The Clash Of The Digital Platforms: The Five-Year Update

On March 7, 2014, I wrote a report called “The Clash Of The Digital Platforms” in which I identified five companies that had a unique status in the world of technology, innovation, and overall business. The five companies were (alphabetically) Amazon, Apple, Facebook, Google, and Microsoft. In a byline piece I wrote for Ad Age’s DigitalNext column later that month, I wrote:

Marketers Need to Pay Attention to the Battle of the Digital Titans

We’re barely into 2014, and already the biggest digital disruptors are either flexing their muscles anew or apparently getting ready. Google acquired Nest for $3.2 billion, Apple said it has nearly $160 billion in the bank, Amazon is reportedly close to shipping a set-top box for your TV, Microsoft has sold millions of its Xbox One game consoles, and Facebook followed its announcement of a record quarter by spending billions to acquire WhatsApp.

It’s an intensifying battle of mythical proportions, and to faraway marketers and product managers in non-digital industries like banking, pharmaceutical, or consumer packaged goods, it may seem not worth much thought — because there’s little they can do about it. (Ad Age DigitalNext, March 20, 2014)

My original working title for the report had been “The Clash of The Digital Titans.” I grew up in the ’70s and ’80s, and the marvelous visual effects of 1981’s Clash of the Titans movie left that concept deeply embedded in my mind. As you know from Greek mythology, the Titans are “urgods,” the deities that preceded the Olympians (and were ultimately displaced by them). In this sense, it was wrong of me to coin the phrase “digital titans” to describe these companies, arguably more like new Olympians than a set of older gods. But coming into the 2010s, the idea that the digital companies that later became known broadly as “tech giants” or “tech titans” could be called titans appealed to me because there was something titanic or fundamental about them that did not apply to other big companies like Walmart, McDonald’s, or Sony, all of which were wildly successful at their peaks.

What was titanic about them was the foundation on which they were each built: They were all digital platforms. Their platforms could be built faster and adapt more regularly to change because they were fundamentally digital — as opposed to Walmart’s logistics platform, which was fundamentally physical. A platform business is built on a marketplace that successfully establishes a self-perpetuating network effect. When eBay built its marketplace, for example, the stability and attractiveness of the marketplace attracted both buyers and sellers. By enhancing the platform on which buyers and sellers transact, eBay could increase the appeal to later entrants, establishing a network effect that would fuel ongoing, even accelerating growth.

But eBay wasn’t on my list of the five platforms to watch when I wrote my 2014 report. That’s because it didn’t have the broad applicability that the other five companies did and do. To pass as a digital platform, a company had to use low-cost digital technology to be present in people’s lives all day long, not just when a particular, usually industry-specific, transaction arose. Apple’s iPhone, Google’s Android platform, Microsoft’s PC software business, Facebook’s social network, and Amazon’s retail business all qualified. Nobody else did outside of China and India, where several local players achieve similar status.

Given the five-year anniversary of my report, I went back to look at what I said then. Sometimes a look back at prior research exposes naiveté, necessarily so, since it’s impossible to predict all the future all the time. But it is possible to predict some of the future some of the time, and in this report, we got more right than we got wrong. And some of what we wrote is yet to come to fruition (hope springs eternal!).

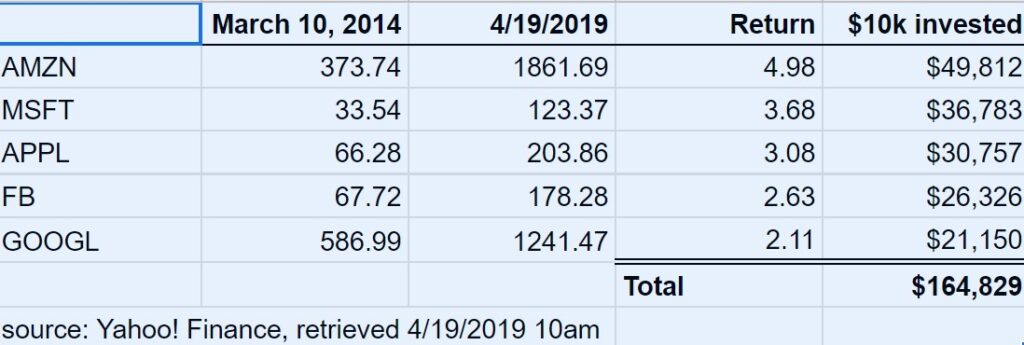

Measured one way, the report was spectacularly right. My report went out on a Friday. If on March 10, the Monday after reading my report, you had invested $10,000 in each of these five companies’ stocks, that $50,000 investment would today be worth $164,829, a multiple of 3.3x. I’m not a financial advisor, but I’ll take this as evidence that the fundamentals of being a digital platform are still as attractive as I suggested five years ago.

In 2014, I described technologies that would permit these companies to penetrate further into consumers’ lives, including wearable devices and other sensors. I then explained the specific opportunities that lay ahead of each company. I wrote with more energy about one of them than the others, namely Amazon. Though you will strain to remember this, five years ago, people routinely questioned why I put Amazon in this category when Amazon was “just an online retailer.” To address this, I wrote in this report:

Amazon has immediate potential and a massive long-term advantage. Amazon has modest plays in mobility, living-room entertainment, and communications, but the retail juggernaut is sitting on the opportunity of a lifetime because it has the best subsidy model, one in which it can justify the cost of cheap or free services by getting consumers to buy more stuff in the future. Combine all the rumors about what Amazon is working on — a phone, a TV set-top box — and you see the areas that Amazon is likely to enter in 2014. But there is one thing the company doesn’t appear to be considering that it could easily grab for itself: personal coaching. Amazon knows everything you search and buy, putting the company in a position to guide you in how you spend your money, manage your health, interact with your family, and make career decisions. Add up all the things Amazon could be doing, and you can see that Amazon could join Apple and even Google at the top of the list very quickly. We have a hunch that Jeff Bezos knows this.

Later that same year, I wrote a report predicting that Amazon would invent the category of home-based voice assistants. The company obliged by doing that a few months later, forever making Amazon something much more than “just a retailer” and putting Amazon in a strong position to help you do everything I wrote about in 2014. Still, before the advent of Alexa, it was daring to write that Amazon would join Apple at the top — it’s satisfying to consider that both of them reached the trillion-dollar valuation stage last year, however briefly. You can see in my table that Amazon did return the most on the five-year investment, a 5x return compared to the 3.3x average of all five of the firms.

This is because platform power is the most powerful source of advantage in a digital economy, where existing platforms can innovate faster, reach customers with novel solutions more quickly, invade adjacent lines of business, and redeploy existing resources more adeptly than new entrants or other merely large, non-platform companies can. It will continue to be so. How these companies use this power is up to them — misuse will continue to trigger murmurs of increased government control, so they’ll have to proceed carefully. But the biggest problem critics of these companies have when they seek a basis to break them up or otherwise rein them in is that you have to demonstrate that actual harm is occurring to justify taking action against a company. And the benefits provided by these platforms far exceed the actual harms you can accuse them of, especially because consumers can, at any time, dial back their commitment to any of these companies — precisely what happened last year to Facebook — thus reducing the harms. Trickier still for critics would be proposing an alternative way to deliver all these benefits: There is none. It will be a digital platform that gives you all of the next most valuable services in your life — even if it chooses to partner with existing banks, healthcare providers, or others to do it — of that you can be sure. It’s just a question of which one.

___________

James McQuivey, PhD is a vice president and principal analyst at Forrester. He is also the author of the book Digital Disruption: Unleashing the Next Wave of Innovation.