Profit Warning! A Software Asset Sprawl Will Weaken IT Service Providers’ Financials

I recently reviewed a portfolio of about 600 software artifacts from 16 large IT service providers. This daunting exercise complements a research stream I have been working on since the beginning of the year on the future of the IT services industry. While I believe the move to software asset (SA)-based IT services will drive maturation of the services industry and help IT service providers remain relevant to their clients, the analysis of this SA inventory raises a few significant challenges:

- Most software assets face scalability issues. Traditional sales and marketing organizations within IT service providers fail to sufficiently scale up the number of clients for their SA-based offerings. Case in point: 68% of the software assets analyzed in this inventory have fewer than five clients. This low number raises concerns on the financial viability of these offerings for service providers.

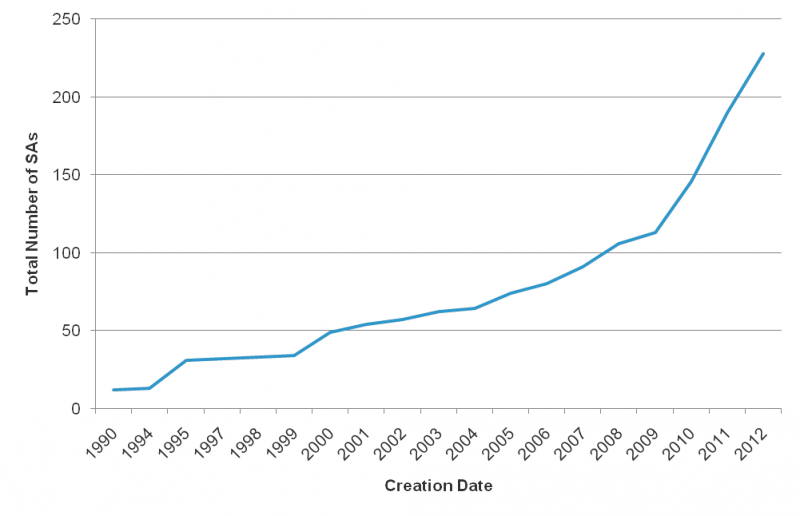

- Service providers will face a SA sprawl over the next couple of years. On average, service providers currently have about 20 SAs in their SA portfolio. The analysis shows that this number is growing exponentially (see below). The number of SAs created has increased by an average of 26% each year since 2009 and is accelerating. More assets were created in the first six months of 2012 than in any previous entire year; SA-related investments are following a similar trajectory.

- Service providers lack the necessary organizational skills to efficiently manage their SA-based activity. Very few service providers have a dedicated group or function that owns and manages the overall portfolio of software assets. SAs usually belong to the vertical, horizontal, or geographic business unit that is in charge of developing, marketing, selling, and maintaining it. As presented in a recent report (Asset-Based IT Services Shift Service Vendors’ Operating Models), the lack of a central SA portfolio management structure raises concerns about the capacity of these firms to sustainably grow SA-based capabilities.

What does this means for service providers? The good news is that most now understand the importance of software assets as a means to remain relevant to their customers in a perfect storm of technology change and are accelerating their SA-related investments. The bad news is that most IT service providers today take a linear approach to the move to SA-based services and leverage their traditional operating models. While the move to an SA-based approach will ultimately prove correct in the long term, a lack of scale of these offerings due to the absence of the right governance processes and organizations will put the profitability of these providers at risk in the near term.