The Age of Alt: Data Commercialization Brings Alternative Data To Market

We all want to know something others don’t know. People have long sought “local knowledge,” “the inside scoop” or “a heads up” – the restaurant not in the guidebook, the real version of the story, or some advanced warning. What they really want is an advantage over common knowledge – and the unique information source that delivers it. They’re looking for alternative data – or “alt-data.”

From the information age where everyone took advantage of easy access to information, we are now entering an age where everyone seeks alternatives: new sources of information and innovative ways of deriving unique insights. This is the “Age of Alt.”

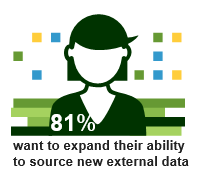

We know that business leaders want to better leverage data and analytics in their decision-making. But more importantly most decision-makers want to supplement their own data with external data; 81% tell us they want to expand their ability to source new external data. Demand for data is exploding.

We know that business leaders want to better leverage data and analytics in their decision-making. But more importantly most decision-makers want to supplement their own data with external data; 81% tell us they want to expand their ability to source new external data. Demand for data is exploding.

With everyone now chasing data, the challenge is to find something new and different – finding the “alt data.”

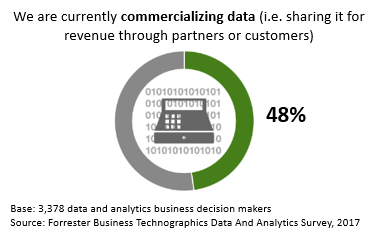

Fortunately, the supply of data is booming as well. Forrester’s hot-off-the-press 2017 Data and Analytics survey reports a huge jump in companies taking their data to market:

Fortunately, the supply of data is booming as well. Forrester’s hot-off-the-press 2017 Data and Analytics survey reports a huge jump in companies taking their data to market:

48% are commercializing their data – and that’s up from 32% last year.

These new data sources out there represent an enormous opportunity to find that information advantage.

Companies like Quandl help bring alternative data to market. They identify potential sources, partnering with traditional companies that have large data sets and are looking for ways to commercialize their data assets. Quandl provides data preparation, productization, and promotion.

Alt data in financial services which is Quandl’s focus allows investors to get a head start – an opportunity they’ll happily and handsomely pay for. For example, car manufacturers report sales monthly, but what if those investing in Ford or Daimler stock knew sales figures daily? They’d have that “heads up” everyone wants to have.

Of course, the advantage only works if access to the information is limited. Quandl determines a data set’s "capital capacity" — how many firms could use the data before its value dissipates. What part of the market does the data set address? How much money can be invested before the signal is exhausted? Access to the data set is limited to ensure customers benefit from the signal and get their share of the data’s capacity. And, limited access keeps the data set within the world of “alt data.”

But with 48% of companies selling their data, we expect the alternative data universe to be broad, and widely accessible… for the right price.