Benchmark Omnichannel Retail And Digital Store Capabilities In Singapore

My colleague Tom Mouhsian and I have just published two retail benchmark reports for Singapore, assessing retailers’ omnichannel retail capabilities and digital store capabilities, respectively.

For both evaluations, we selected six multichannel retailers that operate both online and offline stores and provide “buy online, pick up in store” services in Singapore: Charles & Keith, Decathlon, Harvey Norman, Marks & Spencer, Uniqlo, and Watsons.

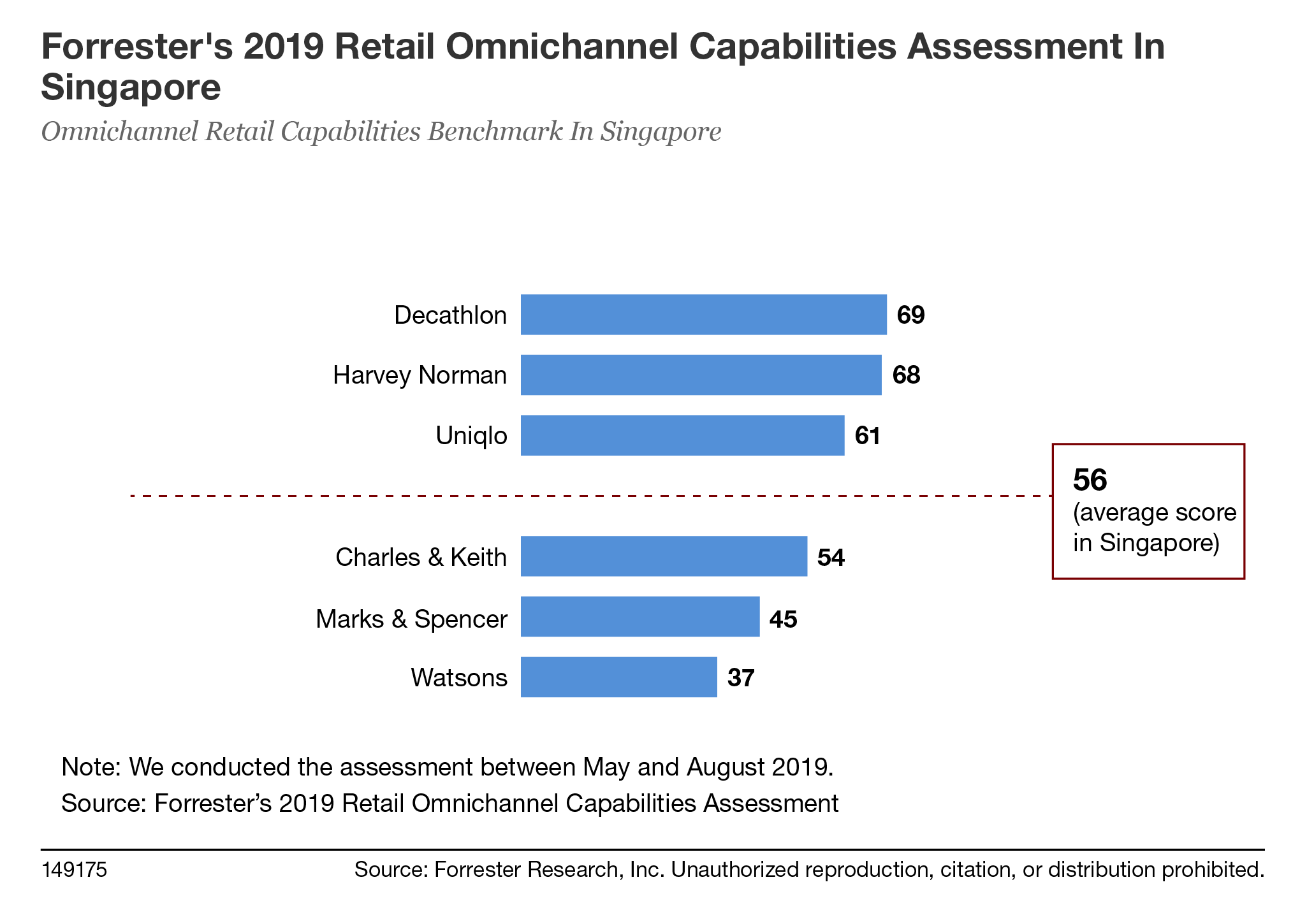

Omnichannel Retail Capabilities Benchmark In Singapore

We scored omnichannel retail capabilities on a four-point scale spanning four key categories: online experience, channel consistency, in-store pickup, and in-store experience. The six retailers’ scores ranged from 37 to 69 out of 100, with an average of 56. On average, retailers in Singapore scored highest on channel consistency and lowest on online experience. Specifically, we found that:

- Retailers differentiate with in-store pickup and channel consistency. Retailers differentiate themselves most from the competition with high performance in three omnichannel capabilities: fast, convenient in-store pickup; consistent loyalty programs and promotions; and visibility into enterprise inventory.

- Decathlon and Harvey Norman were the top-performing retailers. Decathlon has equipped its stores with automated inventory management tools like RFID tags and a dedicated service counter to deliver efficient in-store pickup. Harvey Norman allows customers to filter and see what is in stock and in which store and follows up with fast, streamlined in-store pickup.

- Retailers should eliminate the separation between channels to realize omnichannel retail. To become a fully omnichannel retailer, adopt in-store fulfillment to improve speed and cut costs; implement “buy anywhere, return anywhere” to upgrade shopping experiences; and make pre- and post-purchase experiences consistent.

