Forecasting In Uncertainty: Small Businesses And State And Local Governments Will Be The Prime Vectors Of Tech Market Recession

When President Trump broke off negotiations with congressional Democrats on a new economic stabilization package on Tuesday, October 6, the already high risk of a deeper economic recession shot up — and with it, increasing prospects of a tech market recession lasting well into 2021. The president has backtracked to a degree, with calls for aid to airlines and unemployed workers, but the prospects of any kind of deal before the election are limited. When the Q3 2020 GDP results are released at the end of October, they will undoubtedly show a solid recovery in real GDP and evidence of some improvements in US tech investments. But both the economy and the US tech market will slump again in Q4 2020 and Q1 2021.

My assessment of the economic outlook is that the US economy is shifting from the pandemic recession — with its narrow but deep focus on the consumer-facing, discretionary spending industries shut down in response — to a broader, more traditional recession with much wider but shallower impacts. This new phase of the recession will be driven by steep declines in two sectors of the economy: small businesses and state and local governments. Their downturns will directly impact the US tech market and indirectly hurt it by spreading weakness into financial services, professional services, and manufacturing.

The State Of Small And Midsize Businesses

- Small and midsize businesses (SMBs) are vulnerable. Most of these businesses operate with limited financial reserves. Cash flow is used to pay fixed expenses (rent, loans, insurance, utilities, and tech subscriptions) and variables (salaries and costs). The Payroll Protection Program provided many small businesses with forgivable loans, which allowed many to keep operating despite steep drops in cash flow. But that program is coming to an end, and there are no signs of its extension.

- Small and midsize businesses are worried. The National Federation of Independent Business in August 2020 released the results of a survey of its members and reported that 21% said that they would be out of business in six months if the economy did not improve (“One-in-Five Small Businesses Say They Will Have to Close Their Doors if Economic Conditions Don’t Improve in Next Six Months“). There were 6 million small and midsize businesses (with 500 or fewer employees) in the US in 2017, according to the most recent US Census Bureau’s survey of businesses. They provided 47% of US private-sector jobs that year and contributed 40% of the total payroll. So, the economic impacts of 20% of US small and midsize firms going out of business would be massive.

