Marketplaces Make Their Mark In The Channel

Online marketplaces have been around in one form or another for decades. Accelerating the trend is a myriad of factors including changing buying behaviors and demographics, companies shifting to subscription and consumption models, and the rising importance of ecosystems. Put simply, the future business buyer will look more and more like a consumer.

Based on Forrester data, McKinsey reported last week that US e-commerce penetration has effectively doubled in the past three months during COVID-19 — driving 10 years of growth in one quarter.

One-third of all US business now flows through e-commerce, and 63% of that is through marketplaces.

Given our research on the future of buying combined with the future of work, this will be a permanent shift in behavior that companies of all types need to plan for.

On the B2B side, Forrester had predicted that 17% of all transactions would be through e-commerce and marketplaces by 2023. It is safe to say that COVID-19 will accelerate this prediction by a few years. For perspective, this is a shift of over $2 trillion from traditional retail, dealer, and reseller channels into marketplaces. While the majority of this will still count as “indirect” revenue, it is notable where this revenue will be split:

1. Hyper Marketplaces

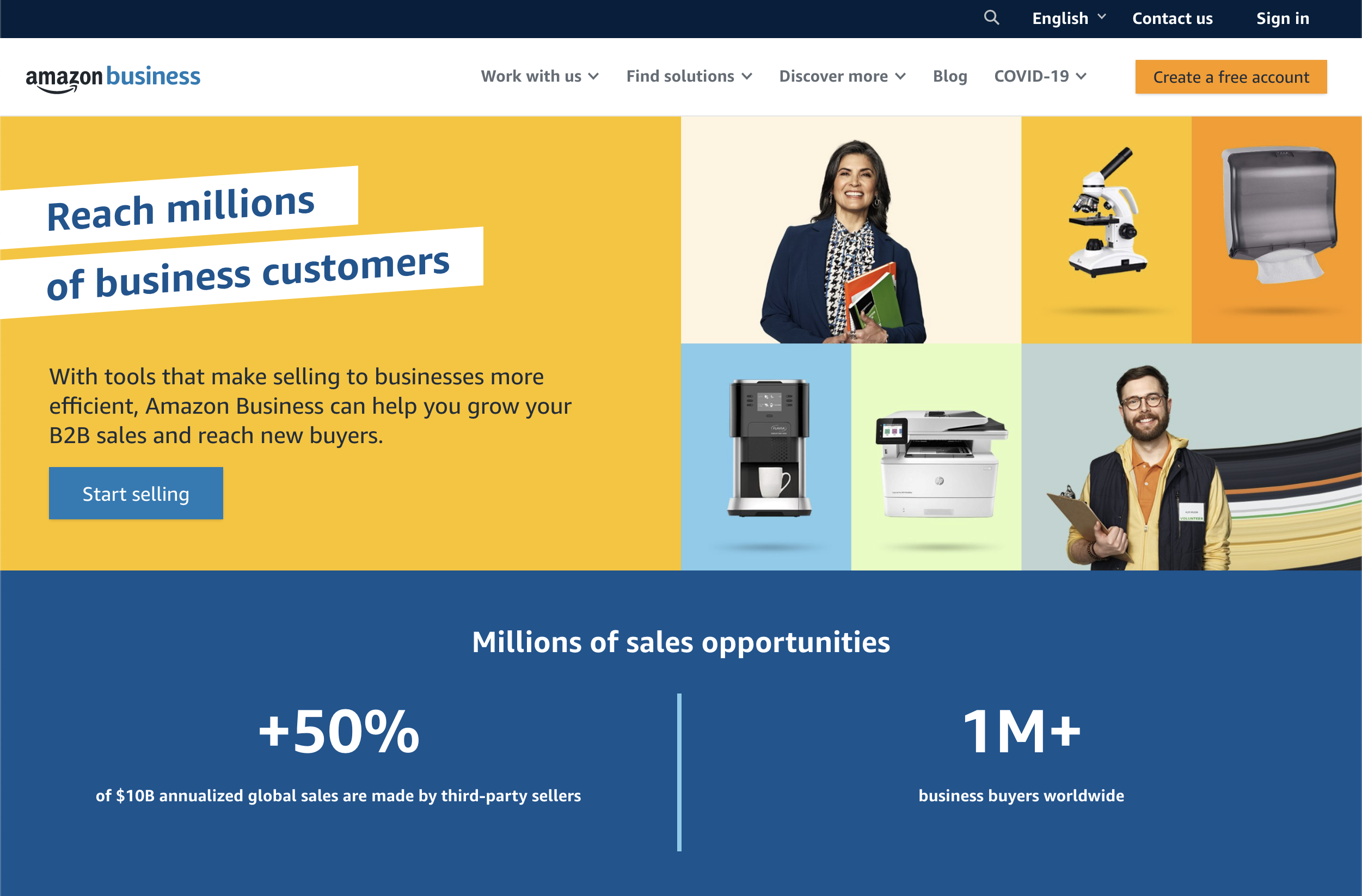

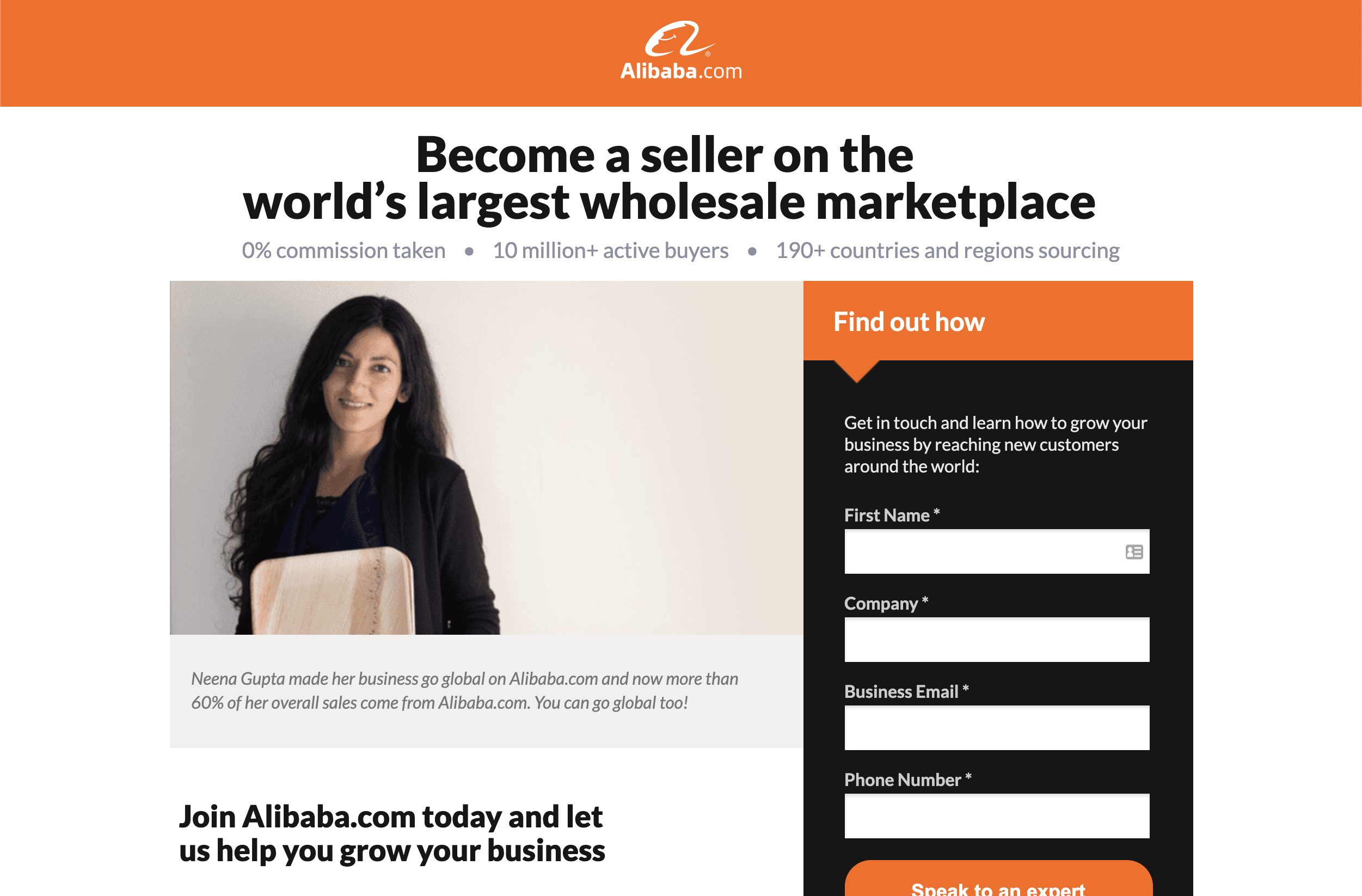

Much like hyperscalers in the cloud world, a small number of global hyper winners have emerged (think Amazon, Amazon Business, and Alibaba).

2. Super Marketplaces

The next tier is defined by super winners that will grab a majority share of the dollars flowing into a specific industry or buyer type (think Salesforce, Microsoft, AWS, Google, Adobe, IBM, SAP, Oracle, ServiceNow, Workday, etc.).

