The Future Of Financial Brands: Less Financial, More Brand

A new crop of challenger brands, such as Alibaba, Amazon, Apple, Google, Starbucks, T-Mobile, Tencent, and Walmart, are on the prowl in the financial services category. And that should have traditional financial brands worried — very worried.

Trouble On The Horizon

Banks have had a great run: They’ve played an essential and highly visible role in people’s lives for nearly a century. In the US, for example, storied brands like American Express, J.P. Morgan, and Wells Fargo are interlaced with the history of nation building. But all that is about to turn a new corner. A new crop of nonfinancial challenger brands, such as Alibaba, Amazon, Apple, Google, Starbucks, T-Mobile, Tencent, and Walmart, are on the prowl in the financial services category. And that should have traditional financial brands worried — very worried.

When It’s Better To Not Be A Bank

You need not look much further than Apple. The brand extended $10 billion of credit in the first two months of its card launch, surpassing previous launches by any provider — a remarkable thrust with a singular value proposition: a credit card from Apple, not from a bank. Imagine, Apple says, what your experience could be if a brand you had a meaningful and rewarding relationship with also managed your finances — a brand like, say, Starbucks, with whom customers store $1.6 billion in value.

Bankrupt Equity

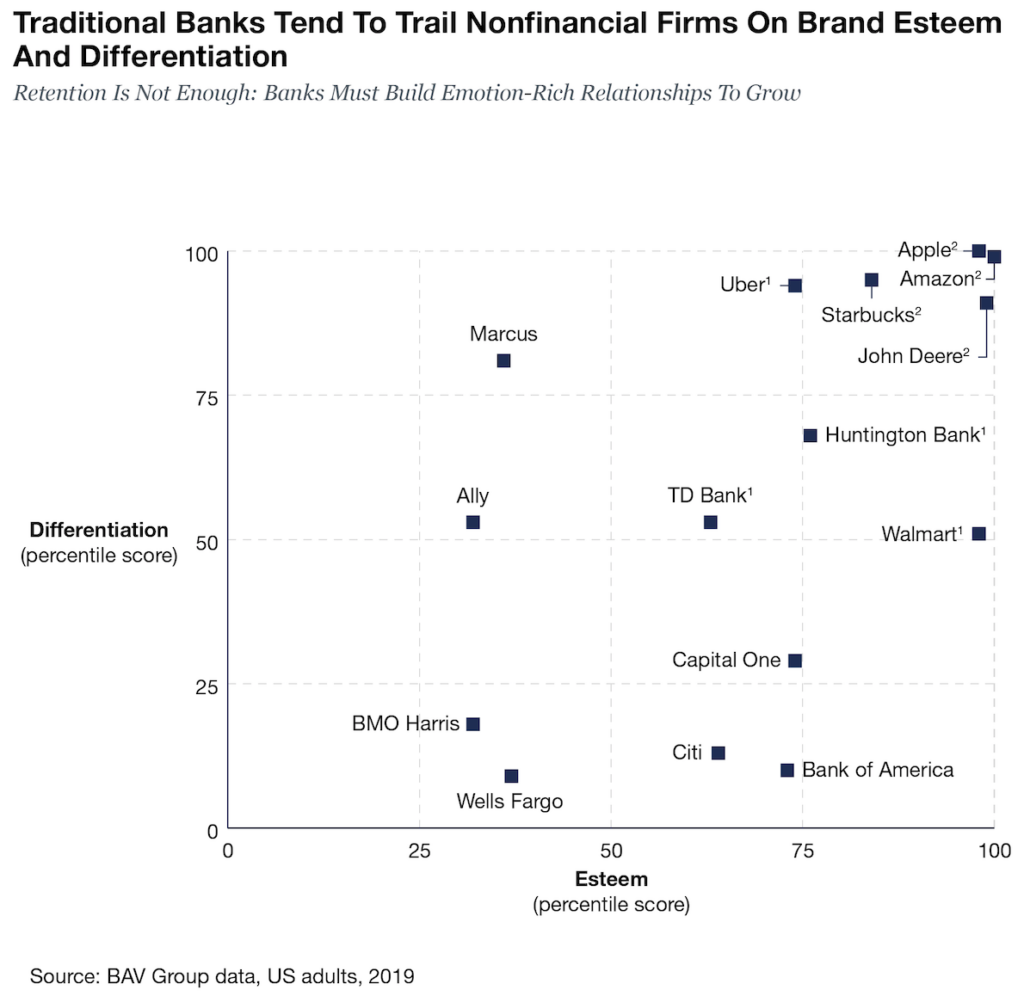

The peril that banks face today is readily apparent if you ask consumers how they view financial brands compared with others they choose to interact with daily. These brands, such as Amazon, Apple, and Walmart (all dabbling in consumer finance), rank in the top-10 percentile of brand equity measures like “differentiation” and “esteem.” Bank brands, however, struggle to exit the bottom quartile. Even equipment manufacturers with registered financial subsidiaries like John Deere outperform traditional financial brands.

Building Financial Brands With Energy

There is good money to be made in banking, and bank brands have low consumer regard, so it’s no surprise that powerful outsider brands want to disrupt the category and share in the spoils. What will it take for a financial firm to mount a viable defense? The answer lies in accumulating the right kind of energy in these brands to influence long-term choice.

As part of Forrester’s brand energy framework, we analyzed and specified the components of a financial brand that drive customer outcomes. Our analysis revealed that roughly 60% of a financial brand’s strength comes from being salient and achieving a fit with customers’ needs — in other words, striving to remain relevant. The remaining 40% has its roots in a brand’s ability to engage and activate emotions. Brands do this best when they secure ongoing meaningful relationships with the customer.

