Forrester’s 2013 US And Canadian Bank Secure Website Rankings

Hello, and a somewhat belated Happy New Year, dear readers! As we prepare for the upcoming year — and start to think about the digital banking space in 2014 — it is worth taking stock of where banks’ secure websites are today.

Late last year, Forrester published our annual benchmarks of the largest banks’ secure websites: The 2013 US Bank Secure Website Rankings can be found here and the 2013 Canadian Bank Secure Website Rankings can be found here. Here are a few highlights from this research:

- Canadian banks excel at cross-selling. Canadian banking providers may well be among the best in the world at cross-selling on secure sites. In our reviews, Canadian banks earned scores that were significantly higher than US firms in our cross-selling category. In fact, every Canadian bank we ranked earned high marks for digital cross-selling. They accomplish this by embedding marketing and calls to action for additional products and employing merchandising tactics within "products and services" tabs.

- US banks shine when it comes to money movement and alerts. All six US banks did well in our money movement category, which includes bill pay, transfers, and P2P payments criteria. The US banks also scored well across the board for alerts by offering extensive account, transaction, and security alerts across a range of delivery endpoints including email, SMS, and in-app alerts.

- Seven large North American banks continue to lead overall. Royal Bank of Canada and Citi once again earned the highest overall scores in their respective countries. In the US, Bank of America and Wells Fargo tied for second-best scores, while in Canada BMO and Scotiabank tied for the second-highest overall scores — and CIBC was right behind them. These banks all earned scores of 67 or higher (out of a possible 100) by providing a wide range of online features that are convenient and easy to use.

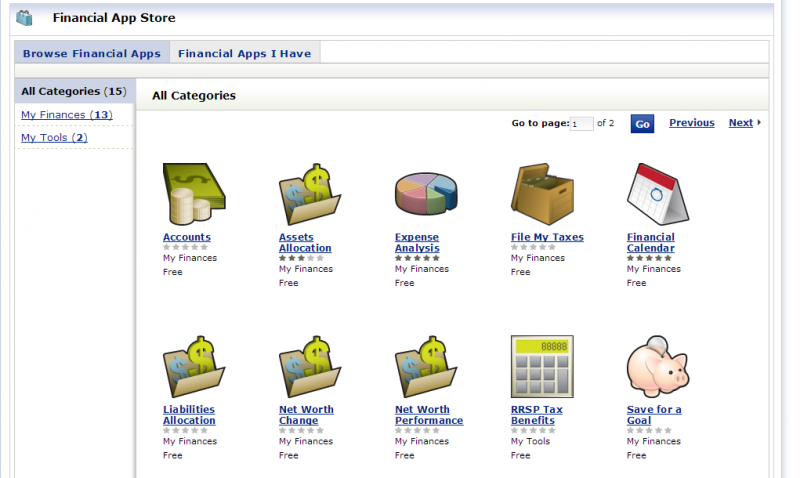

- Digital teams can learn from other banks’ best practices. No one bank has mastered all aspects of secure website strategy and design, but different firms offer best practices in different areas. TD Canada Trust, for example, recently revamped the home page on its secure site, making the layout cleaner, drawing customers' attention to key content and features, and adding a key "summary" at the top of the page to give a quick idea of how a customer is doing. Citi, Bank of America, and Wells Fargo, meanwhile, all offer natural language keyword search on their secure sites — something other banks would be wise to consider. Other innovations include RBC’s innovative "Financial App Store" within its secure website, which lets online bankers choose the web apps that will help them manage their financial lives (see screenshot below).

- Most banks still have work to do when it comes to money management tools. While some US banks like Citi and Wells Fargo have made great strides in providing money management tools, many do not offer spending analysis and/or budgeting tools. Those that do offer digital money management tools need to embed these tools within everyday, commonly used areas of the secure site. In the longer term, digital teams at banks will need to provide forward-looking tools like predictive spending forecasts to help customers understand and anticipate their financial future.

Once again, the full report on US banking providers can be found here, and the report on the largest Canadian banks can be found here.

We invite your comments and reactions to our research.

[screenshot: RBC includes a branded app store on its secure website]