3. Niche Marketplaces

This final tier will pave the last mile to specific customer needs across subindustries, buyer types, geographies, customer segments, or product areas (think midsize healthcare, endpoint security, or channel buyer tech stacks).

Based on the niche-marketplace permutations, there could be millions of offerings. This won’t happen for a number of reasons, but expect hundreds (turning into thousands) of these marketplaces, with sustainable business models, to emerge over the next 3–5 years.

For vendors and channel partners, marketplaces offer a low-cost way to reach online business customers or enter new markets. On the flip side, this also comes with less control over a company’s brand and the user experience. For operators of marketplaces, orchestrating an ecosystem of buyers, sellers, and technology partners requires mastery of e-commerce, brand building, and demand gen — but also offers unique economic benefits of running a digital platform business.

There are a number of recent examples of niche-marketplace activity in channels, partnerships, alliances, and ecosystems:

1. Apideck (https://www.channelstack.co/)

Enables companies to set up their ecosystem quickly and launch scalable marketplaces that connect all stakeholders and boost adoption. This week, it launched the Channel Stack, which is a marketplace that was based on our annual channel software tech stack research.

2. Channel Marketplace (https://www.channelmarketplace.com)

A unified resource where companies can find and research indirect go-to-market resources and support to fulfill key business goals. Through the marketplace, companies can find and interact with member companies in developing solutions that resolve channel challenges and optimize go-to-market operations. Note: It is a curated marketplace with a subset of the 159 software companies on our channel software tech stack, plus key consultants, experts, and other services.

3. Vendasta (https://www.vendasta.com/)

An end-to-end, white-label e-Commerce platform for selling digital solutions to local businesses. It takes a channel-specific approach and is working with partners, distributors, and vendors to easily launch a niche-marketplace platform with an already active base product catalog that can be built on.

4. AppDirect, Oracle, Salesforce, Zift Solutions, and ZINFI

We are starting to see some public buzz from PRM (partner relationship management) companies that are actively building e-commerce functionality as well as marketplace support for both vendors and partners. Supporting both internal and external marketplaces of all sizes and types will be key for indirect sales programs in the future, and these platforms are natural connection points through the entire partner journey.

5.Tackle.io (https://tackle.io/)

There is a new type of platform that reduces the time to list and sell products on the hyper- and super-marketplaces mentioned above. Automating many of the steps while providing granular transaction reporting with minimal engineering resources required. This no-code/low-code type of platform will enable vendors and partners to sell across the major cloud marketplaces and simplify the procurement process, expand routes to market, and reduce time to revenue.

In the past few years, 82% of global B2C e-commerce growth came from marketplaces, and we expect similar trends to be replicated in B2B and B2B2C. As the number of listings and transactions through online marketplaces increases, vendors, distributors, and channel partners must determine if they are a convenient way to reach new customers, a competitive threat — or both. And for those providers who are all in on digital, is it time to consider launching their own marketplace?

For buyers (or prospects), marketplaces offer a full array of self-service buying tools. These are tools for early journey research, partner selection, product stack configuration and pricing, final vendor selection, contracts, purchase, and renewal. Provisioning, implementations, integrations, monitoring, and reporting all become longer-term benefits of marketplaces, and partners have huge opportunities to take advantage of these opportunities.

In fact, the average cloud deal creates a 5x multiplier for partners — where every dollar that is collected by the vendor for the product, around $5 goes to the ecosystem for services and add-on hardware and software.

For example, Salesforce is predicting this number will be $5.80 by 2025, Google Cloud is forecasting $7.54, and Microsoft has some products that stretch this upward of $9.

More options for buyers means more options for sellers. The key question for vendors, distributors, and channel partners is should they: a) double down on their own e-store; 2) look at how to launch their own marketplace; 3) work with partners to see how they can support digital selling; or 4) test out niche marketplaces, super marketplaces, or even Amazon?

Of course, the answer for many is “all of the above.”

Further Channel-Related Reading

What I See Coming For The Channel In 2020

Channel Software Tech Stack 2020

The 64 Best Channel Podcasts Of 2019

Channel Marketers Need To Become Community Marketers — Here’s How

Partner Relationship Management (PRM) Comes Of Age

Through-Channel Marketing Represents The Third Stage For Sales And Marketing Leaders

Channel Data Is A Competitive Differentiator

Measure What Matters: Unlocking The Power Of Partner Ecosystems Demands Powerful Measurement

Time To Rethink Channel Incentives And Program Management (CIPM)?

Channel Automation Becomes Table Stakes For Partnership Success

Can You Deliver A Great Partner Experience Without Great Onboarding?

Do Channel Vendors Need Public Relations Anymore?

Channel Reimagines Physical Events, Looking To Reopen Slowly