Open Finance Will Reshape The Relationship Between Banks And Their Customers

Open finance will change little in the next couple of years — but will transform financial services over the coming decade. It will lead to a radically different financial experience for customers and businesses, underpinning embedded finance and enabling pretty much any industry that can benefit from financial data.

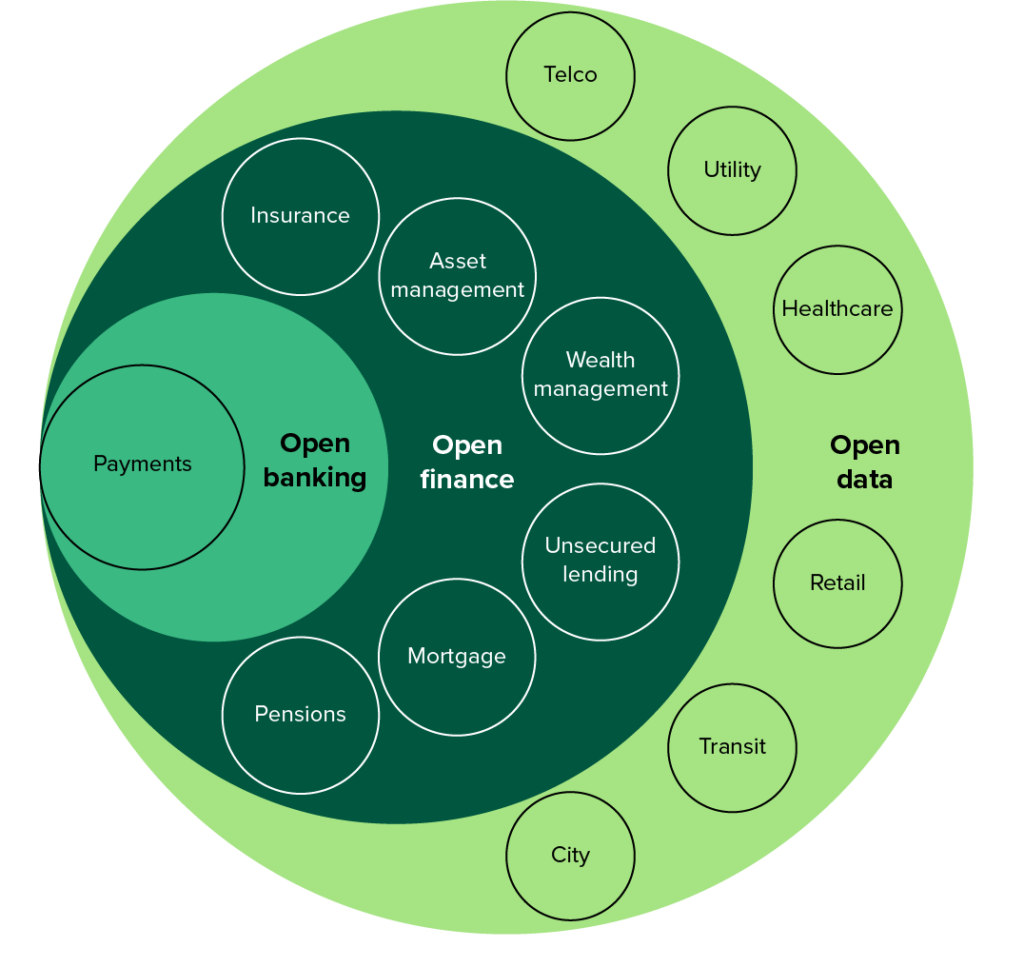

Open finance extends the third-party access principles of open banking across a wider set of financial products such as mortgages, loans, investments, and pensions. It is part of a global trend toward open data and data portability and will enable wider integration across nonfinancial industries, including sectors like healthcare, retail, and government — as well as broadening the range of third parties that will compete or intermediate financial relationships.

Open Finance Marks The Transition From Bank-Controlled Financial Services

Open finance marks a turning point for collaboration in financial services. It brings the ability to reduce friction through automation, to combine real-time insight across multiple sectors, and guide customers to contextualized, personalized results.

An open finance future is about enabling customers to have effective choices and democratizing access to financial services in two ways: 1) underpinning embedded finance and changing the delivery of services and 2) enabling financial inclusion through innovation. It will also lead to customers who will demand a return on their consent to use their data or store their wealth.

Open finance will support embedded, personalized solutions — revolutionizing insurance, for example. Personalized actuarial models will reward customers who share preferences to travel at low-risk times, make efforts to remain healthy, and permit proactive monitoring of homes, using the data from connected devices to dynamically adjust customer premiums. Cross-industry data sharing helps transport authorities identify dangerous roads and junctions, from which mapping services can determine the safest or quietest time of travel as well as the best environmental option.

It will also support financial inclusion, particularly in regions like Asia and Africa. Using data from deliveries, ride-hailing apps, telcos, and digital wallets has enabled innovators such as Indonesia’s Gojek to build financial products for underserved customers, using open data to assess risk in the absence of credit reference agencies.

Two Critical Factors Will Influence The Pace Of Progress

Realizing the benefit of open finance will take years and will come from a blend of regulatory and market drivers. The promise is powerful, and open finance should offer a positive experience for consumers — presenting more supplier choice, relevant products at the point of need, automated services, and more control of data for better financial outcomes — but there is no guarantee of this. Unlocking the benefits of open finance for consumers will require a high degree of coordination within the financial industry and beyond, but to expect interoperable open finance on a global level is currently unrealistic.

Our research reveals that the financial sector and the region or country are crucial in determining both the pace of change and the scale of opportunity. As the UK government noted in its paper on smart data, the overriding inhibitor is not technology but the lack of a framework to securely access, use, and share data.

Setting aside regulatory mandates, some financial sectors (such as unsecured loans and corporate banking) will migrate to open finance faster than others, with the order driven by both implementation complexity and the level of opportunity inherent within the sector. We already see some corporate banks such as Deutsche Bank and Standard Chartered monetizing open API access to drive revenue.

Regional variation will also affect the pace of open finance evolution. A complex interplay of customer readiness, regulatory and market drivers, technological capabilities within financial services providers, and supporting infrastructure — such as digital identity — will influence the pace of adoption within a country or region. For example, the US as yet has no regulatory mandate but does have a population receptive to the capabilities promised by open finance. Australia, meanwhile, has started from an open data concept with the Consumer Data Right, which launched open finance first before focusing on utility and telcos.

The Adoption Of Open Finance Will Take A Decade Or More

Open finance is not a one-off exercise to attain compliance, as open banking was, but will be a continuous process, marking a fundamental shift in how customers access financial services and how firms deliver them. Forrester clients can access Open Finance Will Reshape Financial Services Over The Coming Decade to see how their sector and region will be impacted and use the framework to prioritize their focus, as well as understand the building blocks needed to make this a success.

Protectionism, poorly executed regulation, or obstruction from financial services firms will just delay the inevitable. It is crucial that financial services firms collaborate on the definition of open finance and influence regulators, who will invariably catalyze change but could also hinder opportunity — the report steps you through the main considerations. Financial services execs should take a leaf out of the Nordic banks’ playbook and seize the initiative, using open finance to actively seek innovation for customers. The prize of open finance is too large to remain insular, as the health of customers, nations, and regions is predicated on its success.