Financial Services Firms Need A More Relevant Customer Segmentation Model: Introducing Forrester’s Financial Well-Being Segmentation

Even before the onset of the COVID-19 pandemic, consumers were already facing multiple financial challenges, and many were worried about their financial situation. The pandemic has impacted consumers’ finances further, with many lacking financial resilience and confidence in their financial future.

Financial Services Firms Need A Framework To Better Understand Their Customers’ Financial Mindset And Needs

As financial services increase their focus on improving customers’ financial well-being, they’re looking to develop products and services that can have a positive impact on customers’ financial health. Doing so requires a better understanding of customers’ level of financial resilience and attitudes toward money. Which customers are most at risk of vulnerability? Which ones have experienced financial setbacks? How do they perceive their own financial well-being? What’s their money personality type? Being able to answer these questions will help firms provide tools, experiences, and services each customer specifically needs to develop better money habits, make better financial decisions, and achieve financial well-being.

Financial services firms tend to segment customers based on assets, demographics, product ownership, and use of banking channels. This traditional segmentation approach overlooks the impact of various attitudinal, situational, and external factors on consumers’ financial capability.

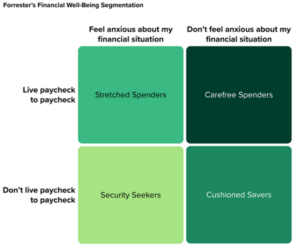

This inspired us to build Forrester’s Financial Well-Being Segmentation, a framework that indicates where consumers stand on the financial well-being spectrum by measuring their level of financial resilience and perceived level of financial security.

Meet Forrester’s Financial Well-Being Segments

Using Forrester Analytics Consumer Technographics® data, we segment online adults into four profiles by asking survey respondents how strongly they agree with the following statements on a five-point scale:

- I live paycheck to paycheck.

- I feel anxious about my financial situation.

The four segments — Stretched Spenders, Carefree Spenders, Security Seekers, and Cushioned Savers — display different levels of financial resilience and attitudes toward money management and financial planning, differ in their sense of security in their financial future, and have unique personal financial management needs.

Financial services firms can map their own customers to the four profiles and thus gain insight into their financial attitudes, behaviors, and interest in or use of specific personal financial management tools, services, or advice.

Forrester clients can access the detailed report here. We’ll also help you keep a pulse on customers’ financial well-being with our upcoming infographics on the state of financial well-being in Canada, France, Italy, the UK, and the US. Join our upcoming webinar on June 16 or connect via an inquiry to learn more. If you’d like to brief us about what you’re doing in this area, reach out to schedule a briefing here.

(Corrado Loreto contributed to this blog post.)