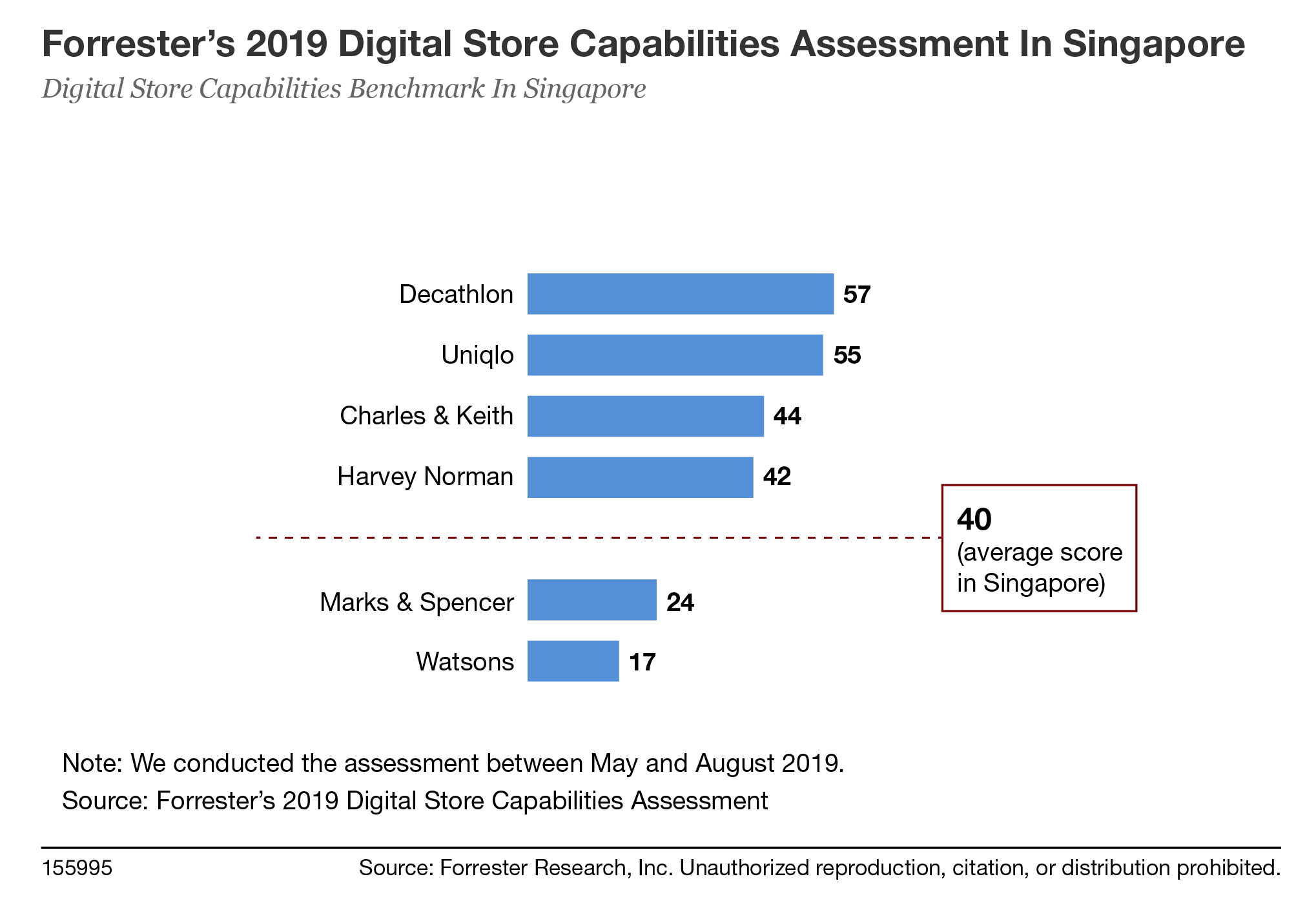

Digital Store Capabilities Benchmark In Singapore

We scored digital store capabilities on a four-point scale spanning four key categories: associate digital tools, customer digital tools, digital engagement screens, and location engagement. The six retailers’ scores ranged from 17 to 57 out of 100, with an average of 40. On average, retailers in Singapore performed better in digital tools for associates and customers than digital engagement screens and location engagement. Specifically, we found that:

- Singapore retailers’ digital store capabilities are still nascent. Digital engagement screens and location engagement in particular have a long way to go. The digital signage adopted by retailers mainly contains static ads, which lack interactivity or contextual content for customers. Similarly, location-based customer engagement is also still far from common among Singaporean retailers.

- Decathlon and Uniqlo were the top-performing retailers. Decathlon’s key strengths are its cross-store inventory visibility for associates and customers and its option for customers to self-checkout with in-aisle kiosks. Uniqlo differentiates itself with location-based technology to engage customers in-store.

- Retailers have yet to create real-time, contextual, and interactive experiences. To enhance shopping experiences, retailers need to provide value-added services that go beyond improving shopping efficiency, such as rich product content access and clienteling, to better serve customers. In-store digital technologies that focus on encouraging customer engagement are the key to differentiation.

To learn more about Forrester’s retail benchmark mythologies and understand how your retail capabilities compare with your peers, read the full reports: “Omnichannel Retail Capabilities Benchmark In Singapore” and “Digital Store Capabilities Benchmark In Singapore.”