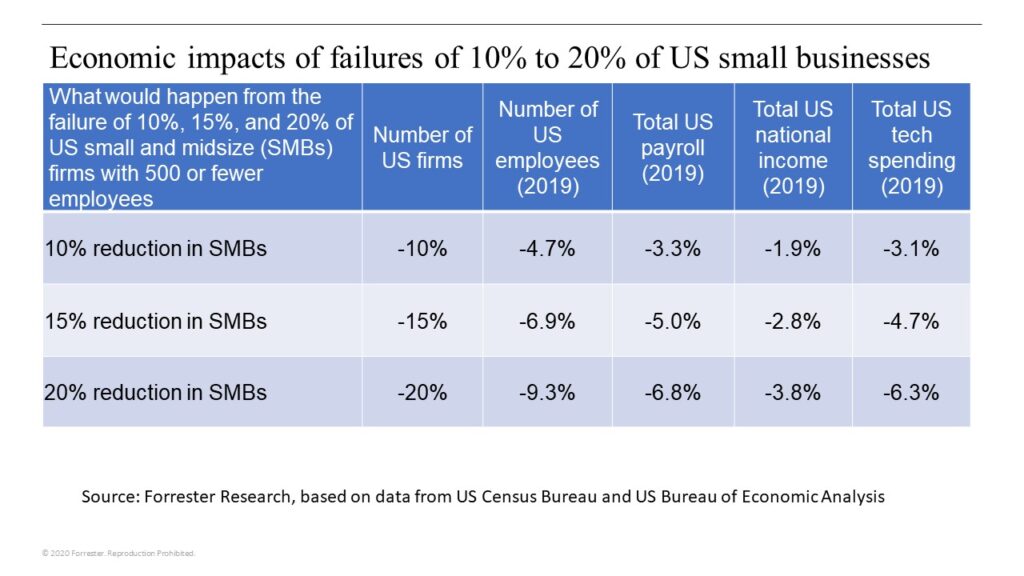

- Widespread failures of SMBs will hit employment, income, and the tech market. Assuming that SMBs had similar shares of US employment, payroll, national income, and tech spending in 2019, the failure of even 10% of small and midsize businesses would cause a 5% drop in employment, a 3% drop in US payrolls, and a 2% drop in US national income. (Small businesses tend to have lower average salaries than large ones.) I estimate that US tech spending would be reduced by 3%. The damage would be even greater if 15% or 20% of US small businesses failed. Tech vendors that sell primarily to SMBs would be the most exposed (see figure below).

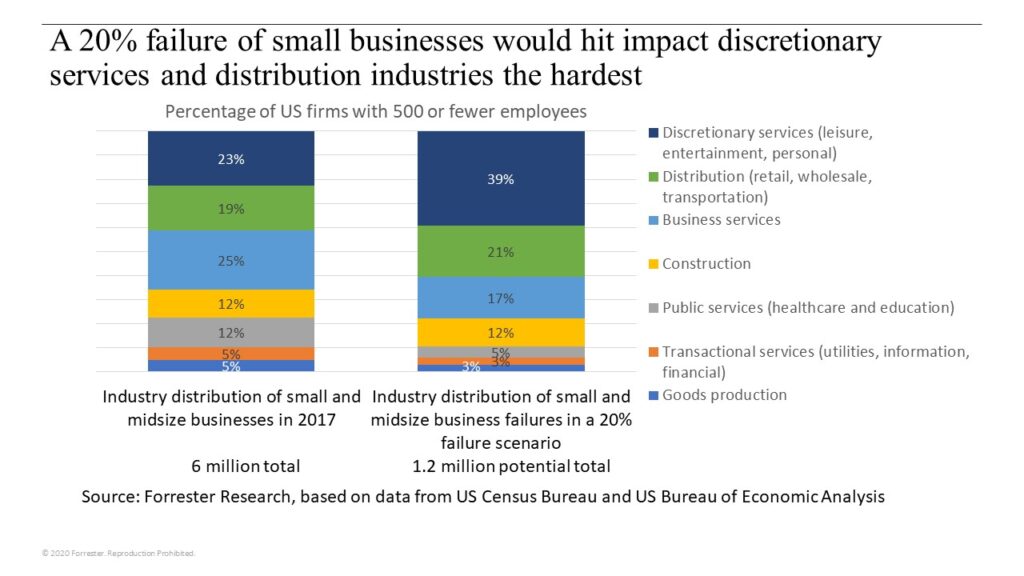

- SMBs are concentrated in the services and distribution sectors, which will suffer the most. The discretionary services industries of leisure, restaurants, hotels, entertainment, and personal services made up 23% of US SMBs in 2017. These industries have born the brunt of pandemic shutdowns and consumer pullbacks related to the pandemic. If 20% of US SMBs fail, we estimate that 39% of those failures would be in this sector. In 2017, 19% of SMBs were in the distribution industries of retail, wholesale, and transportation. SMBs in these industries will get squeezed by reduced orders in a slowing economy and competition from better-funded, larger enterprises. Business services — both professional services like accounting, legal, consulting, and marketing — and outsourced services like temporary workers, leasing, and facilities management are the largest segment of SMBs but will suffer as their SMB customers in the prior industries go out of business and their enterprise clients cut back (see the following figure).

State And Local Governments Are The Second Sources Of Economic And Tech Weakness

Economists who have studied the 2007–2009 recession have stressed that cutbacks at the state and local level were major contributors to the weak and slow recovery in the 10 years after that. That’s why both Federal Reserve officials and House Democrats have called for more financial support to these governments. In the absence of that support, state and local governments have had to start cutting workforces and budgets. State and local government employment in September 2020 was already down by 1.5 million jobs from February — 17% of the total US job loss in that period. Even further cuts are likely in the rest of 2020 as state and local governments struggle to balance budgets hit hard by drops in sales tax and fee revenues. We estimate that state and local governments may cut their employment and spending by 10% in the period from Q1 2020 to Q1 2021.

