The Future Of Banking Has Arrived

Forrester’s view on the future of banking is here. We examine the changes that we expect to play out over the next decade of retail banking. The drivers of the future are evolutions of the past: Some are playing out now; others will be far more prominent by 2025 and table stakes by 2030.

In order to compete in a world with increasingly blurred boundaries — where smart devices and platforms such as Google can deliver the banking experience, ride-sharing apps can supply loans, and cars can be distributed ledgers — banks must ruthlessly determine and play to their strengths. During our research, four clear themes emerged.

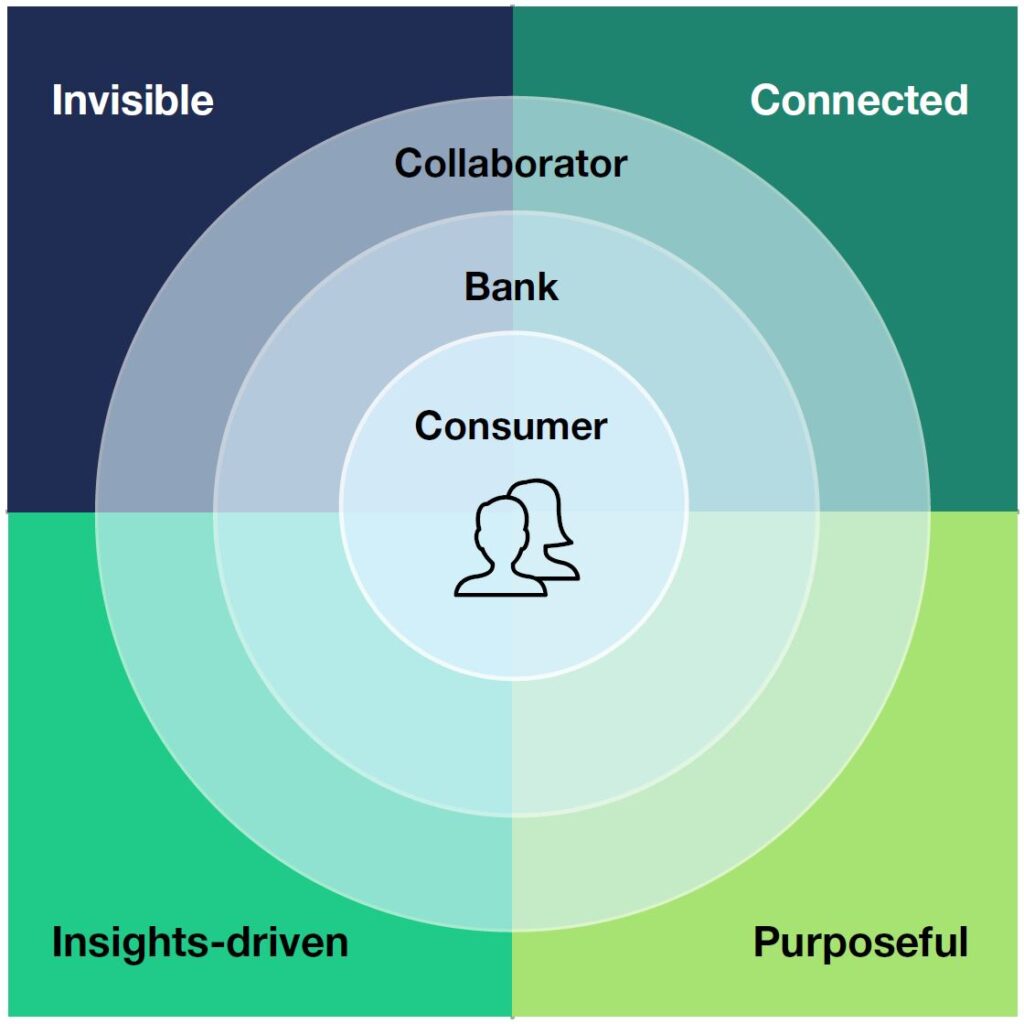

Future Banking Will Be Invisible, Connected, Insights-driven, And Purposeful

By 2030, banks will be:

- Invisible. Leading banks will use technology and far deeper customer insight to insert financial services at the customer’s moment of need, often at the expense of brand visibility. Distribution models are evolving to make use of marketplaces and technologies such as open APIs and 5G to connect finance with homes, machinery, vehicles, and other devices. This will pose challenges for many banks as their retail brands become increasingly invisible to the end consumer.

- Connected. To remain relevant, banks must be present in the ecosystems and products that customers use; to do this, they must cease to see partnerships — and intermediation of their brand — as a threat. Banks will assemble constellations of value: interoperable, trusted environments that enable collaborators beyond banking to weave value into frictionless, rich customer journeys. “Trusted advisor” status is what will differentiate banks from all other touchpoints that offer embedded financial services.

- Insights-driven. Banks will unleash insight from data and elevate custodianship of consumer trust. Their expanded role around consent and identity will enable consumers to have finite control of their financial and digital lives. Consumer trust is the critical asset here. Banks must firmly step up with advice and generate financial intimacy with their customers — customers that expect “RoC” (return on consent) for that trust.

- Purposeful. Consumers will prefer banks that align with their environmental and social values in a more purposeful age, where local and cooperative principles align to matters of global responsibility. Open cultures that build and curate communities will set leaders apart as they grow values-driven ecosystems. Consequently, open innovation and engagement via code, content, and knowledge will create communities driven by a shared purpose, generating collective product development to benefit all.

Banks Will Have A Stark Choice: Own Customers, Or Power Finance; Few Can Manage Both

In the era of open finance, no bank can do it alone. Because of this, we examine the future from three perspectives: that of the bank, that of the customer, and that of the collaborator. Each of these will play a central part in defining the next decade of banking. Some banks will pivot fully to become the platform and rails that other firms run upon; other (larger) banks will contest the tech titans for customer primacy and engagement; and some will do both. Banks will have to selectively leverage and extend the trust they possess and carefully choose their key battlegrounds.

Leading banks are already pivoting and rebooting their strategy — capitalizing on the COVID-19-driven pace of change and innovation and setting their course for the next decade. Forrester is on that journey with them.

If you’d like to learn more, please take a look at our new report on the future of banking and audio insights from our research interviews, accessed below. Please reach out if you have any questions or would like to know how we can help you and your firm prepare for the future of banking.

You can now access this complimentary webinar replay around The Future Of Financial Services, part of our Europe Financial Services Webinar Series. Click here to watch.

Related Forrester Content

Categories

- Age of the Customer

- Banking

- customer centricity

- Customer Engagement

- customer experience

- Customer Experience Strategy

- Customer Insights

- Data Insights

- data science

- digital business

- digital disruption

- digital product management

- Digital Transformation

- Emerging Technology

- employee experience

- financial services

- fintech

- Innovation

- internet of things (IoT)

- marketing automation

- mobile technology

- organizational design

- predictions

- values-based customer experience

- virtual agents

- virtual reality