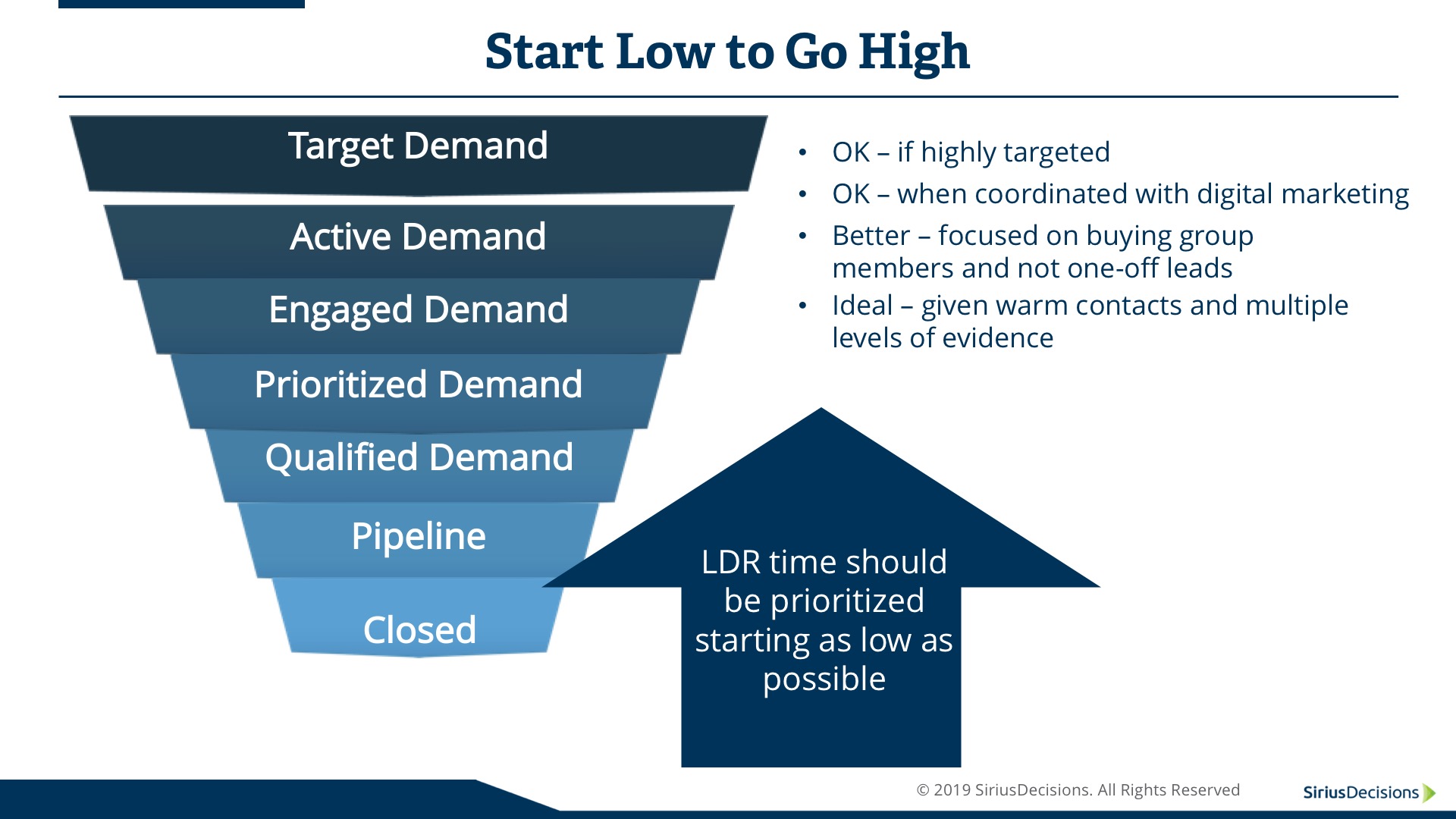

When Tele and Sales Start Low, Revenue Engine Performance Goes High

- The Demand Unit Waterfall™ is not just about measurement, but also about planning

- Think of intent signals and leads as layers of evidence about where to invest tele and sales efforts

- When tele and sales teams start their outreach lower in the Demand Unit Waterfall, they are more effective

By now, most b2b organizations are familiar with the Demand Unit Waterfall, the latest generation of the SiriusDecisions Demand Waterfall®, which is the de facto standard for knowing how the organization is doing when it comes to attracting, engaging and converting buyers. But there’s another, perhaps even more important, way to understand the utility of the Demand Unit Waterfall — as a method for organizing and prioritizing the organization’s outreach to prospects.

Here’s what I mean.

For the sake of this discussion, let’s pretend your organization sells softwidgets, and that the buying group for softwidgets is typically five individuals within that target demand unit.

The Demand Unit Waterfall begins with the target stage, and yours is populated by organizations — demand units — that are good fits for softwidgets. It’s the classic realm of ideal customer profiling, in this case, to identify and segment organizations that are likely to buy softwidgets.

So, now you know which organizations are potential prospects. However, none of them are prospects all the time. Each demand unit is a prospect just once every couple of years or so when it reaches the end of life for its current softwidget solution. The next two stages are about understanding which demand units are likely to be in buying mode in the near term. The active stage is populated by good fit demand units for which there is some evidence that people within that organization are actively researching softwidget suppliers and solutions. They may be visiting competitor websites, softwidget industry analyst and publications — this may be evidence that now is a good time.

But if that buyer hasn’t found your organization in their search yet, they stay in the active stage. Active stage demand units are ideal candidates for digital marketing tactics, to try to lure buying group members to reveal themselves. When at least one person does, their demand unit shifts down to the engaged stage. Now, finally, we have a warm name and that alone will make your tele and/or sales team more productive. What’s different about this Demand Waterfall is that we probably will see more than one person from a demand unit (aka, a buying group) engaging at the same time. Evidence that more than one person is engaging from that five-person buying group may be the most compelling evidence that they are in buying mode. By connecting the dots between buying group member behaviors, we can distinguish the one person who has a fascination for softwidgets but no buying intentions from a real buying group that is going to buy something from your organization or its competitors in the near term.

In a perfect world, branding and demand generation activities would be such that every time a good-fit demand unit was in market for softwidgets, they would find your organization’s website or booth at a trade show, and explicitly tell you about their interest. You would see expressions of interest from multiple buying group members, and prioritize your team’s calling efforts against only the buying groups expressing the most acute interest and therefore only call prioritized stage demand units.

But the world isn’t perfect, so nearly every organization sometimes has to act on less compelling clues. Perhaps only one person from a target org has logged in to see gated assets. We would think of that as an engaged-stage prospect — the equivalent of the typical leads-based approach. Having evidence of just one person who is interested isn’t very compelling, but it’s second best to a having multiple people engaging.

Many organizations are not yet at the point where you can get hand-raisers from all or even most of the active stage buying groups, so they’ll have to go prospecting into those active stage organizations. Because you don’t know precisely who in that account is out doing the looking, the odds won’t be as good as they would be if calling nice, warm names from the engaged and prioritized stages. But at least there is evidence that there may be interest inside that org, if only you can find the people responsible.

Finally, if you can’t find reasonable intent signals showing softwidget interest, you’ll have to have your team call into good-fit accounts. These should still really be good fits; however, purchasing is all about timing, and you have no evidence that now is a good time.

So, that is the way we see it. Gather as much evidence as you can and invest more energy into the buying organizations where you have the most robust evidence of an active buying process, then make your way back up. Start low in the Demand Unit Waterfall to get higher conversion rates from tele and sales teams.