before you embark on your standardization program. This price hike should be a wake-up call to CIOs and sourcing professionals everywhere, to start implementing our approach as soon as possible.