Five Questions To Ask Before Building A Brand Survey

Conducting a brand survey is like flossing: You know you should do it, you mean to do it, and you tell yourself that today is the day that you’ll do it … but then you don’t do it nearly as often as you should.

There are good reasons why we often procrastinate when we need to conduct a brand measurement survey. First of all, they’re expensive: Employing a market research firm can cost approximately $30,000 to $40,000 for a rudimentary survey, and the total can easily run double or triple that amount for a more advanced survey. Secondly, surveys can easily become complex; deciding which questions to ask, finding respondents, and conducting the daunting task of data analysis can quickly become overwhelming. However, just like with flossing, the benefits of running a brand survey completely justify the effort.

Before rushing off to question customers and prospects about their perception of the organization’s brand, ask the following questions. These will not only guide the survey process, but also ensure  you get the right answers to the right questions for your brand.

you get the right answers to the right questions for your brand.

1. Is there a framework in place for measuring brand and reputation?

“Brand” is one of the most slippery and elusive concepts in all of marketing, so measuring it can feel like a real challenge.

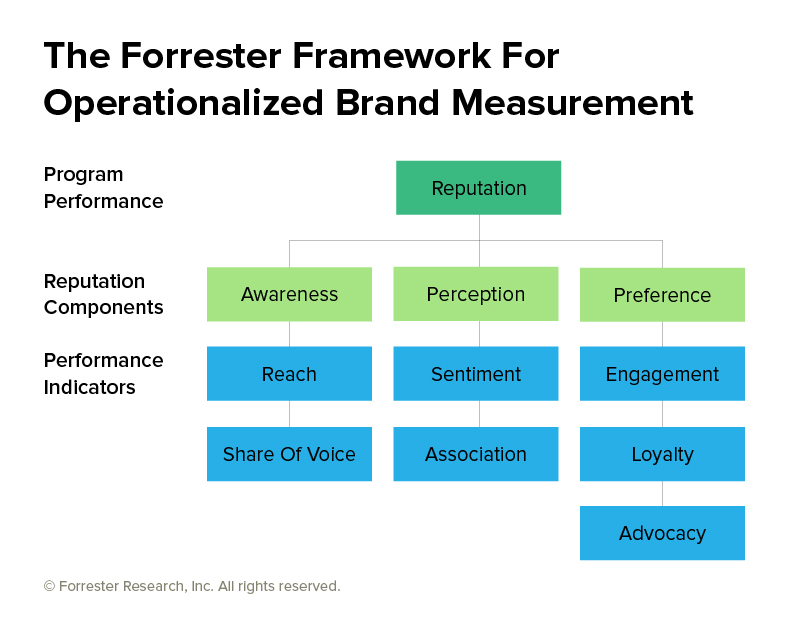

We can help by distilling brand reputation into three core components: awareness, perception and preference. Beneath each components are performance indicators – specific attributes that can be measured and quantified. Following this framework ensures your organization is assessing the full spectrum of the value of its brand.

2. Who is the target audience for your organization’s survey?

Good survey design begins with understanding the targeted audience. Brand surveys can be constructed for an entire company (all buyers) or focused on buyers of a specific offering, vertical market or sub-brand. Forrester’s Buyer Audience Framework, along with existing buyer persona definitions, can help describe and categorize your organization’s survey audience in sufficient detail to identify targets from in-house and external data sources. Establishing a clear and explicit understanding of the target audience for your survey is a critical step.

3. What are the three necessary attributes to constructing a good survey question?

Knowing how to ask a good questions is a practiced skill – just ask a lawyer, psychotherapist or cop. In survey research, good questions have three attributes: validity, reliability and actionability. Validity ensures the question measures the correct information (To avoid confusion, don’t ask several questions at once, and make sure answer options are complete). Reliability ensures that survey respondents give repeatable answers to a question – be sure the question will be clearly understood by all respondents). Finally, actionability means that questions serve a purpose for brand development and decision-making, and heads off “survey bloat” that can result in overly long surveys that nobody wants to complete.

4. Can you get good responses to your brand survey?

Here’s the bad news: it’s getting harder and harder to get people to complete a survey, and this is especially true for surveys that target B2B buyers. Depending on factors such as job title and how well you target, response rates for online B2B surveys rarely go above 20 percent and can easily be in the single digits. Therefore, it’s critical to find ways to improve overall response rates as much as possible, make sure that respondents find the survey relevant to them, and carefully incentivize survey takers.

Lastly, don’t just focus on the number of responses. It is arguably more important that you get the right responses from a target group that is a good facsimile for your buyer audience.

5. What is the plan of action once you get results?

So, you built a great survey, gotten a good response, and have new insights into your organization’s brand health. Now what?

Done right, a brand survey is an excellent tool for strategic decision-making for the whole company. We are what we measure; conducting a brand health survey is the best way to methodically engage with your buyers (as well as prospects, influencers and others) and to gain a firsthand account about your brand. If the survey has been designed correctly, then each question has an intention and will provide a specific answer in a decision-making process. Make sure there is a plan in place for how to engage with internal constituents to take action on the findings. In my career, I’ve worked on brand surveys that have resulted in changes in core messaging, triggered a rebrand, and even caused a change in product roadmap.

Enough questions –time to start flossing (and creating brand surveys)!