The Race To Put Cars In The Cloud Is … Confusing

Back in 2018, Elon Musk’s SpaceX put the first car in space. A flurry of press releases suggest that the (surely simpler?) race to put cars — and carmakers — into the cloud is far from over. Last week, Volkswagen Group jumped into Microsoft’s Azure cloud to “accelerate the development of automated driving.” But the company is also a fan of Amazon Web Services (AWS) and previously announced a relationship with Azure back in 2018: My colleague James Staten enthusiastically covered that at the time. Earlier this month, Ford picked Google as its preferred (but not only) cloud.

It’s not a surprise that a company should want to spread its bets and adopt a multicloud strategy. But it gets more complicated in the automotive sector for two big reasons: first, the apparent desire to give even the most routine procurement a grand-sounding name. Volkswagen, for example, has the Volkswagen Automotive Cloud and the Volkswagen Industrial Cloud. They do very different things. A 2019 relationship between Microsoft and BMW (which has grown to involve others) is called the Open Manufacturing Platform. The second, and more important, big reason is that carmakers have a range of very different uses for cloud across their business. Simplifying the underlying complexity a lot, these can broadly be characterized as:

- General-purpose SaaS enterprise applications, like every other business. Carmakers have offices, just like yours, and the occupants of those offices use Office 365 or Google Workspace, or Zoom or Webex, or Oracle or Salesforce or SAP, just like you. Many of the systems that keep the business operating run in the cloud. Any big software-as-a-service (SaaS) vendor signing a global car brand is likely to make some noise about it, but it has very little to do with the cars.

- General-purpose cloud infrastructure. Developers at automotive firms, like developers at many other places, use cloud-based infrastructure to develop and test their applications and to store data. Most people probably weren’t aware that Tesla used AWS until a cybersecurity firm discovered that an account was being used by hackers to mine cryptocurrencies. Every major carmaker on the planet will make some use of general-purpose cloud infrastructure from one or more of Alibaba, AWS, Azure, or Google without feeling any need to broadcast the fact.

- General-purpose big data tools. Car firms generate a lot of data. The shift toward partly or fully autonomous vehicles requires companies to analyze huge volumes of data as they train their cars to recognize and react to a range of road conditions. Mercedes drove a car around the world to capture data on road conditions and driver behaviors in different countries. Others collect similar data and then use software to simulate even more combinations of conditions. Last week’s announcement from Volkswagen and Microsoft touched this use case.

- Use cases that support the design of cars. A single new Jaguar model consumed 36 million CPU hours to support the running of 1.8 million simulations that generated 1,200 terabytes of data. And all of that contributed to meeting around 40% of the car’s design and performance verifications: The company is now aiming to cover 100%. Ford has used Microsoft’s HoloLens to accelerate the design process for new cars and trucks. As carmakers set themselves ambitious targets to launch a range of completely new electric designs, they’re searching for ways to reduce the time and expense of developing, testing, and validating those designs.

