Should Sales Operations Finally Kick Its Excel Habit?

- Excel provides great flexibility for producing analytics, but it’s inefficient

- Business Intelligence (BI) tools provide economies of scale, but they’re less flexible than Excel

- – Re-categorizing sales intelligence production efforts synthesizes the need for Excel and BI

Microsoft released the first version of Excel on September 30, 1985, and sales operations professionals have been addicted ever since. Why? Because Excel is awesome. It’s flexible. It’s easy to learn. It never breaks (unless you try to use it on a Mac). And – let’s face it – unlike business intelligence (BI) tools, Excel never says “I can’t,” or “I could but it’s really complicated,” or “I could but you’ll need to buy some professional services hours.” Basically, there’s no easier way to perform ad hoc data analysis than with Excel. Even a novice user with basic skills and determination can reduce huge data sets into simple, striking, insightful, visually stunning analysis. With all of these benefits, why would sales operations consider kicking its Excel habit? It’s simple: Excel doesn’t scale well, and keeping its dashboards refreshed is laborious. It’s a productivity drain. So…are BI tools a better option?

Unlike Excel, BI is scalable, but designing it correctly requires a lot of upfront planning. Before you settle on reports and dashboards, you have to know exactly what you want to measure, how you want to measure it, which audience you want to make it visible to, and what format it should be in. That’s a lot to consider when experimenting with data for the first time. And as any data analyst knows, with large data sets, we often don’t know the answers to these questions until we’ve had time to play with the data.

Once this is figured out, BI makes for a great production environment. It keeps reports updated and makes distributing them to a broad self-service audience effortless. Also, there’s no chance of users breaking formulas and changing formats. I know, I know – Excel has a lock feature, but it’s a pain. But BI loses its advantage over Excel when you want to change it, which requires special knowledge as well as skills that most of us – except for those who are full-blown data scientists – don’t have. If you’re a BI vendor saying, “Don’t worry, updating our tool is super easy,” then I challenge you: Is it as super easy as making changes to Excel? Because that’s the standard to which we’re holding you.

Herein lies the Excel/BI dilemma – choosing Excel is prioritizing flexibility over efficiency, but making that choice guarantees a productivity nightmare for sales operations. I talk to sales operations leaders all the time who wish they could be more strategic but find themselves trapped in the daily grind of responding to tactical requests for information or struggling to keep their reporting programs afloat. Many of these leaders even have BI tools, but they’ve stopped using them. Why? Because they’d received a last-minute request for some analysis they couldn’t do in the BI tool – so they got frustrated and scrapped it altogether.

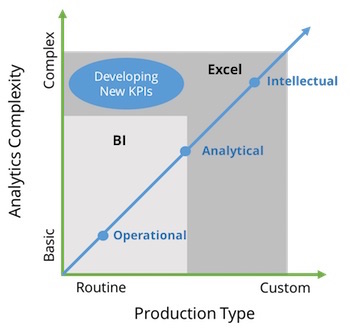

I’m here to say that a compromise can be made: There’s no need to kick the Excel habit or scrap the BI tool. Sales operations leaders abandon BI because they expect way too much of these tools. They want BI to be a sales intelligence panacea – and as of right now, it can’t be. It’s time to think of sales intelligence in a new way: to look at the categories in which Excel does well, the ones in which BI does well, and where there’s room for both solutions. There are three types of sales intelligence in sales operations:

- Operational. This type of sales intelligence focuses on generating the KPIs sales leadership and sales reps use to manage and track their day-to-day business. Some standard KPIs are pipeline coverage ratios, performance against plan and forecast, win rates, pipeline velocity, average deal size, and other metrics that help sales monitor its daily performance.

- Analytical. This type of sales intelligence is more impromptu, is performed by sales operations (or other inquisitive analytical types), and generates correlative analysis that answers sales management’s deeper questions, such as: Why are some reps more productive than others? Is there a correlation between industry, number of employees, opportunity size and win rate? What sales assets are customers using more during which phase of the buyer’s journey, and how is that affecting win rates? Analytical insights get pushed into operational production cycles when we find that having continuous access to them is routinely useful.

- Intellectual. Think of this type of sales intelligence as the annual (high-performing companies do it more often) analysis required to assess and revise each year’s sales go-to-market model, financial plan, quotas, compensation plans and corresponding accrual calculations. This type of analysis answers questions such as: What’s our total addressable market? What are our penetration rates? How should we redeploy our sales resources to cover untapped opportunity? Should we consider an inside sales model? Should we consider deploying product specialists to stimulate new product sales? What are the implications of compensation plan changes on sales motivation and commissions expenses?

Operational sales intelligence is routine, repetitive and relatively predictable. It’s simple. What makes it complex are the data feeds required to keep it accurate and updated. BI is a great fit for this space.

Depending on the questions being asked, analytical sales intelligence is more theoretical, reactive and exploratory, and could require different data sources. BI can contribute in the production of this intelligence, especially since it’s a great data source, but Excel continues to play a large role because of the flexibility that’s required to complete the analysis.

Finally, intellectual sales intelligence requires the highest level of effort, and it’s as much art as it is science in taking into consideration variables that change from moment to moment according to the insights discovered along the way. You’ll rely mostly on Excel to manage this type of intelligence, but you’ll also gain a great deal of efficiency by leveraging point solutions like territory optimization tools, sales compensation management tools and collaborative planning solutions to make analysis more robust and easier.

So, should sales operations finally kick its Excel habit? The answer is clearly no – but if you’re overusing it, maybe you should get some help. You may need a BI intervention! Categorize the types of analysis you’re doing now. My guess is that you’re spending at least 90 percent of your time tackling operational sales intelligence issues and never getting to the analytical or intellectual – or, if you are, it’s during the 60th hour you’ve worked that week. Invest the time to build out the operational capabilities in your BI tool, and stop trying to use it to tackle analytical and intellectual sales intelligence problems. It’s not designed to do this…at least not yet.