Post-Pandemic In-Store Shopping: Consumers Reconsider The Value Of The Store

When the COVID-19 pandemic forced stores to close, online commerce pulled ahead at the fastest rate since 2002. By May 2020, more than six in 10 US online adults reported making an online transaction, such as purchasing groceries or ordering restaurant delivery, for the first time. As retailers reopen their brick-and-mortar spaces, consumers have even more options for where and how they shop. In-store foot traffic is on the rise, while online shopping is projected to grow to 27% of overall retail sales by 2023. Now that consumers have experienced the convenience of online purchasing, shoppers are rethinking the purpose of the in-store experience. Based on data from Forrester’s June 2021 Consumer Energy Index And Retail Pulse Survey, we expect this evaluation to play out over the next 12 to 18 months, and during this time:

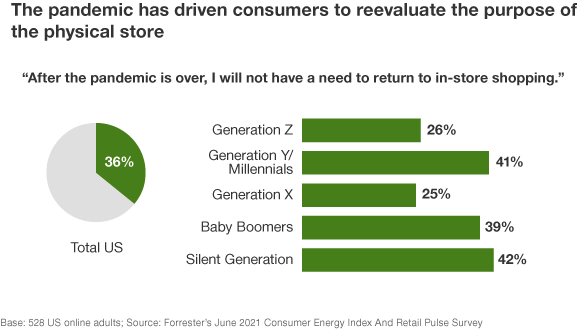

- Consumers will feel underwhelmed by the return to in-store shopping. A whopping 40% of US online adults say that they enjoy shopping in stores a lot less now compared with before the pandemic, and 15% say their enjoyment has waned a little. A third of consumers believe that they will have no burning need to return to in-store shopping even after the pandemic has fully passed.

- Yet they will continue to rely on in-store shopping options for ease, speed, and community. Still, around 40% of US consumers do not go out of their way to avoid in-store shopping today, nor will they refrain from in-store shopping after the pandemic. Consumers cite online shopping frustrations as one of the key reasons to turn to the physical store, along with the desire for community and immersion. When reflecting on their quality of life without brick-and-mortar stores altogether, consumers lament the loss of the emotional experience. As one member of Forrester’s ConsumerVoices market research online community puts it, “Going to stores was a social event for me, a time to meet friends, make new friends, and buy quality merchandise. My life has a void without this.”

- Gen Z consumers will create the greatest demand for in-store experience transformation. More than demographics like gender or income, consumer age shapes shopping choices. Gen X consumers are the most disenchanted by in-store shopping: Forty-seven percent enjoy shopping in stores much less now than two years ago, compared with 35% of their younger counterparts. Millennials particularly don’t see a need to return to in-store shopping and are more inclined than the average consumer to avoid shopping in stores whenever possible. Gen Z consumers are the least likely to feel negative about in-store shopping; instead, Gen Z consumers express the highest levels of excitement around shopping sprees with expanded groups of friends and family.

- Retail preferences will continuously change as consumer risk sensitivities fluctuate. Our previous research has shown that perceptions of physical and financial threats heavily influence consumer behavior through pandemic recovery. Six in 10 “Thrifty” consumers, who perceive minimal risk to their physical well-being and are driven by cost savings, are spending more time shopping in stores, while “Cocooned” consumers, who wield their wallets to protect their physical exposure, are spending less time in stores — 64% of “Cocooned” consumers are trying to avoid stores altogether. This “Cocooned” group is most likely to avoid shopping in stores whenever possible, even after the pandemic is over; their willingness to invest in high-quality digital alternatives will forge a new standard of luxury digital experience. “Poised” consumers, who feel buffered from physical and financial risks, are the most eager and optimistic about trialing new shopping models.

About Forrester’s consumer pandemic recovery outlook series

Any company’s first step in accelerating through the COVID-19 pandemic and building a profitable, sustainable future is to establish a laser-sharp focus on consumers — how their attitudes, expectations, and behaviors are changing and why. Our consumer pandemic recovery outlook blog series provides snapshots of US consumers’ current mindset and evaluates which behaviors they are likely to embrace — and pull away from — over the next 12 to 18 months. Follow my blog to find Forrester’s latest thinking, or read my latest research. As always, I look forward to discussing your questions and ideas via a Forrester inquiry.