The Taming Of The SKU: Dynamic Pricing Helps Retailers Reduce Food Waste And Increase Profit Margins

Although I didn’t know it at the time, my visit to the 2015 Expo in Milan was a foreshadowing of my current food tech research. I discovered the challenge of feeding the planet, explored new agricultural methods, climbed into new harvest combines, and browsed through the supermarket of the future — not to mention ate foods from all over the globe. Little did I know this would all end up relating to my research on how technology — and access to data, in particular — is changing the way we produce, distribute, buy, and consume food. It was at Expo, in that supermarket of the future, that I first discovered dynamic pricing.

Although I didn’t know it at the time, my visit to the 2015 Expo in Milan was a foreshadowing of my current food tech research. I discovered the challenge of feeding the planet, explored new agricultural methods, climbed into new harvest combines, and browsed through the supermarket of the future — not to mention ate foods from all over the globe. Little did I know this would all end up relating to my research on how technology — and access to data, in particular — is changing the way we produce, distribute, buy, and consume food. It was at Expo, in that supermarket of the future, that I first discovered dynamic pricing.

Dynamic Pricing: The Low-Hanging Fruit

Fast-forward to this summer, and dynamic pricing has become part of my life. I try to buy my fruit and vegetables seasonally. And, like most people, I watch the prices come down as each season starts and ends. Who hasn’t eyed those first strawberries that appear on the shelves and debated whether they are worth the €9.99/kilo? Or gotten excited about the crate of peaches that drops to under €1/kilo by the end of the summer but wondered if they could all be eaten in time? I certainly have.

Fast-forward to this summer, and dynamic pricing has become part of my life. I try to buy my fruit and vegetables seasonally. And, like most people, I watch the prices come down as each season starts and ends. Who hasn’t eyed those first strawberries that appear on the shelves and debated whether they are worth the €9.99/kilo? Or gotten excited about the crate of peaches that drops to under €1/kilo by the end of the summer but wondered if they could all be eaten in time? I certainly have.

Those dynamic prices have been the topic of several recent research interviews. How can grocery stores balance the need to recuperate their costs and move produce quickly enough to get it into the hands of consumers before it begins to rot on the shelves? That challenge requires what I’ve now dubbed “the taming of the SKU.” For those not in the retail industry, a “SKU,” or “stock keeping unit,” is a number assigned to a product by a retail store to identify the price, product options, and manufacturer of the merchandise; it is used to track inventory. New inventory management and dynamic pricing solutions help retailers better manage and use that data to drive better outcomes — less food waste and higher margins. Recently, I’ve spoken to several vendors:

Wasteless, an Israel-based startup, focuses on the notion of wasting less. According to its execs, a given supermarket will waste about 6% of its total turnover, mostly due to expired products — basically throwing away those products and their potential profits. That has a massive environmental impact and comes at a great social cost, as well, yet retailers have considered it as just a cost of doing business. A growing focus on the “fresh” category among many retailers, however, means more food waste and more revenue lost. They now realize how much it costs them. Wasteless’ dynamic pricing algorithm has a dual function of food waste reduction and increased profitability by looking at factors that drive inventory and demand projections. The solution integrates with retailers’ inventory systems and points-of-sale systems and monitors product expiration provided via date-enabled barcodes — an upgraded barcode standard that is emerging but not yet widespread. The results of the pricing algorithm are displayed on electronic shelf labels that are now widely used.

Wasteless, an Israel-based startup, focuses on the notion of wasting less. According to its execs, a given supermarket will waste about 6% of its total turnover, mostly due to expired products — basically throwing away those products and their potential profits. That has a massive environmental impact and comes at a great social cost, as well, yet retailers have considered it as just a cost of doing business. A growing focus on the “fresh” category among many retailers, however, means more food waste and more revenue lost. They now realize how much it costs them. Wasteless’ dynamic pricing algorithm has a dual function of food waste reduction and increased profitability by looking at factors that drive inventory and demand projections. The solution integrates with retailers’ inventory systems and points-of-sale systems and monitors product expiration provided via date-enabled barcodes — an upgraded barcode standard that is emerging but not yet widespread. The results of the pricing algorithm are displayed on electronic shelf labels that are now widely used.

Wasteless’ solution currently uses only the retailer’s internal data, which alone can deliver a big impact without becoming too complex. The challenge is to be able to explain price changes to the retailer. The more complex and the more opaque, the harder it is to explain and the harder it is to get them to trust the recommendations. Additional data might provide incremental improvement but at the cost of explainability.

