Economic Health of the Financial Services Industry is Improving – So, What’s Next?

- The path for financial marketing leaders appears to be shifting from defensive and tactical to long-term and strategic

- We currently see three areas of focus among marketing leaders in financial services

- Planning and alignment, technology and customer marketing are now possible strategic initiatives for executives to buy-into

It has been a difficult seven years for the financial services industry – especially for the industry’s marketing professionals. Financial services marketing leaders have faced constant pressure to justify their existence, produce better results with fewer resources, and weather intense (and often confusing) regulatory scrutiny.

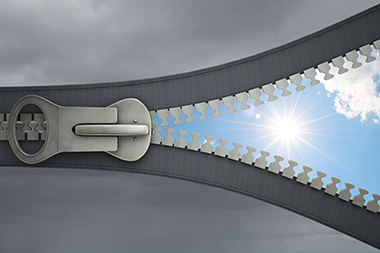

The good news is that the storm clouds appear to be dissipating. Employment in the industry is up by more than 100,000 in the last 12 months, interest rates are rising, and investment is increasing throughout the industry. Our conversations with marketing leaders are shifting from defensive and tactical to long-term and strategic.

The good news is that the storm clouds appear to be dissipating. Employment in the industry is up by more than 100,000 in the last 12 months, interest rates are rising, and investment is increasing throughout the industry. Our conversations with marketing leaders are shifting from defensive and tactical to long-term and strategic.

We are now noticing three areas of focus among marketing leaders in financial services:

Planning and alignment.

If you are evaluating your planning process, the blog post “Six Steps to Successful Marketing Planning” by my colleague Craig Moore is a great place to start.

Technology.

Customer Marketing.

Executing on these strategic initiatives requires financial services marketing leaders to get buy-in across the organization. As the economic health of the industry is finally showing signs of sustainable improvement, now may be the best time we have seen in a while.

Leave us a comment and let us know your thoughts.