CMOs and CSOs: Working Together to Scale Marketing and Sales

- Marketing and sales need to work together as one unit on targets, data, collaboration, and communications

- Understand the relationship between customer lifetime value and customer acquisitions costs to accelerate revenue and profitability together

- Joint analytics will help determine your best customers, drive retention efforts, and enhance overall productivity as you scale your business

At the SiriusDecisions 2016 Summit, Brian Kardon, CMO of Fuze, gave an excellent presentation to CMOs, chief sales officers (CSOs) and chief product officers (CPOs) at our Executive Leadership Exchange. He discussed how it’s critical for marketing and sales to work as one unit to understand and drive customer lifetime value (LTV), and LTV’s relationship to customer acquisition costs (CAC).

At the SiriusDecisions 2016 Summit, Brian Kardon, CMO of Fuze, gave an excellent presentation to CMOs, chief sales officers (CSOs) and chief product officers (CPOs) at our Executive Leadership Exchange. He discussed how it’s critical for marketing and sales to work as one unit to understand and drive customer lifetime value (LTV), and LTV’s relationship to customer acquisition costs (CAC).

To begin, Brian explained that organizations need to run sales and marketing differently – more collaboratively than they have in the past. Key attributes of this shift include:

- Targets. Marketing owns and/or is responsible for leads to bookings; sales is responsible from bookings to revenue.

- Data. Transition from data silos and lack of shared vision to data that is transparent and real-time – and has a shared view.

- Collaboration. From finger-pointing to shared marketing and sales responsibilities.

- Communication. From infrequent and hostile to continuous, with agile decisionmaking.

Next, Brian noted that CMOs and CSOs should consider the ratio of LTV to CAC to drive continuous improvements in growth and profitability. My marketing graduate students tend to fear math, as may some marketing folks. However, the calculations use simple ratios and algebra:

CAC represents cash outflows to acquire customers. LTV represents the cash inflow revenues over the lifetime of the customers. For example:

CAC = $Sum of all sales and marketing expenses/# of new customers added

$40,000,000/400 = $100,000

Next, calculate customer lifetime in months or years, which is the reciprocal of the customer churn rate, as follows:

Monthly churn rate = 1/monthly churn

For 2 percent churn/month

1/.02 = 50 months lifetime of customers

Annual churn = 1/annual churn percentage

For 20 percent churn/year

1/.2 = 5 Years Lifetime of Customers

LTV = Avg. Monthly Recurring Revenue x Avg. Customer Lifetime x Gross Margin percentage

$10,000 x 50 Months x 60% Gross Margin % = $300,000

LTV/CAC = $300,000/$100,000 = 3

Brian indicated that as you scale your business, you should see the LTV/CAC ratio rise over time, thus showing progress. If your ratio is less than 1:1 , you are overspending to acquire customers. Ratios greater than 5:1 probably indicate underspending.

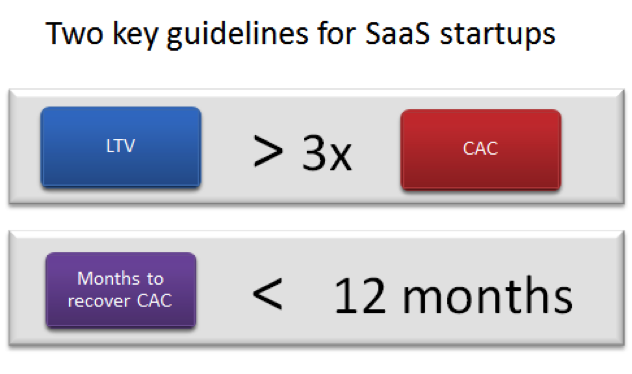

Brian also shared some LTV and CAC guidelines for software-as-a-service (SaaS) startup companies:

You can tweak performance of these metrics to drive continuous improvement. The levers at your disposal include:

For LTV:

- Customer churn rate

- Upsell, cross-sell and customer experience

- Deal size

- Deal duration

- Pricing and gross margin

For CAC:

- Cost per marketing qualified lead (MQL) and sales qualified lead (SQL)

- Ratio of inbound to outbound

- Sales productivity

- Focus on target accounts

- Length of sales cycle

Finally, Brian mentioned some additional factors to watch for as you scale your business:

- Benchmarking performance. Analyze channels and sources of leads, territory sales reps and marketing programs.

- Determine best customers. “Clone” your best customers by industry or use case – those with the highest retention rates and LTVs, and those that are expanding the most.

- Assess retention efforts. Determine the customers or accounts most likely to retain.

- Go for quality, not quantity. Watch out for having too many accounts to cover or leads to follow up on.

- Invest in diverse lead scoring. Look at events like job postings, new technologies deployed, VC and private equity funding events, patents, new location openings and management changes.

- Determine MQL-to-SQL trigger events. Certain events (e.g. new office openings or leases, spikes in social media activity, the hiring of a CFO who previously bought from you) could all trigger increased conversion rates.

- Segment accounts. Run some analytics of purchase probability of the various prospect accounts to prioritize segments.

- Tech stack. Invest time in the right tools, processes and people to leverage them properly.

As CMOs and CSOs strive to accelerate growth and profitability, greater alignment and management of the basic levers of business can go a long way to move a business forward. At SiriusDecisions, we believe today’s CMOs need to be general managers, build strong relationships with their CFOs, and become well-versed in the business tools to model the financial success of their campaigns and initiatives. Leveraging the correlation between LTV and CAC is a great way to start that journey.