Small Business Banking Has Been Disrupted (And There’s No Going Back)

Bankers around the world are rightly worried about the threats posed by digital disruptors getting in between them and their retail banking customers. But Forrester’s newest research reveals that executives should be just as worried — perhaps even more worried — about another market that is being upended: small business banking.

Small- and medium-sized businesses (also called small and medium-sized enterprises, or SMEs) are crucial sources of revenues and profits at most banking providers, so the prospect of bank brands losing their relevance among SMEs should keep bankers awake at night.

Here are just a few of the insights you’ll find in our new research report:

- Disruptors have stepped into the small business banking gaps left by traditional banks . . . Hundreds of digital upstarts, such as Intuit, PayPal, Shopify, Square, Stripe, Tide, and Xero, as well as giants like Amazon, are focusing on small business opportunities that have high margins, inefficiencies, unmet customer needs, and/or new ways to deliver simpler, cheaper, and better small business services. At the same time, new regulations like the EU’s PSD2 and other “open banking” efforts are allowing new entrants to serve SMEs in ways that would have been impossible or difficult just a few years ago.

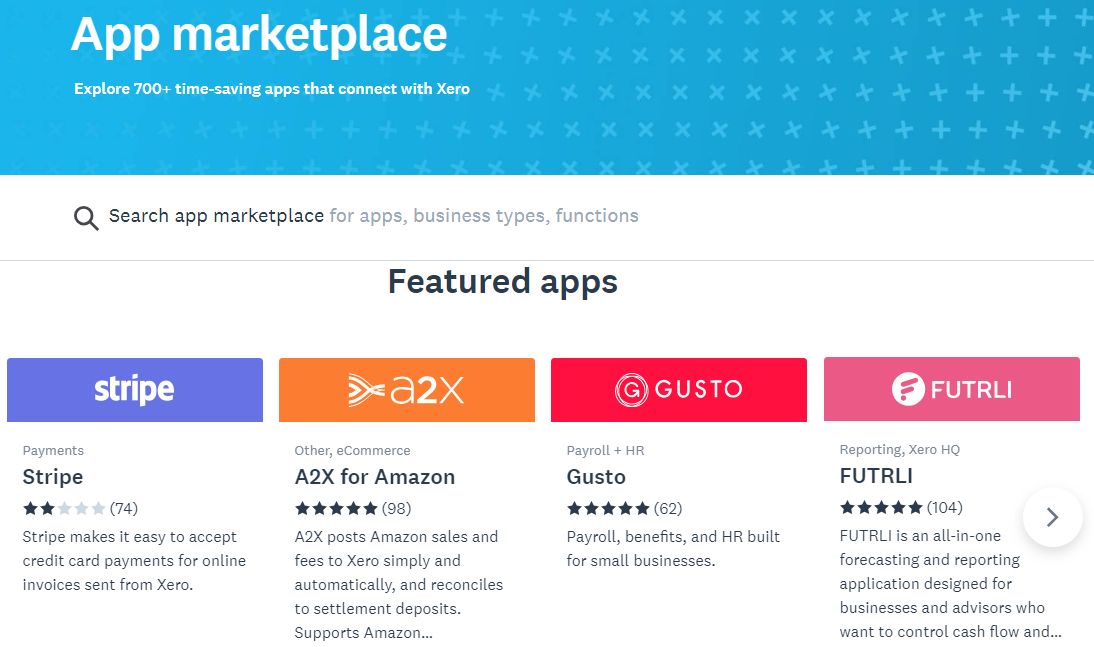

- . . . and they’re building ecosystems that will forever shift the SME landscape. Over the past five years, digital business ecosystems have transformed the landscape of small business services. Disruptors like Fidor Bank, Kreditech, Saasu, and Stripe have partnered with their fellow disruptors to offer adjacent services, such as foreign exchange, point-of-sale payments, accounting, expense management, and payroll. Typically, they build these partnerships using APIs. A striking example is New Zealand’s Xero: It started as a cloud accounting software provider for SMEs and has since launched a marketplace with more than 700 apps from other firms (see screenshot below).

- Too many banks mistake small business lending for small business banking. Interviews and conversations with small business banking executives and managers reveal that most equate “small business strategy” with their organizations’ efforts to lend more money to existing businesses. This is understandable, since selling small business loans via branches has been the proven approach for decades. But focusing only on commoditized lending is a flawed strategy — one that the most successful disruptors have been careful to avoid.

- Traditional banks will need to open up and partner to remain relevant to SMEs. Going forward, banks won’t be competing with each other plus a few startups; they’ll be competing against increasingly powerful digital business ecosystems. As the saying goes, if you can’t beat ’em, join ’em (or at least emulate ’em). Traditional banks can’t win, retain, and engage SMEs by going it alone. Instead, they should embrace continuous exploration involving an array of partnerships (often using APIs) that allow for rapid iteration and opportunities to try out new services from vendors and/or fintechs. At the same time, many banks will need to find ways for their own capabilities to sit inside someone else’s ecosystem or platform.

- Digital banking leaders should better segment SMEs to design superior experiences. Banking teams routinely refer to “segments” of small- and medium-sized businesses, but this typically refers only to a basic breakdown of how big a particular business client is — measured either by revenues, number of employees, or some combination of these two metrics. Segmenting SMEs by these attributes is fine, even necessary, but it’s not sufficient to guide decisions around new digital services, personalized marketing, or sophisticated content marketing. Digital business leaders should work with internal and external partners to develop a more sophisticated segmentation model of the SME market.

I encourage you to read the full report here to find out more. Also, feel free to reach out to us if you want to talk about the future of small business banking.

Thank you,

Peter