2014 US Credit Card Secure Website Benchmark: Discover Continues To Lead

[This blog post was co-authored by Rachel Roizen]

Forrester has just completed our 2014 US credit card secure website benchmark, in which we assessed the features, functionality, and content on the secure websites of the six largest credit card issuers in the US.

You can read and/or download the full report by clicking on the link below:

Here are some key findings from our research:

- Discover again earns the highest overall score. Discover takes the top spot in our review once again this year — it also earned the highest overall score the last time we conducted this benchmark two years ago. Discover offers exceptional money management features like spending analysis that is both personalized and customizable, as well as debt reduction tools. Discover’s secure website also offers first-rate cross-selling, account management, and money movement functionality.

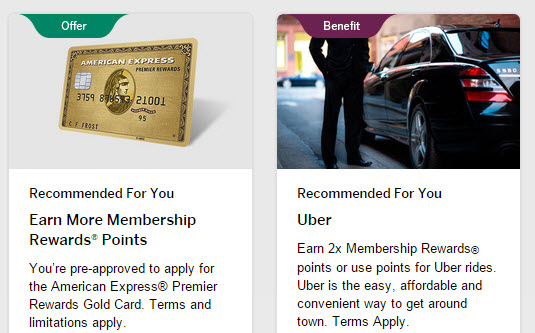

- American Express moves into second place with impressive enhancements. American Express earns the second highest overall score in our benchmark — and it will further enhance its secure website over the next few months.* American Express offers excellent website search and best-in-class home page features for cardholders. Its secure website also earns the highest score for our “merchandising” criteria, with the option to filter and bookmark different product and service offers or to get a personalized recommendation (see image below).

- Many firms lack robust money management features and digital cross-selling. Overall, the credit card websites we evaluated score well in six of the eight categories. But there are two areas most still need to work on: Digital money management (also known as DMM or PFM) and cross-selling. We found that too few firms have embedded money management into commonly used parts of their secure sites — such as the home page — and some credit card companies offer virtually no money management tools on their secure sites. In terms of cross-selling, credit card companies need to do more to make the most of the secure website as a sales and marketing touchpoint, with clear guidance to product information, comparison tools, and educational content.

We encourage you to read the report and let us know your thoughts!

*Note: Some aspects of American Express’ redesign came after our review period, so its score in this benchmark does not reflect all of those changes.

The image below shows an American Express customer viewing products, services, and benefits recommended for them: