Introducing Autonomous Finance: Forrester’s New Research On Algorithm-Based Financial Services

People’s lives are becoming ever more automated as millions of algorithms make decisions — and, in some cases, take actions on those decisions — on behalf of a consumer.

While it’s still early days, the shift toward autonomous services is already happening in financial services thanks to evolving customer expectations, advances in AI and other technologies, and robust fintech activity. Forrester’s current working definition of autonomous finance is: Algorithm-driven financial services that make decisions or take action on a customer’s behalf.

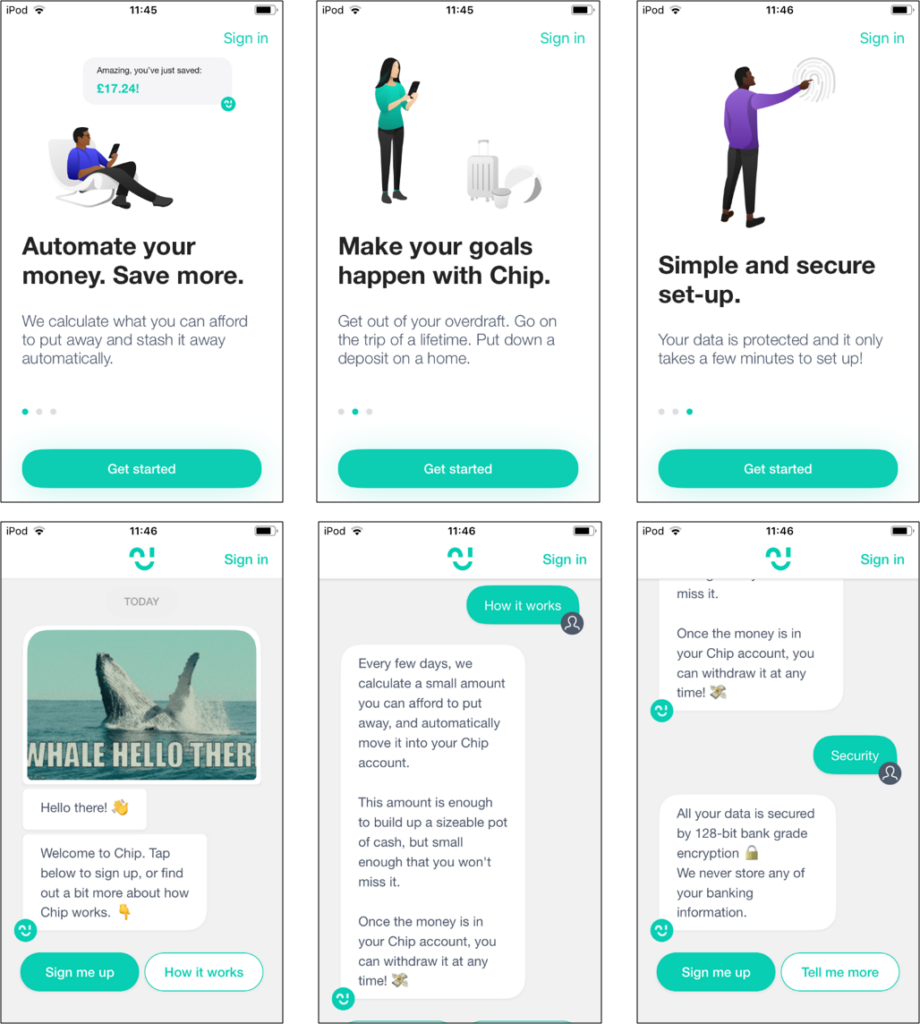

We’ve seen a few early glimpses of autonomous finance from fintech players. Robo-advisors such as Nutmeg and Wealthfront use algorithms to manage investments on behalf of a customer. Chip and Digit use proprietary algorithms to automate saving for customers (see the screenshots from Chip below). Gabi compares and shops for insurance to automatically optimize coverage for a user. And new entrants like Payrailz and Trim promise to automate specific tasks such as bill pay and subscription management on behalf of customers.

To help business leaders prepare for and win in an era of autonomous finance, Forrester is launching new research that focuses on digital services that make financial decisions and take action on behalf of consumers.

We invite you to take part in this research by taking this 5-minute survey. And if you’d like to be interviewed as part of this research, please email Piers Conway.

[Below: Screenshots from Chip’s smartphone app]