The path forward is twofold: relevance and relationship.

Relevance And Relationship — Building Moats And Bridges

Relevance is secured on three fronts:

- Being easily accessible wherever and whenever the consumer wants to engage.

- Being useful (in a “jobs to be done” sense) in peoples’ lives, rather than peddling products.

- Adding intelligence to the mix to create a hyperpersonalized and hyperrelevant value proposition.

Relationships are built on three pillars:

- Being an ally to the customer so that she knows the brand is in it to look out for her, as well.

- Deepening the human connection by building an open, accessible, trust-filled bond.

- Creating uncommon value that secures that holy grail of differentiation, so elusive in financial services.

Done right, this two-pronged strategy will secure current loyalty by building defensive moats around customers while earning permission to build bridges to new products, services, and experiences.

Look No Further Than These Financial Vanguards

The crisis in financial services is not just that most banks don’t get relevance and relationship right. It’s that most of the leading consumer brands eyeing the financial space do. But all is not lost, and there are several best practices within the category for firms to draw on to energize the brand. Here are a few:

- Poland’s Idea Bank sends out Uber-like mobile deposit cars to business customers.

- India’s Axis Bank, rated best in customer service, offers “digital relationship managers” with the ironic responsibility of providing human assistance through the digital experience.

- UK bank Barclays recognized that people don’t want mortgages but instead want a home and has partnered with real estate firm Zoopla to serve that need.

- USAA’s more than 10,000 customer service agents aren’t paid on commission and are encouraged to “downsell” (rather than upsell) to customers.

- In the US, Huntington Bank has put measures in place to prevent unpleasant surprises like duplicate charges or spending that risks overdrafts.

Want More? We Have A Report For That

Peter Wannemacher and I have just published a report on financial brands. The report explores in great detail the topics covered here, including the brand energy dimensions for financial brands, detailed strategies on how to deliver on the three components of relevance and relationship, and best practices from across the globe. Clients can access the report here: “Retention Is Not Enough: Banks Must Build Emotion-Rich Relationships To Grow.”

Peter and I also lead a joint presentation and collaboration session based on this report, which we have tailored to the current virtual/remote working environment. Please contact your account team if this is of interest.