The Four Faces Of Rapid Development

Heads up: We’re revising our market segments and vendor assessments in and around low-code development platforms and digital process automation (DPA). This post explains the changes we’re making in 2019.

We’re making this change in response to client requirements. All clients are engaged in a scramble to raise the amount of automation in their customer engagements and operations. This imperative leads them to focus on business process automation. No customer has enough coders to fill its automation needs. Low-code vendors bolstered their process-automation features to fill this need. Traditional process automation vendors jumped on low-code tooling to address shortcomings of the business process management (BPM) market.

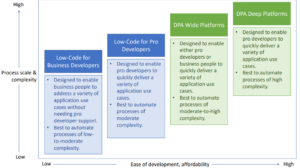

The Result Is Four Overlapping Market Segments (See Figure 1):

- Low-code for AD&D pros (professional developers). These vendors typically target many use cases with products designed first for pro developers. These platforms are generally well suited for development of large numbers of applications and handle basic- and medium-level process complexity. Vendors in this category include Clear Software, GeneXus, Kony, Mendix, Microsoft, Netcall (MatsSoft), OutSystems, Progress Software, Salesforce, ServiceNow, Skuid, ThinkWise, and WaveMaker.

- Low-code for business developers (businesspeople). These vendors typically target many use cases with products designed first for businesspeople. Vendors in this category include Airtable, AppSheet, Betty Blocks, Caspio, FileMaker, Google (App Maker), Kintone, KiSSFLOW, Knack, Quick Base, Scopeland Technology, TIBCO Software (TIBCO Cloud Live Apps), TrackVia, and Zudy.

- Digital process automation for wide deployment. These platforms are process-first and focus on rapid deployment. They are less focused on the professional developer experience but can easily handle a very wide variety of low-code use cases. They are less well suited to most complex process requirements but tend to cost less than DPA solutions for deep deployment. Vendors in this category include AgilePoint, AXON Ivy, bpm’online, FlowForma, JobRouter, K2, Newgen Software, Nintex, and PMG.

- Digital process automation for deep deployment. These platforms excel at the high end of process complexity but may also be the right solution to meet the needs for a wide-deployment, low-code standard in your organization, albeit generally at a higher price point. Vendors in this category include Appian, AuraPortal, Bizagi, Bonitasoft, Genpact, Hyland Software, IBM, ISIS Papyrus, Kofax, OpenText, and Pegasystems.

Figure 1

Our Forrester report, “Now Tech: Rapid App Delivery, Q1 2019,” describes three of the four segments: digital process automation for wide deployments, low-code development platforms for AD&D pros, and low-code development platforms for business developers.

A fourth segment, digital business automation for deep deployment, will be defined in upcoming research reports.

For our 2019 Forrester Wave™ evaluations, we’ve reclassified some vendors into new segments. We did so to create groups of vendors most like one another in their functional value and go-to-market approaches. Our segments are not straitjackets: Vendors can and will compete across our segments.

Your job is to identify competitive sets that make the best sense for your organization’s requirements and strategy. Our job is to help clients navigate three potential confusions in this market:

- All of the dozens of vendors in our four segments employ the declarative tooling of low-code and can be used to deliver a variety of use cases. Thus, vendors classified as digital process automation for deep deployment are very strong for apps that at their core automate demanding business processes but are also effective for: 1) a variety of other use cases and 2) for delivery of complete applications. Our Wave assessments of the four segments incorporate criteria to measure each vendor’s ability to target full app delivery of many use cases.

- Each vendor targets a primary audience but also includes features to address secondary audiences. For example, several low-code platforms for AD&D vendors are investing in tools to serve business developers. To avoid confusion, Forrester assigns each vendor to one and only one of the four market segments: its primary segment. We then assess the vendor’s ability to serve secondary audiences as well as its primary audience.

- Vendor support for low-cost entry and pay-as-you-grow business models is highly variable. In particular, digital process automation for deep deployment vendors primarily reaches customers through direct sales forces and big multiyear contracts. Our Waves include criteria to assess each vendor’s commercial model, price visibility, and likely cost predictability.

What It Means

All four segments are important to clients seeking low-code platforms to advance their software strategies.