Post-Pandemic Media Consumption: Online Streaming Accelerates A New Content Experience

When the COVID-19 pandemic triggered stay-at-home orders and canceled social plans, consumers turned to online media streaming to fill the void. TV/video streaming services touted exclusive content and low prices to lure viewers, and by June 2020, 48% of US online adults had subscribed to at least one streaming service. Our multimodal consumer analysis shows that this behavior is not a mere blip; the intense online media consumption is resetting consumer expectations and reshaping the content consumption experience. Our latest research reveals that over the next 12 to 18 months:

- Heavy TV/video consumption will continue. Fifteen months into the pandemic, 28% of US online adults say they are fatigued from watching so much TV and film, and 21% plan to spend less time watching TV/video as restrictions continue to ease. It’s tempting to believe that, as COVID-19 counts decrease and public spaces fully reopen, consumers will trade screen time for (actual) face time and put those hours of TV binging on the couch toward hiking the Appalachian Trail. While most US consumers will seek new modes of entertainment, few will reduce their media consumption hours to do so: 41% enjoy watching TV/video even more now than they did before the pandemic, and 42% continue to rely on TV/video as a distraction from real-world stressors.

- Offline content consumption will dwindle as online dominates. Between 2010 and 2020, offline TV/video consumption declined from 13 hours on average per week to 8.6 hours. During the same time, online TV/ video consumption increased from 1.7 hours to 7 hours. The jolt of the pandemic fast-tracked the shift to online content consumption. Now, US consumers show no signs of pulling back from their online channels: 46% of consumers report spending the same amount of time on their personal devices today as they did last year when the pandemic restrictions took effect; 39% of consumers report spending even more time on their gadgets.

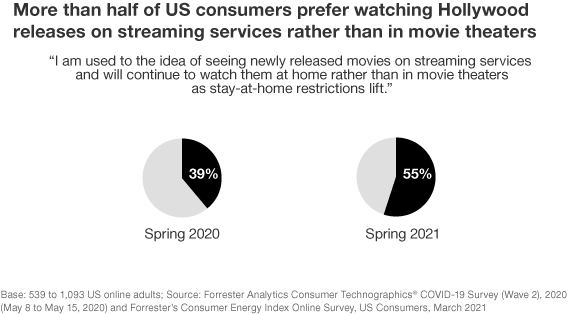

- Movie theaters will become a niche pastime in the face of streaming services. In June 2020, 39% of US consumers liked the idea of seeing newly released movies on streaming services and planned to continue watching them at home rather than in movie theaters. Today, even with a robust vaccine rollout underway and movie theaters opening their doors, 55% agree. Consumers who recently subscribed to Netflix, Amazon Prime Video, or Disney+ are most prepared to continue their subscriptions. Younger consumers, who often feel overwhelmed by the number of TV/video streaming services, will continue to rapidly experiment across streaming platforms.

- Online streaming will bring the public experience into the privacy of closed social circles. While pandemic restrictions are lifting, 34% of US consumers — who skew older — plan to continue watching their favorite TV shows and movies independently or while social distancing; 31% — who skew younger — are eager to watch with friends and family. Only 14% prefer to watch TV/video in public spaces. Whether you’ve been beaming into virtual concerts with millions of other fans around the globe or peering into your colleagues’ home offices, kitchens, or living rooms, the pandemic has blurred the line between public and private social experiences. Now, consumers are ready for the sizzle of the movie premiere and the joy of viewing parties to continue behind closed doors within curated community gatherings.

About Forrester’s consumer pandemic recovery outlook series

Any company’s first step in accelerating through the COVID-19 pandemic and building a profitable, sustainable future is to establish a laser-sharp focus on consumers — how their attitudes, expectations, and behaviors are changing and why. Our consumer pandemic recovery outlook blog series provides snapshots of US consumers’ current mindset and evaluates which behaviors they are likely to embrace — and pull away from — over the next 12 to 18 months. Follow my blog to find Forrester’s latest thinking or read my latest research. As always, I look forward to discussing your questions and ideas via a Forrester inquiry.