Price: Not the Most Important Driver of B2B Buying Decisions

- While many of us were taught that lower prices could ensure more business, this is not at all true for B2B buyers

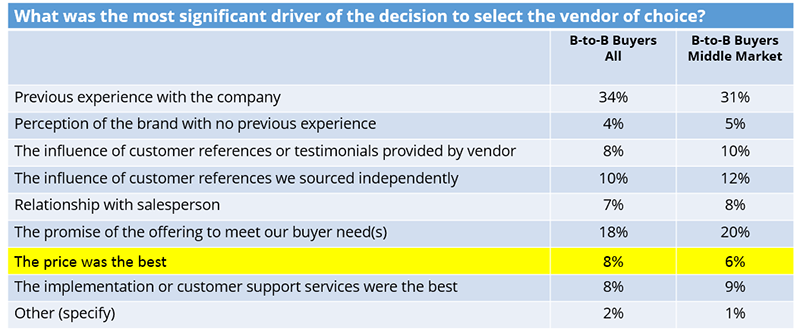

- In our 2015 buying study, 8 percent said price is the main driver of their decision to select a specific vendor for a new offering

- Here are three conclusions and three key actions to take based on our 2015 buying study

While many of us were taught that lower prices could ensure more business, this is not at all true for B2B buyers. In the SiriusDecisions 2015 buying study, only 8 percent (of more than 1,000 survey respondents) selected price as the most significant driver of their decision to select a specific vendor for a newly purchased offering.

The most important decision driver – previous experience with the company, at 34 percent – was twice as popular as the second most chosen driver, the promise of the offering to meet buyer needs. In fact, even customer references are stronger drivers than price.

If you are one of the many B2B organizations targeting the mid-market, keep in mind that only 6 percent of those respondents chose price as the number-one driver. Previous experience with the company – at 31 percent – and the promise of the offering to meet their needs – at 20 percent – were considered far more important. The influence of customer references, relationship with the sales rep, and implementation and customer support also proved more important than price.

You can draw three big conclusions from these findings:

1. A terrific customer experience trumps price by a long shot. The inference here is that buyers are willing to pay for offerings from companies they like; specifically those that have been enjoyable to do business with and have met the buyer’s needs in the past.

2. B2B buyers are much more interested in ensuring their needs are met than they are in lowest price. Again, the inference here is that buyers are willing to pay for offerings that they feel will meet their needs.

3. Especially for mid-market buyers, the overall buying experience, the assurance that they are making the right buying decision, and the ease of getting the new offering in place are more important than price. From this, we might conclude that buyers get a lot of value from these areas and will be willing to pay for it.

And here are three key actions based on those findings:

1. Conduct ongoing assessments of customer satisfaction through NPS analysis or other means to ensure one of the number-one drivers of value – previous experience with the company – is positive. Speak to and survey your customers to understand the value they get from doing business with your company in addition to the value they gain from your specific offering. Does your current pricing equal the value they gain? Are you possibly leaving money on the table? Might it make more sense to charge for that value so you can keep providing great products and high customer satisfaction?

2. As an organization, consider how you speak to the importance buyers place on “the promise of the offering to meet buyer needs.” Here is where selling tools such as value actualization, customer testimonials and trials can drive home the ability of the offering to meet buyer needs. This allows you to price the offering commensurate with the huge amount of value buyers have told us they gain from this knowledge.

3. When moving from large customers to mid-market, avoid emphasizing price as a key decision driver for your buyers. While your instinct might be to assume that mid-market buyers won’t pay as much as buyers from large companies, the reverse is often true. Enable sales to sell the drivers these buyers actually care most about – positive customer experience, assurance that they are making the right product choice and getting the offering up and consistently running smoothly.

Clients of our product management advisory service have access to briefs covering a range of price challenges around pricing a product in a new market to announcing a price increase in a current market. Contact us if you’re interested in learning more about how we can help with your pricing challenges.