Canadian Tech Market Will Fall At Least 7% In 2020 Due To The COVID-19 Recession

The Canadian tech market will fall in 2020. The only question is how much. Forrester’s latest forecast for Canadian business and government of tech goods, software, and services shows the best case is a 7% drop in 2020 (Scenario A). However, a bleaker projection of an 11% fall is becoming more likely as the US pandemic accelerates and the US economy takes a hit (Scenario B) (see the Forrester report, Canadian Tech Budget Outlooks In A COVID-19 Recession).

The COVID-19 pandemic, consumer and business reactions to the disease, and government efforts to contain it have already caused Canadian real GDP to drop at an annualized rate of 8.2% in Q1 2020. Economic forecasters at the International Monetary Fund and other institutions project Canada’s real GDP will be down by 8% for all of 2020, with the best-case outlooks showing a recovery in 2021. For perspective, these forecasts indicate that Canada’s economic downturn this year will be worse than the 2009 recession. Still, the relatively positive Scenario A of a recession that starts to ease by Q4 2020 with a solid recovery in 2021 has better than even odds of playing out, for three reasons: 1.) Canada’s response to COVID-19 has been generally effective and has brought down the number of new cases and deaths significantly; 2.) the Canadian government installed a major economic stabilization program with a fiscal stimulus of C$193 billion (8.4% of GDP); and 3.) Canada’s economy is decently positioned for a resilient recovery due to good health coverage and social support programs, which will reinforce consumer spending and a financially solid business sector.

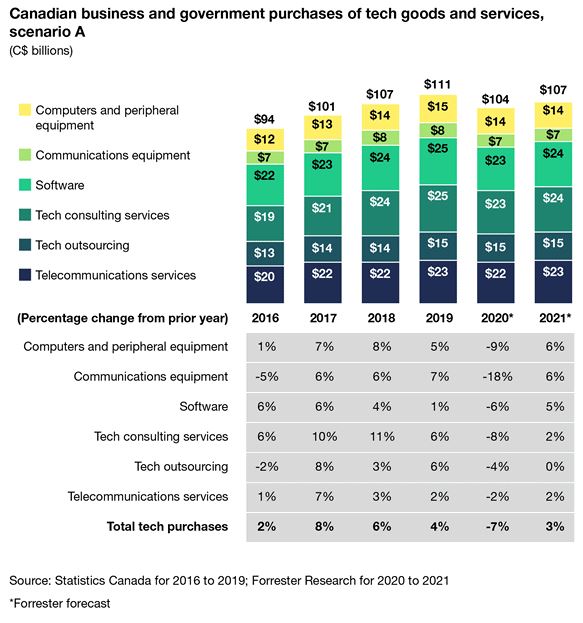

In this scenario, Canada’s tech market would fall by 7% in 2020, from C$111 billion in 2019 to C$104 billion in 2020. For Canada’s tech market, communication equipment would have the biggest drop, an 18% decrease, as temporary increases to support work-from-home arrangements get overwhelmed by telco and business cutbacks in capital investment. Computer equipment, software, and tech consulting would also see big drops, with tech outsourcing and telecommunications the least affected, showing only 4% and 2% decreases. 2021 would bring an upturn in demand, especially in hardware (communication and computer equipment), which would rebound by 6%, though still remaining below 2019 levels.

Forrester’s Forecast For The Canadian Tech Market, 2016-2021

However, the US, Canada’s neighbor and biggest trading partner, is likely to experience Scenario B: a deeper recession that lasts well into 2021. The US COVID-19 caseload is rising, economic stabilization efforts are due to run out, and the economic damage is spreading. Canada’s economy could get caught in this downdraft. If so, Scenario B of a Canadian recession that lasts into 2021 would prevail. This alternative and bleaker scenario would lead to an 11% decrease in tech spending in 2020, rather than the 7% decrease expected in the more optimistic scenario.

Cutting tech budgets in this pandemic recession will be inevitable for many Canadian companies in 2020, and it may well need to continue into 2021. CIOs and their business partners should adopt an adaptive tech budget strategy, allowing them to adjust spending as the economic outlook evolves. Such a strategy will start with cutting spending on hardware and new projects and then move into software, telecommunications, and outsourcing contracts as needs arise. Forrester also recommends that companies take a “menu of options” approach, which would afford company flexibility to withstand a deeper and longer recession, and remain mindful of their relationship with vendors.

For more information, clients can check out the full report here.

Audrey Hecht contributed to this blog post.