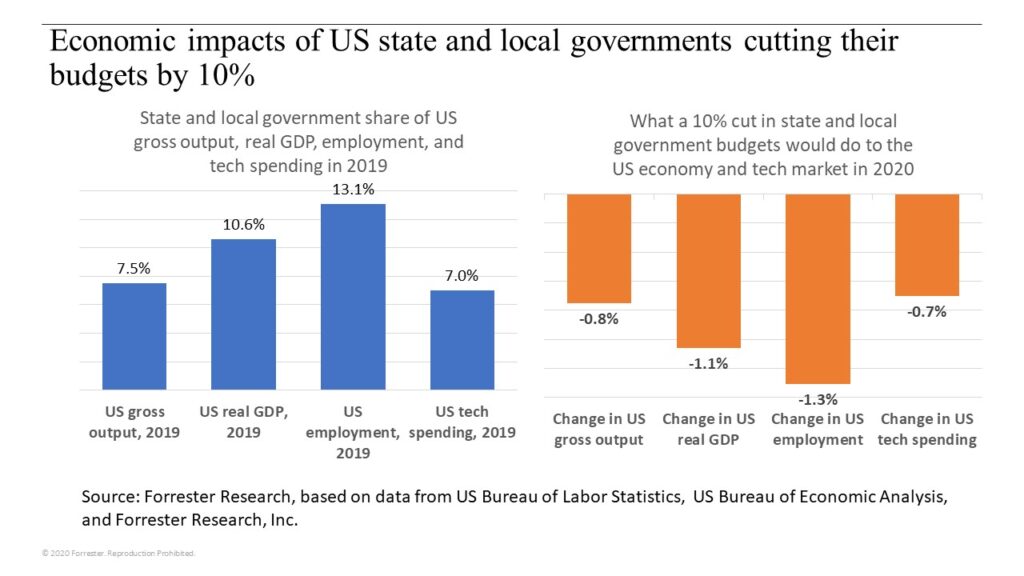

- State and local governments represent 8% to 13% of US economic activity and 7% of the US tech market. State and local government revenues in 2019 were 7% of total US gross output (generally equivalent to total revenues of all US businesses and governments. State and local government purchases and spending equaled 10.5% of US real GDP in 2019 and provided 13% of all US jobs. State and local government spending on tech goods, services, and staffing was 7% of the US total.

- A 10% cut in state and local government spending would subtract 0.8 to 1.3 percentage points in the growth of US economic indicators. A 1.1 percentage point reduction in US real GDP growth may not seem like much, but remember that US real GDP growth in 2019 was 2.2%. A 10% drop in state and local government spending would have cut that in half, to just 1.1% (see figure below).

- A 10% cut in state and local government tech spending would shave 0.7 percentage points from US tech spending growth. We’re projecting that US tech markets are the most likely to fall by 6.3% in 2020 and 1.5% in 2021 (see “US Tech Market Outlook For 2020 To 2021: Three Scenarios Will Help CIOs Understand The Length And Depth Of The Pandemic Recession“). Cuts in tech buying by state and local governments are a key element in those declines. Tech vendors that sell to state and local governments should be worried.

Failures Of SMBs And State And Local Government Budget Cutbacks Will Feed Tech Market Weakness Elsewhere

The direct impacts on the US tech market from SMB failures and state and local cutbacks are only part of the story, albeit the most visible. Businesses that sell goods and services to these sectors or to their employees will see reduced revenues. They, in turn, will cut their costs through layoffs and reduced purchases from manufacturers, retailers, services providers, and financial institutions. A strong, multitrillion-dollar US federal government stimulus program could keep that from happening. But, in its absence, both economic weakness and tech market weakness will last well into 2021.