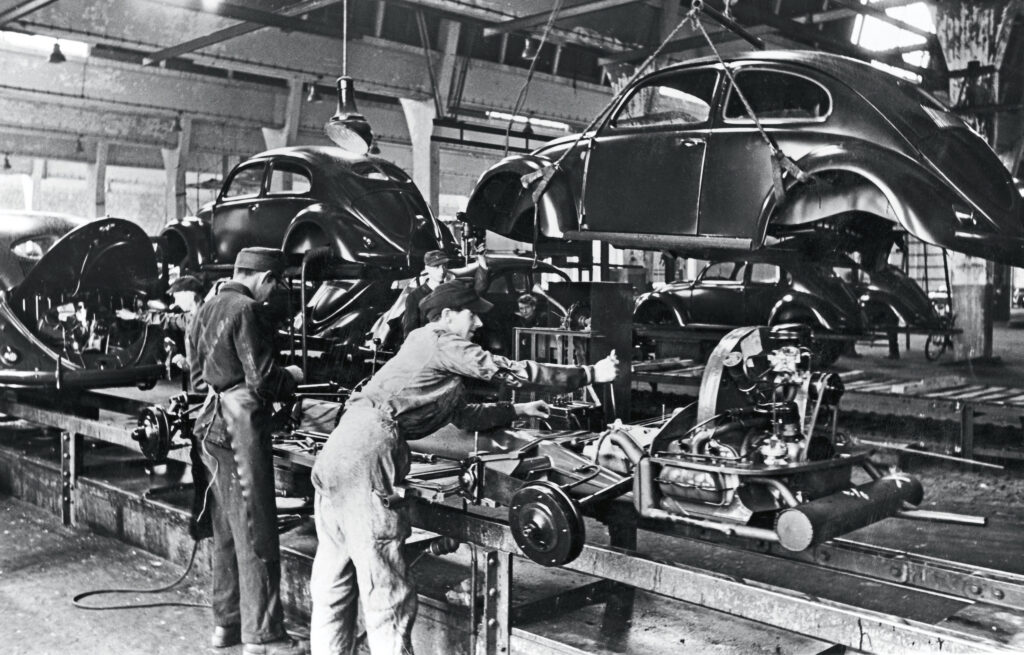

- Use cases that support the manufacture of cars. In many ways, a car factory is just like any other factory. It’s full of big machines hitting things, welding things, bolting things, bending things, spraying things, and moving things around. Those machines need to be controlled and monitored, and data from them can be analyzed to work out when they will break or how they might be used more efficiently. The ambitions for the Volkswagen Industrial Cloud, the Open Manufacturing Platform, and a partnership between Google and Renault all broadly address pieces of this use case. Volkswagen hopes, eventually, to extend beyond its own factories to apply similar processes to its partners in the supply chain.

- Use cases that support the operation and maintenance of cars. Carmakers get nervous when they think that they might lose control of the software systems that make their cars go. Just as much as the physical design of the car, this is intellectual property that they believe differentiates them from their peers and that they don’t want to give up. Indeed, many want even more control. Even with its (AWS) Industrial Cloud and its (Microsoft) Automotive Cloud, Volkswagen is doubling down on its own software development capabilities. The “$50 billion plan” isn’t going entirely smoothly, but the company remains committed to increasing the proportion of in-house software development for its cars from today’s 10% to around 60%. Most of the rest will still be done by the automotive system suppliers that do it today (the likes of Bosch and Continental), and part of the original promise of the Automotive Cloud was that it might aggregate data from all of these participants in the in-car ecosystem. Others, like Ford or Volvo, appear more willing to cautiously cede some control over the operation of the car. Both are working with Google to bake the company’s Android Automotive (not to be confused with the similarly named Android Auto) into the car. Instead of using a Ford system or a Volvo system to turn up the heat or navigate home, drivers will rely on Android — no phone required. How much these systems really need to be owned and maintained by the carmaker is a question for another day, but cloud infrastructure clearly plays a role: All those over-the-air updates to in-car systems need to come from somewhere, and all of the diagnostic data about driver behavior and vehicle performance needs to go somewhere for processing. Suitably secured, a global cloud is probably better suited to serving a global fleet of cars than a lone data center in Dearborn or Gothenburg or Wolfsburg. Additional services and revenue streams linked to the car and its operation, such as situational awareness, usage-based insurance, location- or driver-specific product promotion, and others, mostly remain hypothetical or of limited utility for now.

- Use cases that enhance the driver (and passenger) experience. Many modern cars support Android Auto (again, not the same thing as Android Automotive) or Apple CarPlay, projecting apps from a paired phone onto the car’s display and passing audio through the car’s microphones and speakers. Amazon’s Alexa is also available as an option in some cars from Audi, BMW, Chevrolet, and others. There’s no real integration with the car here, as all of the intelligence sits on the phone or in the cloud.

As carmakers grapple with their industry’s disruptive forces — the interrelated shifts to more connected, autonomous, shared, and electric vehicles, often referred to as CASE — cloud is an important tool in the toolbox. The carmakers gain value, and the cloud providers love to shout about it. But next time a headline screams the news about the latest car/cloud marriage, remember to dig a little and ask which problem the cloud provider is really being asked to fix.

(Image source: Volkswagen)