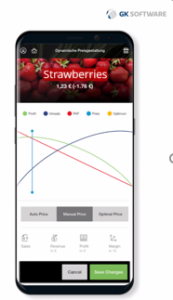

GK Software, a German software provide for the retail industry, offers dynamic pricing within its broader portfolio of retail solutions, which includes the application of AI for retail. It partners closely with SAP and benefited from an SAP investment to expand its retail solutions, including dynamic pricing. While pricing was historically done in a spreadsheet, the number of factors in the mix now means that it is too difficult to do manually. The GK dynamic pricing solution pulls in data from multiple sources, both internal — inventory, company targets, and sales transactions — as well as external data such as competitor pricing, seasonal trends, and current click data. Combined, this data determines the best pricing options for the store and consumer.

GK Software, a German software provide for the retail industry, offers dynamic pricing within its broader portfolio of retail solutions, which includes the application of AI for retail. It partners closely with SAP and benefited from an SAP investment to expand its retail solutions, including dynamic pricing. While pricing was historically done in a spreadsheet, the number of factors in the mix now means that it is too difficult to do manually. The GK dynamic pricing solution pulls in data from multiple sources, both internal — inventory, company targets, and sales transactions — as well as external data such as competitor pricing, seasonal trends, and current click data. Combined, this data determines the best pricing options for the store and consumer.

The GK solution also offers outreach to customers through couponing to let them know about price changes and offer “halo” promotions such as discounts on whipped cream to go with price-reduced strawberries, for example. Recipe recommendations also enable partnerships with major brands, such as a strawberry cheesecake that also promotes Kraft Philadelphia Cream Cheese.

Who Is The Target Market?

Multiple factors come to play here and not only the price itself. Dynamic pricing appeals to both the high-end grocers and the budget chains and to those who are risk-averse.

- Regional, more upscale grocers. Because they are more focused on fresh foods and their consumers care most about reducing food waste, they put these programs front and center.

- Budget grocery stores. Because they want to offer better prices and promote their pricing strategy — “We’re doing everything we can to offer you the best prices” — they focus on the discount element of the program.

- Risk-averse stores. New legislation in Germany legalizes “containering” or dumpster diving. For companies concerned about the liability of people getting sick from their dumpsters, dynamic pricing becomes more appealing as produce is sold before it gets thrown out.

Both vendors confirmed greater interest among European retailers with a nod to customer values and the fact that concern about food waste is greater in Europe than in North America — discussed in an earlier blog, Waste Not, Want Not: Can Food Tech Help?

Two Trends On The Menu

Two trends that vendors are following closely are the need for standards and for data literacy.

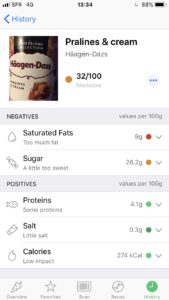

Standardized data and better access. The industry needs to promote common data formats and the adoption of more advanced barcodes to promote greater transparency. A little bit of trivia: The very first scanning of the now-ubiquitous Universal Product Code (UPC) barcode was on a pack of Wrigley Company chewing gum in June 1974, according to Wikipedia. In the ’90s, the quick response (QR) code was created by the auto industry. And more recently, Apple revolutionized these codes by making them easily scannable by a mobile device. With the advent of apps such as Yuka, a widely used product scanning app, consumers scan and discover the details hidden within these codes. The onus is now on manufacturers to publish more data on their products, including what’s in it, where it comes from, how it traveled to get from there, and how long it will stay fresh.

Standardized data and better access. The industry needs to promote common data formats and the adoption of more advanced barcodes to promote greater transparency. A little bit of trivia: The very first scanning of the now-ubiquitous Universal Product Code (UPC) barcode was on a pack of Wrigley Company chewing gum in June 1974, according to Wikipedia. In the ’90s, the quick response (QR) code was created by the auto industry. And more recently, Apple revolutionized these codes by making them easily scannable by a mobile device. With the advent of apps such as Yuka, a widely used product scanning app, consumers scan and discover the details hidden within these codes. The onus is now on manufacturers to publish more data on their products, including what’s in it, where it comes from, how it traveled to get from there, and how long it will stay fresh.- Education and data literacy. To encourage that kind of transparency, everyone along the value chain needs to understand the value of the data. According to the vendors we spoke to, transparency is rewarded by consumers who would rather buy a product that they can get the details on than one that publishes nothing, even if that product might be “better.” Retailers who understand the value of that data will pressure their suppliers to become more transparent. Greater data literacy across the board will further transparency.

More and standardized data means that retailers can better optimize their pricing and promotions, adapting to the shelf life of product and customer trends. Consumers get better produce at a better price; retailers sell more.

The bottom line: More data equals less waste.