The Forrester SaaS ITSM Tool Market Overview: Who Is Where With What

It’s finally here. The Forrester Market Overview: SaaS IT Service Management Tools covers: a little ITSM tool history and how we have moved on, the benefits and risks of the SaaS delivery model, key selection criteria for selecting a SaaS (or on-premises) tool, and overviews of 23 tools (from 21 vendors) and their functional capabilities across the enterprise and midmarket marketplaces.

“Why on earth did you write a SaaS-only ITSM report?” I hear some cry

It’s simple – Forrester client demand. In 2012, a good 25% of my 400ish a year client inquiries related to IT service management (ITSM) tool selection; and the SaaS-delivery model (and the key vendors) was covered in nigh on all of them. That’s not to say the client ultimately went SaaS though, inquiries are very much about rapid information exchange in helping clients make important decisions. It’s not about making the decision for the client.

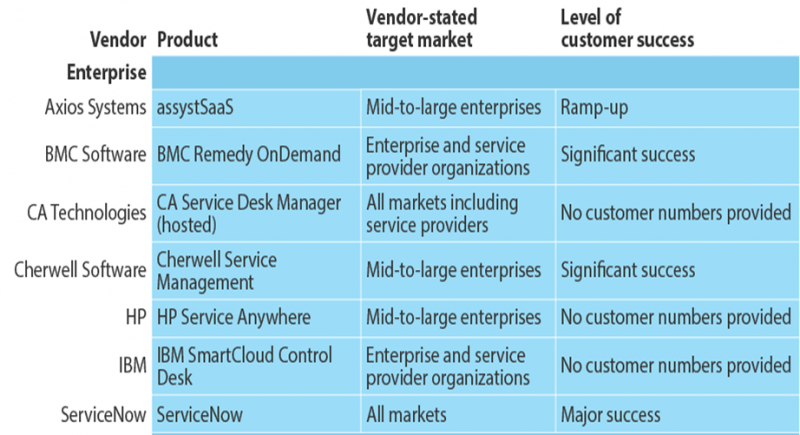

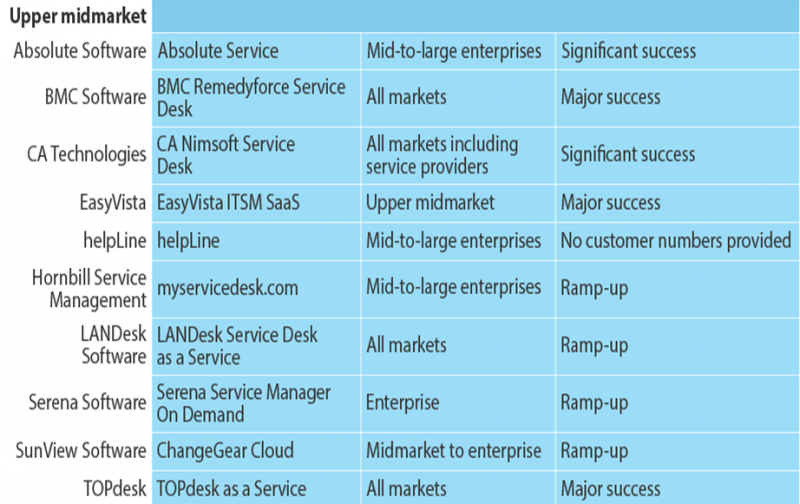

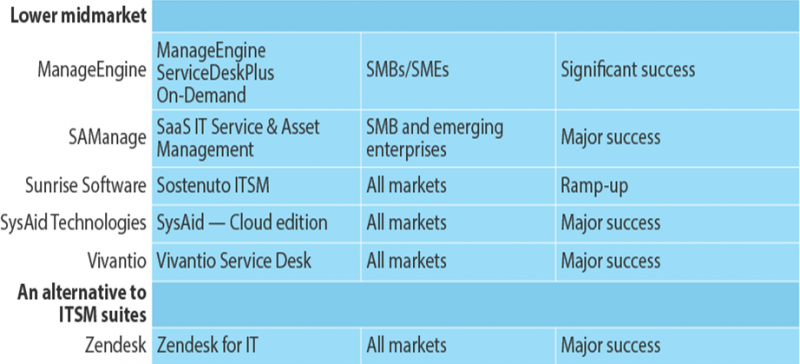

What the SaaS ITSM market looks like

The following figure shows the 23 vendor tools split by average customer subscription (seat) count (described as Enterprise, Upper Midmarket, and Lower Midmarket) and their degree of customer success (the number of paying customers):

