Your New #1 Competitor

Who is your company’s Number One competitor? Actually, it’s not who you think it is. In fact, it’s probably not “who” at all, but rather “what” that is taking away the most sales from your sales team(s).

We recently asked 180 IT salespeople with greater than three years of experience this question: “Thinking about the opportunities you’ve lost in the last 12 months, what is the most common reason for the loss?” They replied that in 43% of losses the reason was “Lost funding or lost to no decision: customer stopped the procurement process.”

Your Real #1 Competitor

Your company’s “competition,” more often than not, is actually buyers deciding not to make a decision at all. You lose to a “no decision.” Your perceived competitors didn’t win either. No transaction happened, no value was created; only cost was incurred by all parties involved. OK, so is this really a "new competitor." No. However, due to changes that I'll discuss below, it is a competitor that has gained far more of a foothold on business that you would like to have. So what happened?

As a sales leader, I often found the overall opportunity pipeline stuffed full of these no-decision “opportunities” that got stuck at the proposal or business case stage (proposal submitted) and just never moved forward. You’re seeing those right now right? I call this a constipated pipeline. It’s not healthy. Ah, but hope rings eternal for salespeople. So these were the opportunities that required tough management questions to ascertain whether they would ever convert to business. Buyers didn’t choose a competitor, so for the salesperson, the opportunity was still an opportunity. Only it wasn’t. The buyer had decided not to decide. So managers had to help the salespeople understand why the buyer wasn’t moving forward, when all along they were agreeing that their “solution” seemed like a good idea. Investing in “stuck” opportunities saps energy to pursue real opportunities. Flush them. Let’s understand why salespeople lose to a “no decision.”

Agreement Networks

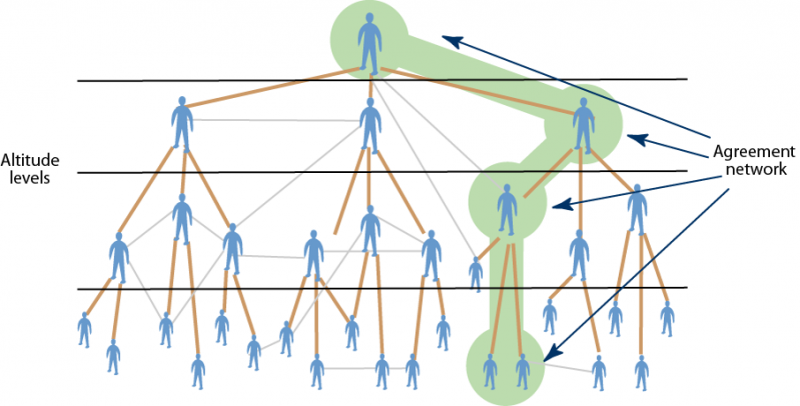

The first reason is that your buyer’s world has changed, dramatically, in the new economy. When I was a salesperson in the 1980s and 90s, Directors and Vice Presidents had substantial budget and autonomy to make decisions within their domains. Today, there is vast scrutiny over what, in the past would have been considered modest, expenditures. The result is that there are almost always numerous people involved in the buying process. So salespeople more than ever before must understand and navigate complex agreement networks and processes within the buying organization that span different altitudes and functional roles. Because decisions are more cross-functional, every dollar is compared against how it could add value in potentially completely non-related areas of investment.

Therefore opportunities that result in a “no decision” are often symptomatic of salespeople (and their managers) that have not adapted to the complexities of the decision networks in their prospective customers’ organizations.

Perception of Value

The second reason, which is directly related to decision networks, is a lack of understanding of how the people within the agreement network perceive value. There is no longer such thing as “the customer” or “the buyer” because there are multiples within the agreement network.

So much attention has been focused on helping salespeople communicate Return on Investment (ROI). Is this working? When asked “How would you rate your ability to create and present ROI information?” 88% of those salespeople surveyed in our Seller Insight Study indicated that they were either proficient (61%) or highly proficient (27%). Really? More importantly, are these models really capturing buyer perception of value? Or are they creating a perception in sellers that they just need to capture ROI data to “communicate value”. Nothing could be further from reality. Is it good to capture and present financial impact? In many cases it is. But financial ROI is not a sufficient representation of value.

There is no singular perception of value. A “company” does not perceive the value of your offerings through a single lens. Therefore, a salesperson must not only understand who is involved in the buying process, but they must also understand how each influential person in that network perceives the value of the offering being considered. Of course, this can’t happen without identifying and engaging the members of the agreement network each decision. But assuming that a salesperson gains access to all of the relevant buyers, the Value Equation framework can be used by salespeople to understand the perspectives of each “buyer” in the agreement network. See my earlier blog, Understanding How Value Adds Up for Buyers and read Introduction to the Value Equation Framework report for more detailed insights.

Also, it is irrelevant how much value a salesperson can envision for the customer if they would just move forward. Only buyers can determine what is valuable. How much forecasted revenue in your company’s pipeline right now is the result of the salesperson projecting their own bias of potential customer value, vs. what the prospective customers’ perceptions are?

This can all sound very daunting and resource intensive. Regardless, this is the reality of selling in the 21st century. If you want your salespeople to win large opportunities, then they must be proficient at understanding how value is perceived at the different altitudes and within the functional roles that participate in decision networks today, and they must be able to transfer relevant knowledge to the right buyers to help forge a strong perception of value.

Here’s a dose of reality. Only 19% (U.S.) of the more than 400 IT and Executive Buyers surveyed in our Buyer Insights Study believe that that meetings with salespeople are valuable and live up to their expectations. Consider that 68% of the time, those buyers were already looking for a product that the vendor provides. So there is clearly a break that occurs in the buying process after the salesperson has gained access to “a buyer.”

Summary

When an opportunity is designated “lost to no decision,” a salesperson will more than likely point the finger at the price (too high), or product functionality (not enough), or some other factor. To a degree they’re right; it’s clear that the buyer(s) didn’t see enough value to justify an investment. Regardless, the responsibility still resides with the salesperson in a “no decision” outcome because they didn’t help the buyer connect the dots on value.

For professionals in Sales Enablement roles the call to action is get real about the “no decision” impact on the top line, and take cross-functional coordinated action to help salespeople address this. Does your company have a coordinated (as opposed to segmented) objective win/loss review process that involves the right people, culls out bias, and gets to the actionable facts to support salespeople in better communicating value? Are your salespeople pitching products or services, or are they truly understanding the challenges and value equation of each of the roles involved in making decisions on the seller’s offerings? How is your company measuring this? How are you preparing your salespeople with the messages and capabilities to sell in the radically different selling environment that we are now in?

I’d love to hear your perspectives and discuss your specific opportunities for winning against “no decisions.”