Social Will Be The Fastest-Growing Digital Advertising Channel Globally

While 2018 was a challenging year for global social media advertising amid the implementation of GDPR, privacy scandals, and brand safety concerns, Forrester forecasts that social will remain the fastest-growing digital advertising channel globally over the next five years. This growth will be driven by increasing revenue per user and will be fastest in Asia Pacific and other markets outside of North America and Europe. We expect Asia Pacific’s share of global social advertising spend to increase from 30% in 2018 to 35% in 2023, mostly due to growth in China. Revenue per user is powering the overall growth in social advertising spend in terms of both depth and width: Social media players are increasing their revenue per user by launching novel advertising formats and increasing ad loads (depth), while individuals are using multiple social platforms and adding new platforms to the list of social media they use (width).

The dynamics of per-user revenue growth differ depending on whether the market is developed or emerging:

- Developed markets are driven by growth in revenue per user. In 2018, North America and Europe saw their Facebook user bases grow year-over-year by just 3% and 1%, respectively. However, revenue per user increased by approximately 36% in both regions, helped by the launch of new features like Stories and Watch. These innovations keep users engaged and provide more opportunity to serve them ads.

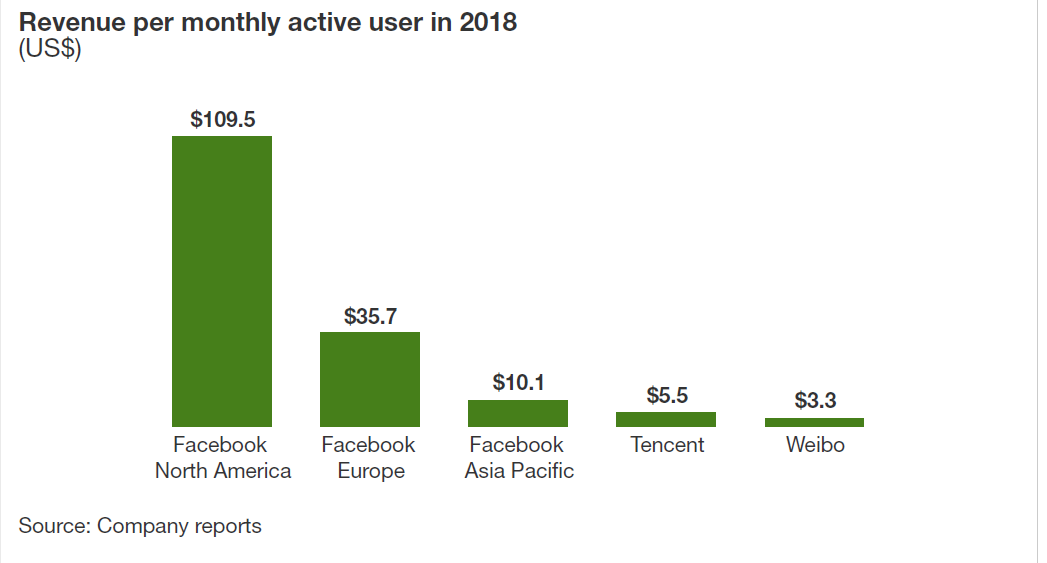

- Emerging markets are transitioning from growth in user numbers to growth in per-user revenue. While the increase in the number of users of social channels is slowing in most key emerging markets (India is the exception), growth in revenue per user remains robust. China’s social revenue per user will grow at a compound annual rate of 17% from 2018 to 2023 — the fastest globally. In prior years, Tencent and Weibo focused on acquiring new users, but as social user penetration approaches saturation, revenue per user growth will become their primary revenue driver. Compared with their Western counterparts, Chinese social players’ ad revenue per user is low, leaving ample room for growth, which is going to benefit these players in the future.

Tencent’s Revenue Per Monthly Active User Lags Against Its Peers

For more detail on the drivers of social revenue per user and the breakdown of global social advertising spending by region, device, format, and social network, please see our latest ForecastView report, “Forrester Analytics: Social Media Advertising Forecast, 2019 To 2023 (Global).”

Related Forrester Content (For Client Purchase):