Why Usage-Based Car Insurers Need Don Draper

Don’t you hate when a company advertises a product but fails to make it easy to find and buy?

Mad Men’s Don Draper, who, in the 1960’s could have been as likely to work in insurance as advertising (but the story would have been not nearly so interesting), would have a field day with the findings from Forrester’s just published report, “The Next Act For Usage-Based Car Insurance”, the first in a four-report series addressing the UBI landscape in the US, Canada,and Europe and the future of UBI.

Smart devices, smartphones, and smart cars are converging to create what should be a smart insurance choice for safe drivers and their insurers. The report examines American consumer interest and adoption of usage-based car insurance and the obstacles to purchase, many of which point directly to insurance eBusiness failings.

When Forrester last looked at the UBI market in 2008 (then termed “Pay As You Drive” or PAYD), consumers couldn’t get it because of a big distribution problem: It was offered by few insurers in just a few states. A couple of months ago, we decided to see just what had changed over the past five or so years when it came to consumer interest and purchase. What did we learn?

- The distribution problem has been cracked. In our research, we found 16 insurers offering UBI coverage. Progressive was offering the coverage in 46 of 51 potential jurisdictions, and even as the report was going live, we were learning of new offers in press releases and new state insurance filings, including Liberty Mutual’s RightTrack and New York’s approval of UBI offerings for Allstate, Allianz, the Hartford, Progressive, State Farm, and Utica National.

- Consumers are interested, but…One-third of US online adults surveyed expressed interest in usage-based car insurance, mostly drawn by the potential cost savings. But a number of concerns are thwarting purchase including worries about cost increases, inability to compare rates with traditional policies, and reluctance to install devices in their cars.

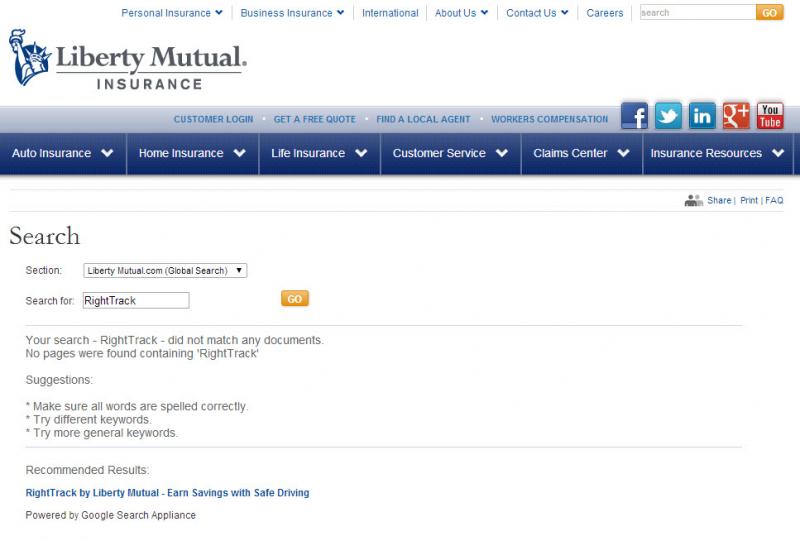

- Insurers are testing shopper patience and resourcefulness. Apart from Progressive Casualty Insurance, US insurers are failing to market and sell their usage-based insurance offerings effectively. Shortcomings include navigation issues that make the coverage difficult to find on websites, inadequate tools that don’t enable easy comparisons with traditional policies, and misaligned agent financial incentives. By way of example, a Goggle search of Liberty Mutual and RightTrack brings you to Liberty Mutual’s service partner, Octo, but a search today for RightTrack on Liberty Mutual’s website brings a null set (and Liberty Mutual was hardly alone with this particular failure) :

The key takeaway? It’s time for UBI insurers to redesign their usage-based digital marketing and sales strategies and do it now. Why? Because there’s a battle going on as insurers pursue the safest drivers.Careful drivers who value digital services will be disappointed with experiences that don’t meet their expectations. And that goes for after the UBI purchase: As Don said back in Season 3:

“…it's a label on a can. And it will be true because it will promise the quality of the product that's inside.”