COVID-19 Stokes The Chatbot Hype In Financial Services

COVID-19 and its associated containment measures are accelerating digital transformation and automation in financial services. Customer service has been under enormous pressure, and financial services firms such as Nationwide Building Society in the UK and the Royal Bank of Canada have launched chatbots to deal with the unusually high volume of requests. However, digital teams in financial services firms should remain wary of deploying chatbots and voice assistants faster than their customers are ready for them, or than their systems can support.

To better understand chatbot capabilities in financial services, we evaluated the chatbot offering of over 150 global financial services firms. We also analyzed consumer sentiment and adoption of chatbots in Europe and North America. We found that although artificial intelligence is evolving fast, today’s chatbots are not yet equipped to handle any and all financial tasks.

Digital business executives planning to roll out chatbot or voice should be aware that:

- Financial services customers remain wary of chatbots and voice interfaces. Only a minority of customers feel comfortable using virtual agents for customer service in financial services. While around a third of European and American customers trust chatbots to handle simple financial tasks, almost two-thirds don’t trust them to handle complex financial tasks. Similarly, only a fraction of customers uses voice assistants to interact with their financial services providers. Customer expectations, use, and comfort with chatbots and voice assistants lag behind other industries due to the complexity of financial interactions and privacy concerns.

- Most financial services firms have launched or are piloting chatbots, but functionality is still limited. Financial services chatbots are most likely to be found in mobile banking apps. More than two-thirds of top global financial services firms have a chatbot on their app, and a slightly lower number also deploys them in their online banking. In addition, one-third of the financial services firms that we evaluated have developed voice-based experiences. Amazon Alexa is the most popular conversational interface, followed by Google Assistant and Apple Siri. Voice assistants offer only basic functionality, though consumers rate those experiences highly.

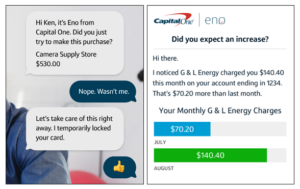

- The future of virtual assistants in financial services is bright but still remote. Leading financial services firms will evolve their chatbots and voice experiences into virtual assistants that will proactively send alerts, provide savings tips, make product recommendations, and ultimately help customers better manage their finances. Bank of America’s Erica, Capital One’s Eno, and Clinc’s Finie are pioneering virtual assistant functionality that could drive future voice interactions. Virtual assistants will follow us into cars and hotels, embedding finance into our everyday lives; they hold the key to more inclusive digital design, supporting the elderly or those with learning and other disabilities. But conversational experiences are still in the early stages of maturity, and digital teams must think of chatbot and voice as part of a disciplined digital experience portfolio. “Forrester’s Moments Map, 2020” uses a mathematical model to help executives figure out the right mix.

To learn more about the current state of chatbots and voice assistants in financial services, check out our new reports: “The State Of Chatbots In Financial Services” and “The State Of Voice Assistants In Financial Services, 2020.” And if you have more questions, feel free to schedule a call with us through our inquiry system.