As Overall Energy Wanes, Preserve Relationships With Your Highest-Energy Consumers

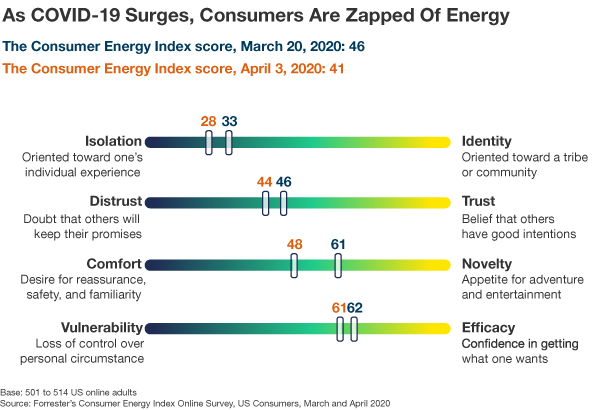

To measure precisely what kind of emotional toll COVID-19 is taking on consumers — and how current consumer sentiment will influence imminent behavior — we are applying Forrester’s Consumer Energy Index, our data-driven framework that captures how ready and willing consumers are to reach out to brands.

Three weeks ago, COVID-19 was driving consumer energy down on all four dimensions. Our latest pulse reveals that consumer energy has waned even further — total energy has dropped from 46 to 41, and the biggest change is the movement away from “novelty”:

What The Data Means:

- Consumers feel increasingly fragmented and disconnected. Physical isolation continues to drive consumers into a place of emotional isolation. Consumers’ tendency to reinforce identity through community participation and group affiliations is being replaced with a mindset of individuality.

- Consumers hesitate before trusting organizations. The two-point drop on the consumer energy “trust” dimension indicates that consumers still find it hard to believe that brands will follow through on their promises.

- Consumers are quickly losing their appetite for adventure. Data from early March signaled that consumers were eager to learn something new or be entertained. Now, the appeal of novelty is wearing off. Rather than seeking variety, consumers are seeking familiarity.

- Consumers have a mild confidence in their ability to regain control. Consumers’ sense of control took the biggest hit when the pandemic initially reached the US. Since then, “efficacy” scores have remained fairly unchanged. Although consumers are generally less assertive in their pursuit of resources than average, they don’t feel entirely powerless over their situation.

What This Means For Brands:

With weeks to go before the COVID-19 peak, prepare to preserve relationships with your highest-energy consumers. Although no one can predict the course of the virus or the physical and emotional damage it will leave in its wake, our data trend suggests that consumer energy will continue to fade, albeit at a slower pace, as the COVID-19 wave intensifies. While consumers with the lowest energy levels will pull back from brands the most, consumers with higher energy levels will have more capacity to tune into brand messaging or lean into a brand experience. Demonstrate empathy and partnership with your high-energy consumers to show that you are by their side in a time of crisis, and be prepared to serve them when they reignite momentum on the other side of the pandemic. This is because data proves that:

- High-energy consumers are most optimistic about their future. Optimism is fuel for consumer confidence, the source of consumer trust, and a strong driver of consumer behavior. Optimistic, high-energy consumers will be the first to reenter the market.

- High-energy consumers look to brands as a source of value. Consumers with the highest energy levels are most willing to believe that brands have good intentions and make business decisions by prioritizing consumer well-being, not only the health of their own business.

- High consumer energy is the strongest predictor of brand engagement. Our analysis reveals that consumer energy directly drives optimism and positive brand perception more than age, income, or time spent learning about COVID-19.

Questions, comments, or ideas? I look forward to sharing more data detail and discussing via inquiry.