There are of course other ITSM tool vendors who declined to participate for a variety of reasons. One would be that they were not briefing Forrester analysts and thus not on our radar.

The key benefits of SaaS for ITSM

The software-as-a-service delivery model can offer fast deployment speeds, low upfront costs, and ongoing flexibility to scale up or down as needs change. These benefits are universal, whether applied to customer relationship management (CRM), enterprise resource planning (ERP), collaboration, or ITSM. Key benefits of the SaaS delivery model for ITSM include:

- Subscription-based pricing that lowers total cost of ownership, initially. For many firms, the key benefit of SaaS is its simple, subscription-based pricing model: Firms pay a subscription fee per month (or year) per user that covers everything needed to operate, including support and maintenance. This model provides a lower and consistent level of opex without any of the capex investment required for on-premises hardware and software licenses. As a result, the total cost of ownership of SaaS is lower. However, this is often only temporary, as the total cost of ownership of SaaS often can become more expensive than on-premises after three to four years, depending on customer ITSM maturity. Also, some vendors offer subscription-based pricing (opex rather than capex) for their on-premises offerings.

- Simple implementation and upgrades that minimize staff effort. An SaaS-delivered ITSM tool only requires a web browser and an Internet connection to function — no client to install, no hardware to support, and nothing to upgrade locally. SaaS also offers seamless, automatic upgrades, typically two to four times per year (a caveat here is that customer customizations can still cause issues with the ease of said upgrades). This means that users can access the latest features and functionality faster than in an on-premises deployment, where upgrade cycles often take 18 to 24 months.

- Reduced support needs. SaaS can reduce or eliminate internal IT support since the SaaS provider typically includes support and maintenance in the subscription (with the provider responsible for patching and bug fixing).

- Greater opportunity of use. The simplicity of pricing can also be viewed from a value-for-money perspective, in that a per-seat subscription will usually cover access to capabilities across multiple ITIL processes rather than the traditional need for organizations to buy multiple licenses across multiple ITSM products (or modules). This gives an organization the freedom to continue its adoption of the ITIL framework over time without additional cost, other than for additional users and seats as necessary.

- Higher user satisfaction. Although Forrester hears frequent complaints about ITSM tools, the data suggests that satisfaction is higher than dissatisfaction. However, SaaS customers are far more satisfied. While all other models maintain an about 70:30 satisfied/dissatisfied ratio or worse, SaaS is an impressive 88:12. We believe it's a combination of the benefits above. Software-as-a-service's ease of use, instant availability, and pay-per-use nature are in stark contrast to older on-premises experiences that firms perceive as clunky and which take months or years to rollout, all while spending significant capital investment upfront before value is received.

In the report this is balanced with the risks of SaaS. One should also remember that modern ITSM tool vendors can also deliver these benefits via on-premises tools.

Finally, if you want to find out more …

… About:

- The risks of the SaaS delivery model

- Key selection criteria for selecting a SaaS (or on-premises) tool

- Overviews of 23 tools (from 21 vendors) and their functional capabilities

… For clients the report is available here. For non-clients I am hopeful to add a link to a publicly-available copy via vendor website at some point.

7 March UPDATE: Axios Systems has made the report available here.

As always your thoughts and comments are appreciated … who else would you have liked to have seen included?

If you liked this … this earlier SaaS for ITSM blog might also be of interest: http://blogs.forrester.com/stephen_mann/12-08-31-saas_for_itsm_getting_past_the_hype