CX: How Indian Brands Performed In 2021

Ever watched “50 First Dates“? It’s the one where Adam Sandler woos Drew Barrymore, but there’s a catch: Each date is a “first date” because she can’t remember anything from their previous encounters — all thanks to her short-term memory loss. So, he’s forced to impress her all over again, every single day.

A version of this plays out between me and my bank every day, except in reverse. They’re the ones wooing me, but they’re also the ones with the memory loss. You see, I’ve been a customer for over 17 years, yet they can’t remember anything about me. Of course, that doesn’t stop them from confidently spamming me at least four times a day, across different channels, but with zero context. It’s no surprise that the bank’s spray-and-pray strategy has not worked. In the last six months, I’ve clicked open their message exactly once, which was by mistake. Despite all this, to their credit — or perhaps due to my inertia — I’ve stuck with them; they’ve managed to retain my business (a salary account) for all these years. But thanks to their amnesia, they’ve been unable to enrich the relationship further. Which means that, of the holy trinity of loyalty — retention, enrichment, and advocacy — they’ve managed to do OK on just one of them.

Like most large firms, I’m pretty sure the bank knows this. What I’m unsure about is whether they’re able to understand why they’ve been unsuccessful at enhancing the relationship, or what they should do about it. This is true of not only my bank. Many enterprises struggle with the same questions – why are customers having a poor experience? Of all the changes they can make to improve customer experience (CX), which ones will drive revenue-improving loyalty? What will be the ROI of making these CX changes?

Enter Forrester’s Customer Experience (CX Index™) — a CX measurement framework that not only uncovers the quality of CX, but also links it to loyalty. (Otherwise, what’s even the point of providing good experiences?) Furthermore, it uses a host of driver statements to test why customers gave you a certain CX score, thus helping you uncover which areas you need to improve to really move the needle on revenue-improving loyalty. In addition, it also helps firms benchmark their CX against peers.

We’ve been using the robust CX Index methodology to measure customer experience across firms, industries, and geos for many years. This year, we collected CX Index data from almost 200,000 consumers on nearly 500 brands in 14 industries across 11 global markets. Specifically in India, we polled over 5,000 consumers about their experiences with 29 brands across auto manufacturers, credit cards, banks, and digital retailers. The survey ran earlier this year from March through April 2021, providing a great way to understand how brands fared after COVID-19 forced them to change their CX approach on the fly. So, how did they fare?

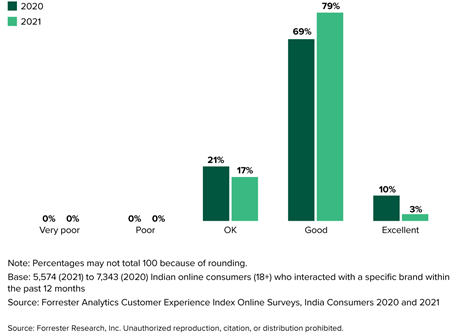

Overall, compared with last year, this is what we found:

- Brands could not sustain excellence but fended off mediocrity. Only one of the 29 brands in the survey — HDFC Bank — was excellent; four brands offered OK CX; and the remaining 24 brands had good scores. Four brands saw a significant score increase. Again, top among these was HDFC Bank. On the other hand, seven brands saw a significant score decrease.

- The quality of customer experiences dipped in banks and digital retail. Multiple lockdowns and physical restrictions through the year clearly affected their ability to effectively serve their customers, despite their digital interfaces. While the pandemic and its effects were out of their hands, many brands in these industries missed an opportunity to create an emotional impact through their own response and communication.

- The top-performing brands met customers’ core needs and understood their emotions. In the challenging year that went by, the best brands did a far better job of easing customers’ pain than their peers. Moreover, these brands also provided a more emotionally pleasing experience, evident from their 9-plus percentage point lead over peers in emotion scores.

For a full list of brands, their CX scores, and other findings, the report on the India CX Index is available here (behind a paywall).

And whatever became of my bank? No prizes for guessing how it fared. (Hint: It lagged disappointingly behind some of its peers.) Of course, brands may blame the pandemic for their current CX flip-flop, but one thing is clear: If businesses are to emerge from this global crisis, they must build experiences that empathetically engage with their customers. For brands that can do this, by figuring out where they lag and what to fix, much like in the movie, there is a happy ending in sight. For brands that fail at this, the exhausting wooing continues afresh every day, and it’s “50 First Dates” all over again.